Hong Kong stocks jumped 9% on Wednesday to mark their best day since 2008, after China’s top policymaker assured markets of stability and support and helped put a floor under sectors hurt by regulatory crackdowns.

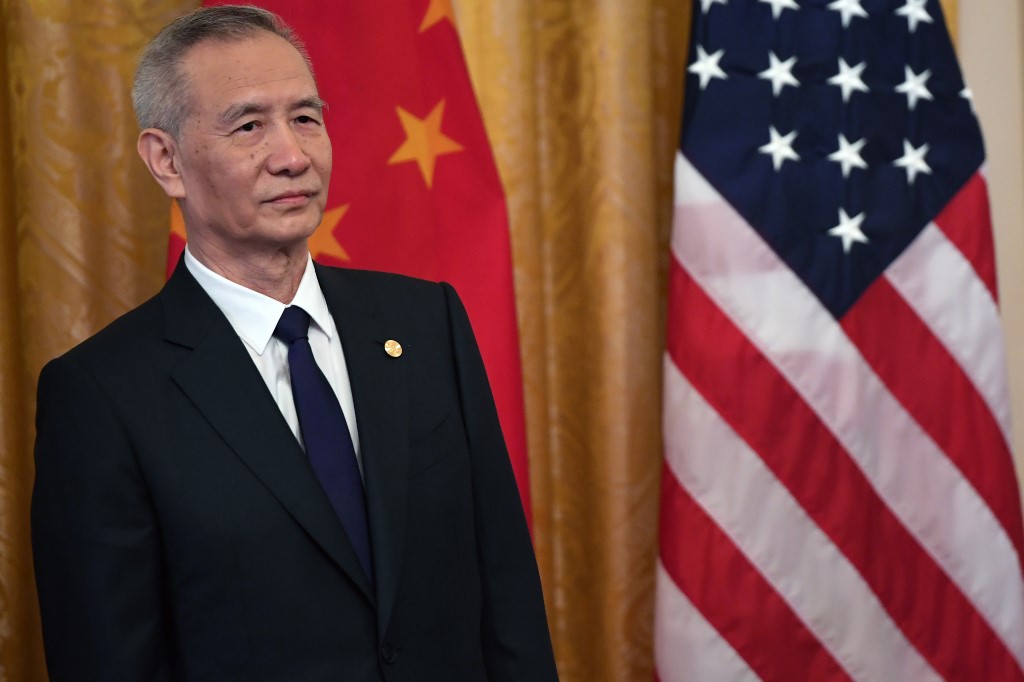

China’s Vice Premier Liu He said Beijing would roll out support for the Chinese economy as well as be cautious with measures for capital markets.

The Xinhua news agency also cited Liu as saying, at a meeting of the Financial Stability and Development Committee under the State Council, that regulators would coordinate better with their counterparts in Hong Kong.

The comments helped the Hang Seng index claw back all the ground lost on Tuesday when Chinese stocks were pummelled by rising domestic Covid-19 cases, fears about a blowback on China from its dealings with sanctions-hit Russia, continued regulatory crackdowns and the risk of more mainland firms being delisted by US exchanges.

The HSI rose more than 9% to above the 20,000 mark. The Hang Seng Tech Index logged its biggest daily gain of 22%, recovering a good deal of the ground it had ceded since March 10.

“It’s quite positive, at least for the moment, as Liu addressed some key concerns in the market, especially regarding the regulatory crackdown,” said Ting Lu, chief China economist at Nomura. “Liu also demands the PBOC to take action, so I believe the PBOC will do some easing in the next couple of months.”

The blue-chip CSI300 index gained the most since July 2020, rising 4.3%, while the Shanghai Composite Index added 3.5% and the Hong Kong-listed China Enterprises Index gained 12.5%.

Meituan, Tencent, Alibaba Soar

Among Hong Kong index heavyweights, Meituan jumped 32.1%, while Tencent Holdings and Alibaba Group soared 23% and 27%, respectively, logging their biggest daily gains.

Other stocks caught in China’s regulatory crosshairs, such as education, also rallied, with New Oriental Education & Technology Group rising 37%.

A report by Xinhua said US and Chinese regulators had kept up good communication about Chinese companies listed in the US and made progress. It said they are now working to form a cooperation process to allow the auditing of Chinese stocks listed on US exchanges.

The China Securities Regulatory Commission said on Friday: “We believe the two sides will be able to jointly work out cooperation arrangements that comply with the legal and regulatory requirements of both countries in an expedited manner, to better protect global investors and promote the stability and robustness of the two capital markets.”

The US Public Company Accounting Oversight Board confirmed this, saying: “We are actively engaged and have been meeting with PRC authorities in an effort to reach an agreement that would allow the PCAOB access to PCAOB-registered firms in mainland China and Hong Kong, consistent with the cooperation we receive everywhere else in the world. We remain interested in a relationship with PRC authorities that facilitates that access.”

In the US, however, experts remain sceptical over the prospects for a deal between the nations.

“I think it is unlikely there has been a breakthrough,” says Jeff Mahoney, General Counsel with the US-based Council of Institutional Investors. “Based on China’s prior history of making such statements and the fact that there appears to be an unwillingness for the US to make a compliance exception for China.”

China Easing Worries

Meanwhile, Liu’s comments also helped to ease worries that encouraging economic data for January and February were leading to complacency among policymakers in Beijing. The central bank surprised markets on Tuesday by not cutting one of its key lending rates.

Liu also said China encourages long-term institutional investors to increase stock holdings, after China’s blue-chip index .CSI300 closed at 21-month lows in the previous session.

“It is quite reasonable for the Chinese government to properly step in, maintain the basic stability of the stock market and avoid further decline,” Zhang Ming, deputy director of Institute of Finance & Banking at Chinese Academy of Social Sciences, said in a note on Tuesday.

Zhang said this round of declines came against a very complex background, hit by “external geopolitical shocks, China-US game and malicious short-selling by international investors.”

JPMorgan Downgrade

JPMorgan Chase & Co downgraded 28 Chinese stocks listed in the United States and Hong Kong on Monday, citing “China’s geopolitical risks” as “more and more countries and corporates impose sanctions on Russia.”

“China’s tech stocks are underpinned by value, while Liu’s speech ignited the rebound,” said Xie Chen, fund manager at Shanghai Jianwen Investment Management Co.

However, Nomura’s Lu said markets might continue to be worried that China is getting isolated due to the Russia-Ukraine war.

“A meeting cannot solve all issues, given the economy is not in good shape,” Yin Peixin, investment vice director at RBH (Shanghai) Asset Management Co said.

The jump in China shares lifted broader Asian markets, which also benefited from Ukrainian President Volodymyr Zelenskiy’s comments on Wednesday that peace talks were sounding more realistic but more time was needed.

China’s yuan also reacted to Liu’s comments and the sharp rebounds in the stock market. The yuan extended early gains and hit a high of 6.3460 per dollar at one point in the afternoon session, up nearly 0.4%.

Mainland China reported 1,952 new confirmed Covid-19 cases on March 15, the national health authority said on Wednesday, dropping from a two-year high caseload of 3,602 a day earlier.

A recent surge in infections had raised concerns about the rising economic costs of its tough measures to contain the disease.

• Reuters with additional editing by Jim Pollard

ALSO on AF:

China’s Tencent Could Face Money Laundering Fine – WSJ

China’s Covid-19 Outbreaks Extend Supply Chain Woes

China Seen Telling State Firms To Reveal Dealings With Ant