Solar panel manufacturers in China are enjoying a steep drop in costs this year, with Beijing ploughing billions of dollars into the industry to bump up capacity.

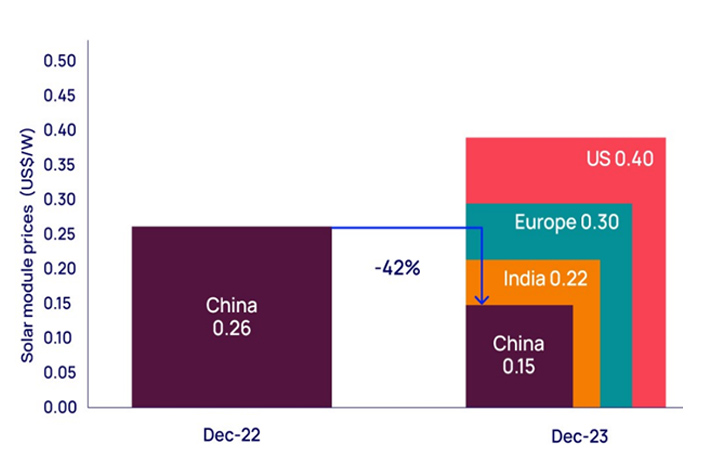

Panel production costs in the world’s largest producer of solar energy have declined a whopping 42% from year ago, dropping as low as 15 cents per watt, according to a report by energy consultant Wood Mackenzie.

That’s more than 60% below the US price of 40 cents per watt, according to the report. A year ago, Chinese panels cost 26 cents per watt.

Also on AF: World Backs COP28 Deal to Reduce Use of Fossil Fuels

China’s price plunge gives manufacturers there an enormous advantage over rivals in places like the United States and Europe.

US producers have been increasingly concerned by the wave of new factories in China, which could make their own uneconomical.

Meanwhile, the United States is incentivising its own small solar industry to take on China.

India emerging solar destination

Panel production cost in India was a tad higher than China at 22 cents per watt, Wood Mackenzie said.

Europe’s production cost stands at 30 cents per watt.

India has quickly risen the ranks in solar power production, buoyed largely by state incentive programmes aimed at growing the industry.

In a report last month, Wood Mackenzie said India would become the world’s second-largest solar module producer by 2025.

Even so, the country imported $1.1 billion worth of solar modules in the first six months of fiscal 2023-24, PV magazine reported. That surpassed the country’s total imports for entirety of fiscal 2022-23, which stood at $943.53 million.

China was the largest supplier to India despite a 76% year-on-year drop in the country’s solar module shipments to its neighbour.

View this post on Instagram

Winter chill setting on China’s solar market

China accounts for 80% of the world’s solar manufacturing capacity and is expected to dominate the global solar supply chain for much of the next decade.

In November, Wood Mackenzie estimated that China’s solar power capacity would be enough to meet annual global demand through to 2032.

The jump in solar production has been largely propelled by China’s efforts to bump up production capacity. The Xi Jinping-led government has invested $130 billion in the industry just this year.

Those moves have created a glut in solar production, which is set drive module prices to further lows.

Module prices in China slid to a record low in December as manufacturers in the country rushed to clear their inventories amid a seasonal lull, PV magazine reported last week. Solar panel demand tends to drop off during the winter months in the country.

Prices are set to fall for the remainder of 2023 and could remain low even in 2024, before stabilising in 2025, the report added.

- Reuters, with additional inputs from Vishakha Saxena

Also read:

China to ‘Dominate’ Global Solar Supply Chain For Next Decade

China Warns of Export Curb on Polysilicon, Solar Wafers

US Crackdown on China ‘Slave Labour’ Blocks Solar Projects

US Ban on Xinjiang Could Hit Global Solar Panel Industry

China’s Shift to Renewable Energy Roaring Ahead – Guardian

India’s Power Play to Become a Global Solar Force – Hindu