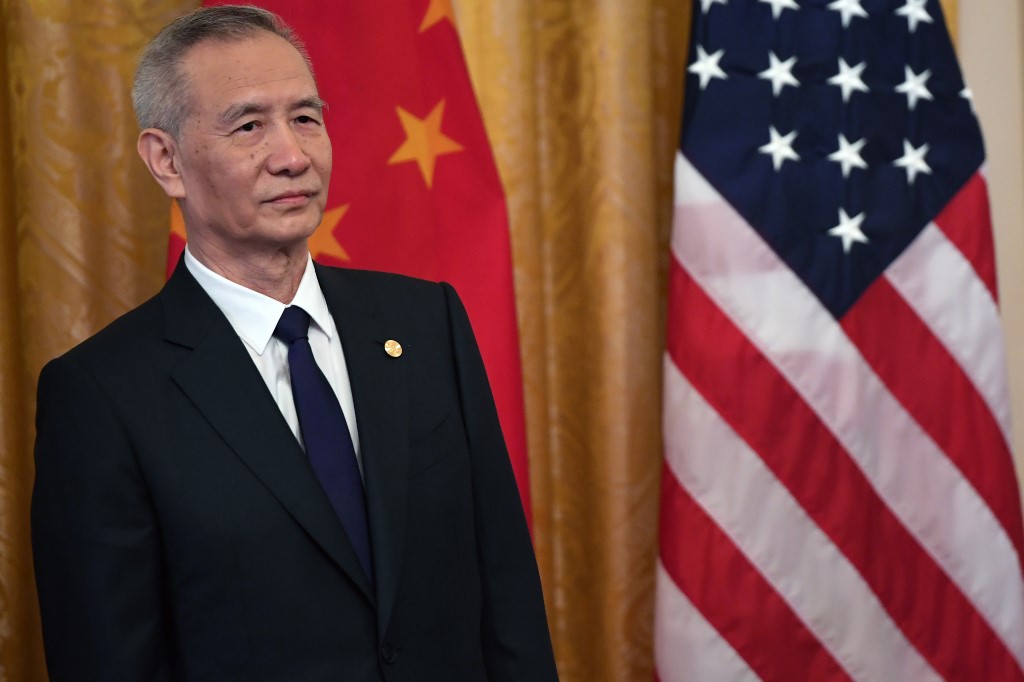

(ATF) China will show “zero tolerance” for misconduct following a recent string of bond defaults, the chairman of the Financial Stability and Development Committee (FSDC) Vice Premier Liu He has said.

Fraudulent issuance, disclosure of false information, malicious transfer of assets and misappropriation of issuance funds will be strictly investigated, and various “debt evasion” behaviour will be severely punished, the FSDC said after a meeting on Saturday to discuss the defaults, a statement on the central government’s website announced.

The recent rise in defaults resulted from cyclical, institutional and behavioural factors, the FSDC stated. It stressed efforts to promote sustainable and healthy development of China’s bond market.

The committee said financial regulators and local governments should firmly uphold the authority of the legal system and supervise market entities to fulfill their responsibilities.

Bond issuers, their shareholders, financial institutions and intermediaries must strictly abide by laws, regulations and market rules, and guard against moral risks, it said.

Those at the meeting called for more inter-department coordination and cooperation to control risks. Prevention and warning systems will be strengthened to forestall systemic risks, and liquidity should be kept reasonably ample.

Several high-profile defaults by Chinese state firms, including Yongcheng Coal & Electricity Holding Group and Huachen Auto Group Holdings (known as “Brilliance Group”) have sent shockwaves across China’s corporate bond market.

The bond defaults dented investor confidence and pushed up funding costs for many corporate borrowers, adding to pressures on China’s nascent economic recovery. The “rolling thunderstorm” of defaults triggered a wave of bond cancellations.

SEE: Wave of China bond issues cancelled as defaults trigger market panic

Chinese regulators have launched probes into the two state borrowers and their bond underwriters.

The Association of Dealers said Haitong Securities was suspected of assisting Yongcheng Coal to illegally issue bonds and manipulate the market, and underwriters of the Yongcheng Coal default – Industrial Bank, China Everbright Bank and Zhongyuan Bank – were suspected of violating “self-financing” rules.

