(ATF) Returns on China bonds fell for the second day in three on Monday, dragged down by coupon payments that dented all but one of the five ATF Chinese fixed-income indexes.

The ALLENDEX Local Government bonds index was the only gauge to gain, helped higher by People’s Bank of China governor Yu Gang’s comments in local media that the central bank was committed to targeted stimulus to help smaller businesses recover from the coronavirus downturn. A 3.75 trillion yuan package of special bond sales is expected to benefit local municipalities who will be charged with identifying and managing suitable reconstruction projects.

The ATF China Bond 50 Index fell 0.05%

The benchmark ATF China Bond 50 Index fell 0.05% extending losses this month to 0.12%. Of the ALLINDEX sub-gauges, Corporates slid 0.09%, Enterprises fell 0.08% and Financials lost 0.08%, while Local Governments advanced 0.03%.

FOREX COMMENT: “China Minsheng Bank, Henan Water and China Huaneng Group fell on the ALLINDEX Financials, Corporates and Enterprise indexes after making coupon payments on Monday and Friday. Such payments tend to send bond prices lower because they reduce the future earnings of fixed-income assets.” Uwe Parpart

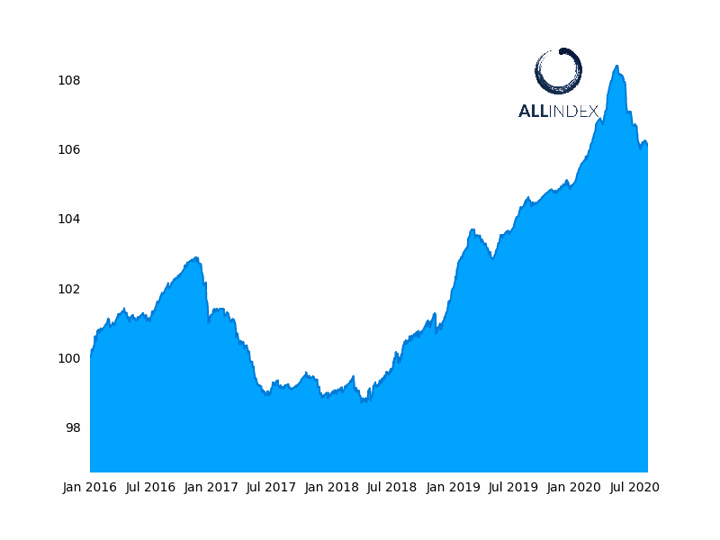

Chinese non-sovereign bonds are trading at January levels after reaching record highs in the spring, when the central bank increased debt sales to stimulate the coronavirus-shattered economy. A slowdown in issuance in early summer prompted a selloff. That was hastened as investors switched into Chinese equities on the back of concerns over the US economy amid a sharp resurgence in coronavirus cases. Recent pledges by the PBoC to resume targeted stimulus have helped the ATF index claw back some of those losses.

Guotai Jinan Securities, Henan Water and China Huaneng Group fell on the ALLINDEX Financials, Corporates and Enterprise indexes after making coupon payments on Monday and Friday. Such payments tend to send bond prices lower because they reduce the future earnings of fixed-income assets.

PBoC governor Yi Gang said the central bank would press on with plans to target further stimulus towards projects that benefit smaller businesses after earlier bond issues tended to be snapped up by banks, repackaged and sold on at better rates to help bolster their own balance sheets. The central bank chief said he wanted further easing measures to have a direct impact on the real economy.

Yuan strength relative to the US dollar and signs of the increasing stability of China’s economic recovery are also making Chinese bonds attractive to overseas investors.