China is likely to continue increasing production for rare earth elements through 2022, driven by growing demand for electric vehicles (EVs), according to an S&P Global Intelligence report.

Demand for rare earth elements could be three to seven times above current levels by 2040, according to the International Energy Agency.

Last month, China set the first batch of its 2022 rare earth mining output quota at 100,800 tonnes, 20% higher than the same time last year.

The country announces quotas twice annually, including mining quotas for the more common light rare earths as well as the heavy rare earths.

But any increase in output is not likely to be significant, especially with heavy rare earths, due to environmental requirements, Yang Wenhua, a senior analyst with data provider Shanghai Metals Market, told S&P.

The world’s reliance on China for rare earth elements has been gradually easing, but the country is expected to continue increasing production, exports and pricing for the commodity group through 2022.

Elsewhere, several countries could face a slowdown in mining production due to proposed higher taxes, a trend that may keep supplies tight for metals and minerals critical to the energy transition.

The rare earth elements comprise the 15 lanthanides as well as scandium and yttrium, many of which are essential for electric vehicles, magnets and other clean energy technologies.

“The upside trend [of China’s rare earths prices, output and exports] definitely will continue through 2022,” Yang said.

The global rare earths shortage could last until 2025 due to governments’ efforts to switch to low-carbon economies, Yang added.

Increased demand was reflected in a rare earths price index compiled by the Association of China Rare Earth Industry, which has jumped more than 85% from June 2021.

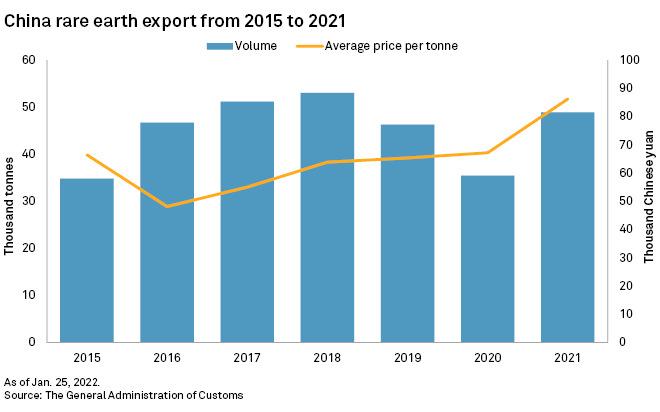

Meanwhile, China’s exports of rare earths surged by 38% to 48,918 tonnes in 2021, the highest since 2018, data from the General Administration of Customs showed.

The quota for heavy rare earth elements has remained unchanged for more than three years. Heavy rare earth elements such as dysprosium and terbium are critical for defence and medical technologies, but the production process can be highly pollutive.

China’s rare earths exports are projected to grow 30% in 2022, while annual output will likely increase by 20%. Prices will also stay high in 2022.

Prices for neodymium and praseodymium oxides jumped more than 75% and 143%, respectively, according to S&P data.

Neodymium and praseodymium oxides are used in permanent magnets, a key material for EVs.

READ MORE:

China Calls On Rare Earths Firms To Help Cool Prices

Australia’s Lynas Posts Record Profit on Rare Earths Demand

Shenghe Resources Plans to Buy Stake in Peak Rare Earths