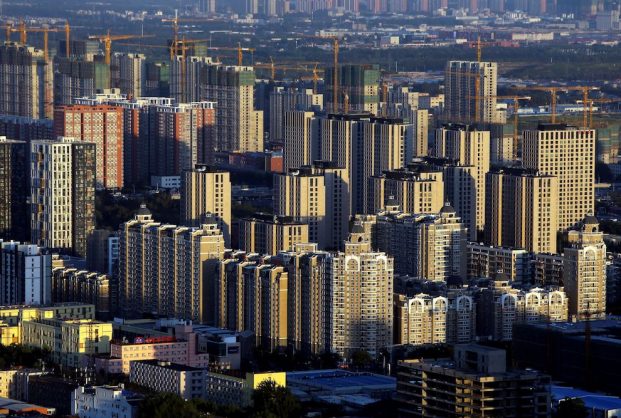

Chinese real estate and bank stocks plunged on Thursday amid fears that debt troubles in the property sector will hit lenders as more homebuyers threatened to halt mortgage payments.

A growing number of homebuyers have in the past few weeks threatened to stop making mortgage payments if property developers do not resume construction of pre-sold homes, according to official media.

The “stop mortgage repayment” movement has spread to more than 100 property projects across several Chinese provinces, the Securities Times reported on Thursday.

Also on AF: China Property Protests Threaten $220 Billion Hit For Banks

The CSI300 Bank index fell as much as 3.3% in early trading, hitting its lowest level since March 2020.

Chinese developers listed on the mainland and Hong Kong also slumped.

Fierce Sell-Offs

“People are worried this may hurt bank loans and affect others, not-in-trouble projects,” Steven Leung, executive director of institutional sales at brokerage UOB Kay Hian in Hong Kong, said.

Smaller lenders suffered fierce sell-offs.

China Merchants Bank dropped as much as 6.3%, while Bank of Chengdu lost 5% earlier in the day.

Also on AF: Two China Provinces to Repay Depositors After Rare Protests

“China’s property downturn may finally adversely affect onshore financial institutions after hitting the offshore high-yield dollar bond market,” Nomura chief China economist Ting Lu wrote.

“A disorderly deleveraging may not only lead to a credit crunch for developers and massive defaults in offshore dollar bond markets, but also rising non-performing loans for banks, which sit at the centre of China’s financial system.”

- Reuters with additional editing by Jim Pollard

ALSO READ:

China Real Estate Reform Likely to Boost Mortgage Demand

China Cuts Mortgage Reference Rate to Bolster Economy

Big Four China Banks Cut Mortgage Rates In Guangzhou