Meanwhile, China Securities Regulatory Commission issued a warning letter last Friday to Brilliance Group, and decided to investigate its suspected misconduct in failing to promptly disclose a series of major events such as credit rating changes, assets being seized and held, defaults on repayments for trusts, bonds and bank loans, and major lawsuits.

Earlier, Shanghai Stock Exchange said a warning letter that accused Brilliance Group of quietly transferring its stake in its Hong Kong-listed subsidiary Brilliance China, which has a profitable joint venture with BMW. Critics have claimed the “quiet” asset transfer was a way for the group to avoid paying its debts.

The Association of Dealers, which is a self-regulatory body under the central bank, also penalised a company for the first time for structured issuances. It barred Zhejiang-based private company Jinggong Group from issuing bonds for two years because Jinggong had directly bought its own debt or promised to repurchase it later when it issued two bonds in 2018. The company defaulted on both bonds last year.

SEE: Brilliance moved its most valuable asset before bond default

After the bond defaults, the industry called for greater crackdowns on legal violations to maintain order in the bond market and avoid disorderly defaults.

Zhang Xu, chief fixed-income analyst at Everbright Securities, said that compared with other financing methods, bond financing is more convenient, has lower issuance costs, and fewer requirements for collateral. However, the above-mentioned features of bond financing are derived from its historically low default rate and orderly defaults.

In recent years, the default of AAA-level entities has disrupted the previous order, and caused an increase in overall financing costs of the bond market. It has added difficulty and reduced the quality and effectiveness of financial institutions in supporting the real economy.

“Orderly defaults help the market grow, but disorderly defaults destroy the credit accumulated for more than a decade,” Zhang said. “Only when defaults are conducted in an orderly fashion can it help strengthen market discipline and allow the Chinese bond market to develop,” he said.

Under normal circumstances a stumble in China’s bond market, the world’s second-biggest, would have triggered worries about cascading defaults or a massive exodus.

But global investors say this is a mere hiccup as the pandemic has been speeding changes in the nation’s credit markets and conditions were right for further opening up.

The confidence also stems from the prudent management of this year’s economic slump and conservative central bank policies, which ensured that mistakes of the past were not repeated.

SEE: Chinese credits weather the storm

“There is no need to overreact to recent bond defaults by Chinese state-owned enterprises (SOEs), but stay cautious,” several Nomura China analysts said in a commentary.

In their view, the recent SOEs defaults do not mark the start of a new deleveraging campaign. They are confident the recent SOE defaults are not part of a top-down plan by Beijing, but rather an act by local officials to test the boundaries of policymakers in Beijing and market investors.

Nomura China does not foresee a systemic credit crisis because China’s economy has been rebounding and the People’s Bank of China has enough space to prevent a systemic credit crisis.

“Some defaults of SOE, if managed well, could improve the overall health of China’s credit bond market,” they said. “We view an increase in SOE defaults as inevitable, and most likely we will see many more such defaults in coming years,” they added.

Ke Chen, Chief Analytics Officer at Pengyuan Credit Rating, also expects to see increasing defaults in China’s corporate bond market.

“China’s governments face substantial challenges in striking a balance of maintaining a robust economic growth and reducing leverage and risks in the economy and financial system,” Chen said.

As the country’s economy recovered from the impact of Covid-19, Beijing had shifted away from the accommodative policies of supporting distressed firms, which actually have fundamental problems.

“China’s government started to allow defaults of SOEs that are not economically efficient and strategically important. We will see larger divergences among private firms, weak SOEs, and strong SOEs.”

Chen said allowing distressed companies to fail and removing the implicit government guarantees will improve capital allocation efficiency, impose market discipline, and reduce moral hazard. These defaults will also allow the market to price in financial risks more accurately, so investors will need to pay more attention to fundamentals, he said.

‘Beware of the north’

Nomura China noted that all 10 SOEs with bond defaults this year were based in the north of China.

“This is because SOEs play a much more important role in the economy of North China and because, over the years, economic growth has been higher in South China, especially along the Yangtze River and Pearl River deltas, than North China,” they said.

They advised investors to consider the geographical distribution of SOE bond defaults when making investment decisions.

ALSO SEE: China’s finance guns tidy up after bond default debacle