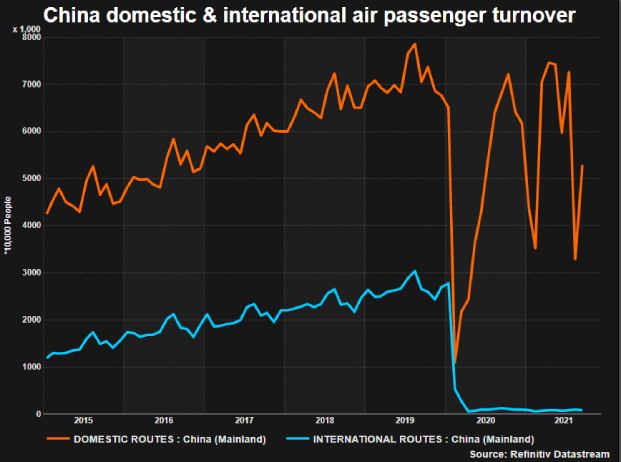

China’s domestic air traffic, once the world’s envy after a fast rebound during the pandemic, is faltering due to a zero-Covid policy that has led to tighter travel rules in Beijing and weaker consumer confidence.

The outlook for the fourth quarter, normally a popular time for southerners to head north for winter breaks and northerners to head south for warmer weather, is dimming due to Covid related disruptions at a time when international traffic is negligible.

“It’s very exhausting that the virus somehow always manages to make a comeback,” said Elaine Shen, a Shanghai resident who had to put off her domestic travel plans for the first time since the start of the pandemic due to rising cases.

Domestic capacity at the country’s three biggest airlines reached around 115% of pre-Covid levels in April but by October had fallen to around 77% due to outbreaks with lower peaks after each rebound, HSBC data show.

That contrasts with a steadier US domestic recovery.

In mid-November, the situation worsened when the Beijing municipality announced that travellers from any Chinese city that reported even a single Covid case within the past 14 days would be restricted from entering the capital, which is being protected ahead of the 2022 Winter Olympics.

Hangzhou, the capital of Zhejiang province, on Tuesday slashed its number of flights to Beijing to just one per day due to two local cases.

Air China, China Eastern Airlines and China Southern Airlines posted a combined loss of nearly 8 billion yuan ($1.25 billion) in the third quarter.

There is potential downside risk to combined fourth-quarter estimates that have a current consensus loss of 7.2 billion, HSBC analysts said.

Chinese Airlines Cut Domestic Flights

Domestic air passenger traffic stood at around 40% of pre-Covid levels in November, while the number of flights dropped to around 60% of 2019 levels, according to aviation data provider Variflight.

Chinese airlines last week cut 9.4% of scheduled domestic flights for December, according to airline data firm Cirium, amid fears about the Omicron variant.

The fall in traffic comes as Chinese airlines ready for the return of the Boeing 737 MAX around year-end after it last week received safety approvals from China’s aviation regulator.

The extra capacity is likely to prove a burden, according to Chen Jianguo at Aircraft Owners and Pilots Association of China.

“Because of Covid, most airlines in China are not short of capacity,” he said. “Rather, they’re running a serious surplus of aircraft at the moment… So (for the MAX), airlines have no option but to suffer in silence.”

- Reuters with additional editing by Jim Pollard

ALSO READ:

China’s Zero-Tolerance Covid Tactics Check Tourism Comeback

Parts Of North China Tighten Curbs As Covid-19 Cases Flare Up

China Study Warns Of Huge Covid Outbreak If It Opens Up