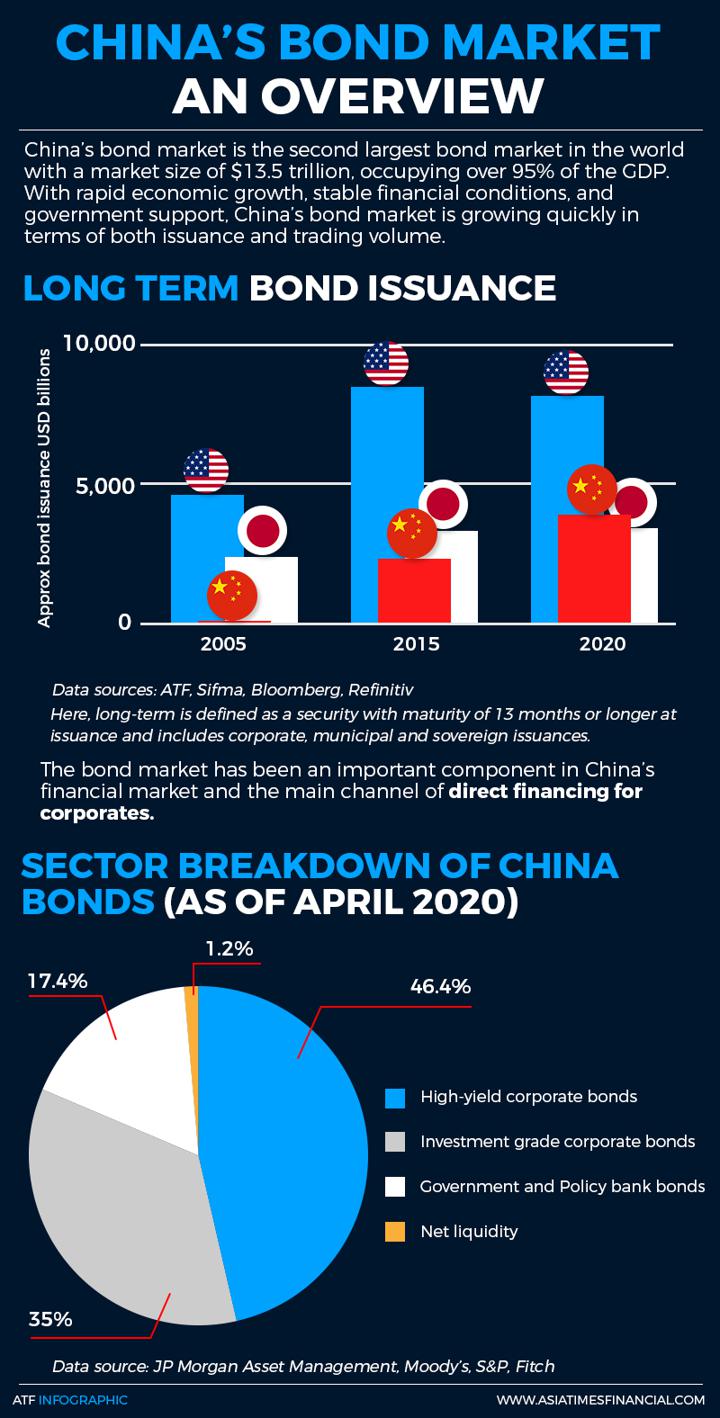

(ATF) Under normal circumstances a stumble in China’s bond market, the world’s second-biggest, would have triggered worries about cascading defaults or a massive exodus.

But global investors say this is a mere hiccup as the pandemic has been speeding otherwise slow changes in the nation’s credit markets and conditions were right for further opening up.

The confidence also stems from the prudent management of this year’s economic slump and conservative central bank policies, which ensured that mistakes of the past were not repeated.

The Asia Eight: Daily must-reads from world’s most dynamic region

“Battling through a turbulent year, investors have come to terms with dramatic changes in the corporate sector as well as in financial markets,” said Paras Anand, Chief Investment Officer, Asset Management, Asia Pacific at Fidelity.

