Chinese leaders agreed this week to run a budget deficit of 3% of gross domestic product in 2024, sources have revealed.

The decision was made at an annual economic summit, while off-budget debt of up to 1 trillion yuan ($140 billion) could provide further fiscal support, three sources said.

The deficit figure is lower than this year’s revised 3.8% target, suggesting Beijing wants to maintain fiscal discipline and is not considering a big fiscal outlay next year, but the option to issue off-budget sovereign debt provides the regime with flexibility to step up stimulus to maintain stable economic growth.

Two of the sources said special sovereign bonds could be issued to pay for extra expenditures as needed. One said they could amount to 1 trillion yuan ($140.2 billion). All three sources spoke on condition of anonymity due to the sensitivity of the discussions.

ALSO SEE: China Solar Panel Costs Plunge in 2023, 60% Cheaper Than US

China has issued special treasury bonds before. In 2020, it sold 1 trillion yuan in such debt to fund Covid-related measures. In 2007, it issued 1.55 trillion yuan to capitalise its sovereign wealth fund. In 1998, it issued 270 billion yuan to recapitalise state banks.

China does not include special bonds in its annual budget plans, as it sees the instrument as an extraordinary measure to raise proceeds for specific projects or policy goals in times of need.

“The 2024 deficit ratio is set to be 3% and the insufficient part can be supplemented by special sovereign debt,” one of the sources said.

China’s State Council Information Office, which handles media queries on behalf of the government, the finance ministry, and top state planner the National Development and Reform Commission did not immediately respond to a request for comment.

The official targets are usually not announced publicly until China’s annual parliament meeting, usually held in March.

Local governments may issue $560bn in bonds

Another key part of China’s overall fiscal stance is the bond quota local governments are allowed to issue, which is also outside the government’s budget. One of the sources said it could be close to 4 trillion yuan ($560 billion) in 2024, versus 3.8 trillion yuan this year.

The other sources did not provide any figure.

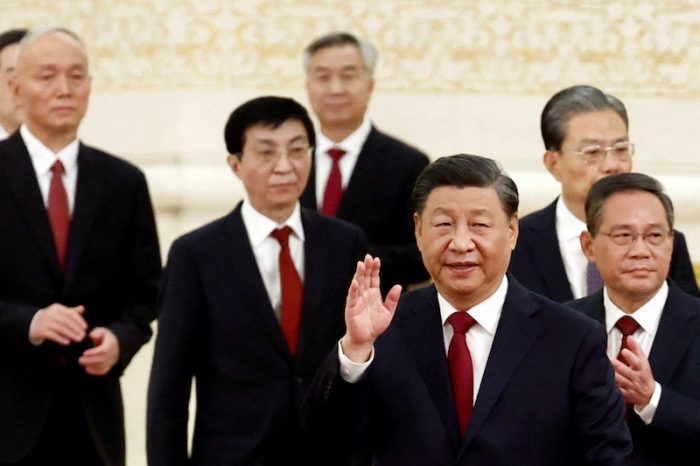

The annual Central Economic Work Conference, at which President Xi Jinping and other top officials set the course for the world’s second-largest economy in the coming year, took place behind closed doors on Monday and Tuesday.

A readout of the meeting by state news agency Xinhua said the leaders agreed to a proactive fiscal policy for 2024.

China plans a new round of fiscal and tax reforms and the government is looking to improve the structure of fiscal spending to support strategic tasks, state media said, without giving details.

The Politburo, a top decision-making body of the ruling Communist Party, said last week that fiscal policy would be “flexible, moderate, precise, and effective.”

China has historically kept its budget deficit ratio at or below 3%, with recent exceptions being the pandemic-hit years of 2020 and 2021, as well as this year as authorities stepped up efforts to bolster a stuttering economic recovery.

2024 growth target of about 5%

China’s government advisers have said they would recommend economic growth targets for 2024 ranging from 4.5% to 5.5%, with the majority favouring a target of around 5% – the same as this year.

All three sources who spoke after the annual meeting confirmed China was likely to target growth of around 5% in 2024.

Investors are scrutinising China’s fiscal position more closely after ratings agency Moody’s last week slapped it with a downgrade warning, citing costs to bail out debt-laden local governments and state firms and control its property crisis.

Local government debt reached 92 trillion yuan, or 76% of China’s economic output in 2022, up from 62.2% in 2019, International Monetary Fund data showed.

Analysts expect China to reserve some flexibility around its budget deficit next year, in case the economy underperforms.

In October, China unveiled a plan to issue 1 trillion yuan in sovereign bonds by year-end to enhance flood-prevention infrastructure. They were included in the budget, raising the 2023 deficit target to 3.8% of GDP from the original 3%.

While economic growth is on track for around 5% this year, it compares with a Covid-weakened 2022, and reaching a similar level in 2024 may need heavier fiscal support, analysts said.

- Reuters with additional editing by Jim Pollard

ALSO SEE:

Moody’s Downgrades China’s Credit Outlook to Negative

‘De-Risking’ by Western Businesses Eroding China’s Outlook

China Not Doing Enough to Spark Property Turnaround: Analysts

China Asks Banks to Roll Over $13tn Local Debt at Lower Rates