The China Evergrande debt crisis gathered momentum Thursday when the giant property developer was called a defaulter for the first time when Fitch Ratings downgraded it to ‘’Restricted Default’’ status.

China Evergrande debt stands at about $300 billion and Fitch said it did not respond to a request for confirmation on coupon payments worth $82.5 million that were due last month with a 30-day grace period ending on Monday.

“We are therefore assuming they were not paid,” it said.

Watch AF TV: Evergrande boss forced to ditch the jet set to clear debt

Fitch defines a restricted default as indicating an issuer has experienced a default or a distressed debt exchange, but has not begun winding-up processes such as bankruptcy filings, and remains in operation.

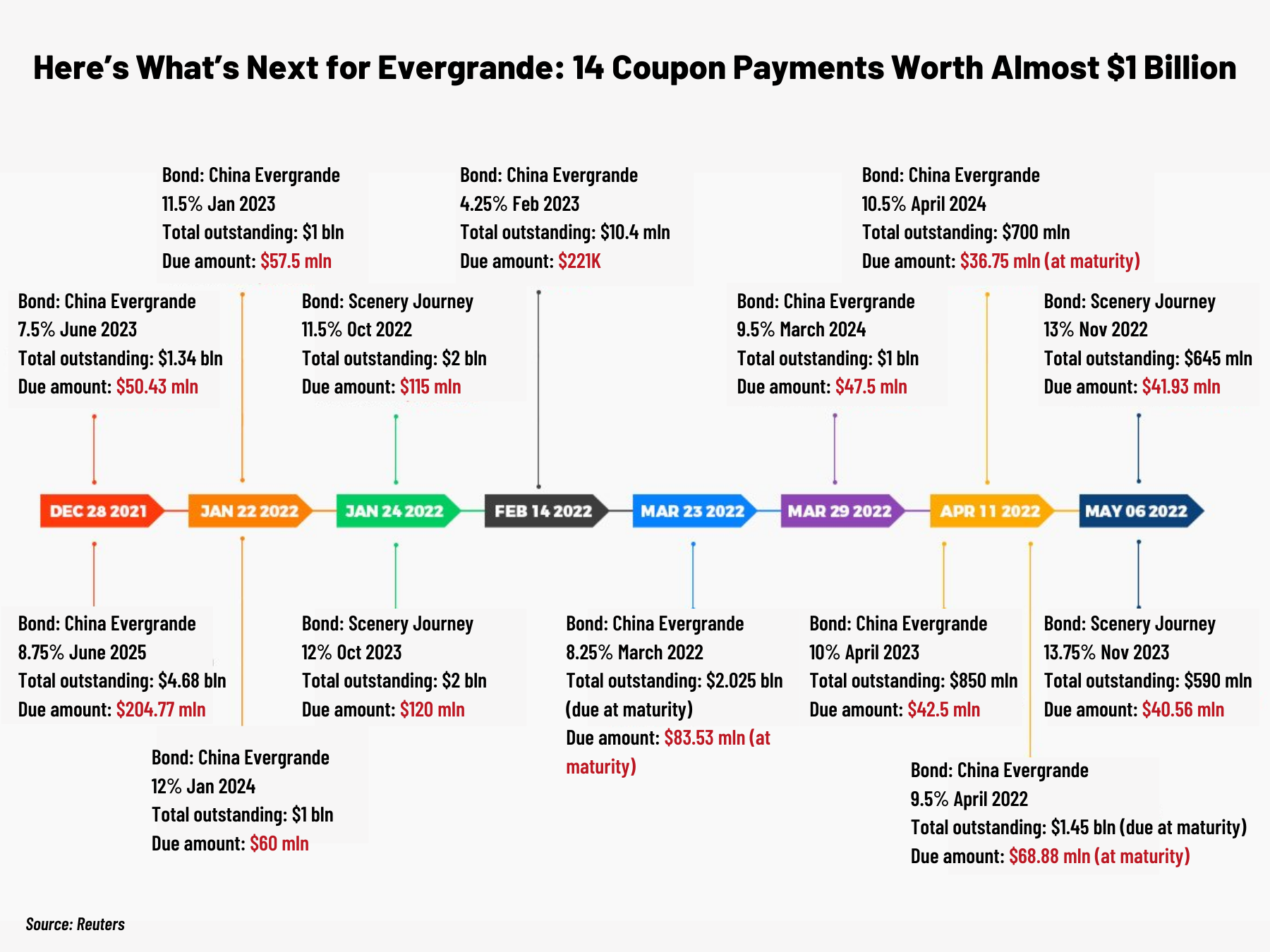

The following timeline shows the next bond coupon payments that must be negotiated to avoid a China Evergrande default. There are 14 of them through early May that together total almost $1 billion.

• By Nitin Bhagat and Vishakha Saxena