“Unlike digital acceleration, the rise of China’s fixed-income market is evolving with little fanfare. But the potentially seismic shift is firmly underway, with huge implications for the landscape of global fixed income investments.”

Earlier this month, state-owned Yongcheng Coal & Electricity Holding Group defaulted on domestic bonds due in 2021 as a growing number of missed payments are expected in the government backed sectors pressured by overcapacity and lack of support from Beijing.

“We expect to see increasing defaults in China’s corporate bond market. China’s governments face substantial challenges in striking a balance of maintaining a robust economic growth and reducing leverage and risks in the economy and financial system,” said Ke Chen, Chief Analytics Officer at Pengyuan Credit Rating.

He said that as China’s economy recovered from the impact of COVID-19, Beijing had shifted away from the accommodative policies supporting distressed firms which actually have fundamental problems.

“China’s government started to allow to default the SOEs that are not economically efficient and strategically important. We will see larger divergences among private firms, weak SOEs, and strong SOEs.”

Chen said allowing distressed companies to fail and removing the implicit government guarantees will improve capital allocation efficiency, impose market discipline, and reduce moral hazard. These defaults would also allow the market to price the financial risks more accurately and that investors will need to pay more attention to fundamentals, he added.

Rising rates

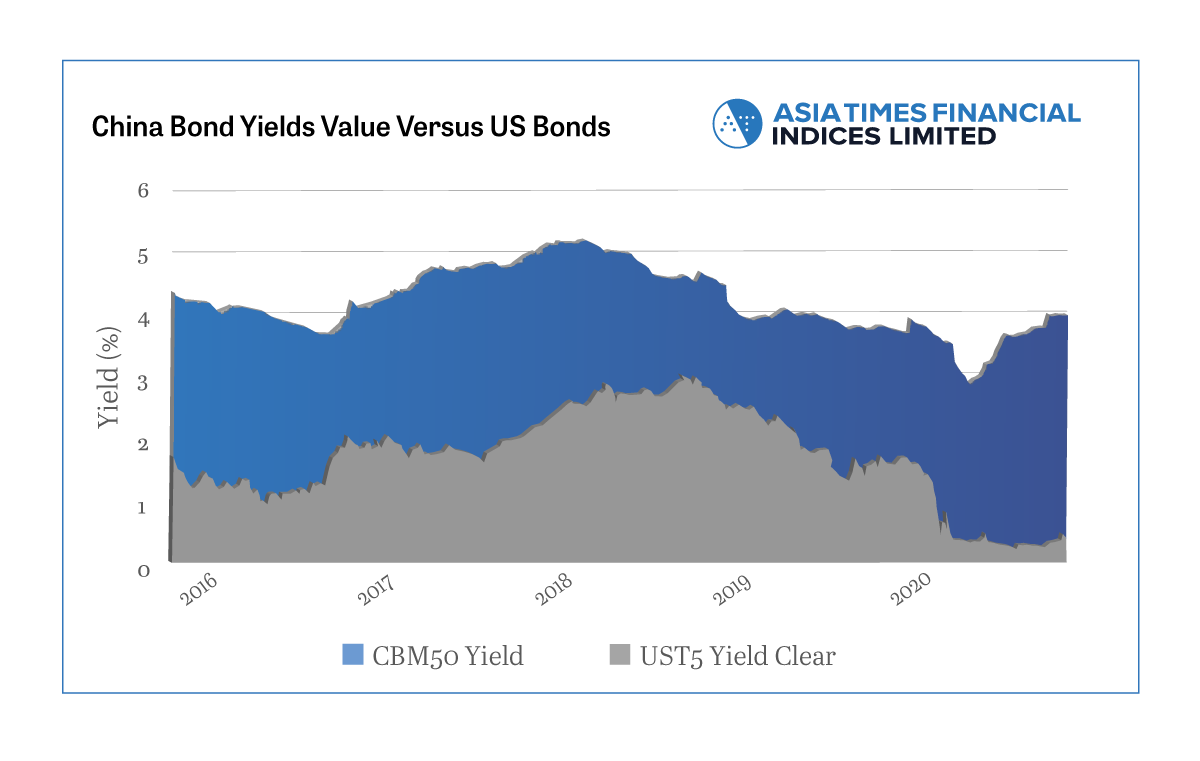

These defaults are one of the reasons behind rising rates even among China’s highest-rated corporates. Since hitting a low of 2.7932% in May, the yield on Asia Times Financial China Bond Market 50 (ATF CB50) index, has surged to 3.9339% as a combination of factors led to investors dumping their holdings.

“Defaults in China are being overplayed – look at the US where defaults don’t even make the headlines,” said Gary Dugan, CEO at Global CIO Office. “It’s just the cultural transition which is making global markets sit up and take notice. China corporate bonds offer value compared with much of the high-grade market in the rest of the world. The absolute yields and spreads are favourable but one has to do due diligence and proper research.”

The ATF CB50 index currently yields 217 basis points more than five-year US Treasuries. The spread has widened since May as defaults have picked up but this is hardly cause for alarm. Investors say this can only be expected given the size of the world’s second largest economy.

The ATF CB50 is an onshore bond index representing corporates, state-owned enterprises, financial institutions and local governments. It is built as an access product to the Chinese onshore bond market and follows a transparent selection process with 50 bonds of 50 issuers.

“The current bond indexes are stale and do not represent China corporate credit risk properly,” said Chairman of Asia Times Financial Indices, Peter Knez. He was former Global Head of Fixed Income and Global CIO at Barclays Global Investors and Co-CIO Fixed Income at BlackRock.

“They miss the elements of innovation and strategic components of the economy. The largest trading bloc in the world need to be represented better to capture the change to a bi-polar regime. The ATF CBM50 captures and describes the new global regime and the changed economic realities in fixed income.”

The defaults are being viewed positively by experienced fixed income professionals.

“The trajectory of defaults is higher as China is allowing credit differentiation to take place and sending the signal that bailouts will not necessarily be universal,” said Binay Chandgothia, Managing Director – Portfolio Manager, Principal Global Asset Allocation.

“As China’s debt-to-GDP ratio rises, it is natural for more incidents of defaults during an economic downturn. But the yields are higher, which compensates for the additional risk of higher de-facto defaults.

“We like Chinese bonds because of the strong carry income and the stable outlook for the yuan, notwithstanding the recent selloff and the rise in defaults.”

Yuan rallies

The yuan has rallied more than 5% this year versus the dollar and more gains are expected. It has appreciated from around 7 to a dollar at the start of the year to 6.60 yuan to a dollar. ANZ economists expect it to rise to 6.50 to a dollar by 2021.

And although these defaults have pressured yields, there was no sign of panic as investors look upon it as a measure of a maturing market, where defaults are routine.

“So far the market seems to take these defaults as idiosyncratic events specific to the onshore bond market. The offshore hard-currency market has weakened, but not nearly to the same extent. CNY has continued to strengthen and equity markets have taken the events in their stride. The market is not (yet) reacting as if this is a repeat of 2017’s systemic credit crunch (due to deleveraging),” said Aidan Yao, senior emerging Asia economist at AXA Investment Managers.

Chinese bonds are under-owned when compared with their international peers but that is changing as foreign inflows accelerate following the market’s inclusion in global bond indexes.

Standard Chartered expects inflows of $150 billion to $180bn, and that it would lift foreign ownership of China government bonds to 20% by the end of 2022 from 8.5% currently. This is dwarfed by the foreign ownership levels of the debt of Japan (12.1%) and the US (28%), or even some emerging-market countries such as Indonesia (39%) and Malaysia (24%).

“When global fixed-income investors scrambled for cover in panic selloffs in March, China’s onshore bond market offered a rare haven with low volatility and no liquidity crunch,” said Fidelity’s Anand.

But timing and credit selection are two important aspects to gaining exposure.

“A key tenet of successful fixed-income investing in China is to get in when the news flow is negative with a long-term view. Exiting at a time like this when there have been two defaults can be at a high cost because bid-offer spreads are wide as trading liquidity is thin. The other important thing is to choose managers with a long-term fundamental tilt in their issue selection process,” said Chandgothia.