(ATF) Cryptocurrencies took a breather after their recent sharp rally but could soon be headed higher after overcoming technical resistance levels with investors waiting in the wings to buy.

Bitcoin, which rallied on Sunday to a peak of $58,354, was down 9.65% at $50,616. Still, it is up more than 80% this year. Since hitting a low in March below $4,000, bitcoin has surged nearly 1,200%.

“People have realised the potential of cryptos, there has been mainstream acceptance, especially after PayPal, and now Tesla decided to accept Bitcoin as a form of payment,” Fawad Razaqzada, strategist at TF Global Markets, told Asia Times Financial Television.

He expects Bitcoin to keep within the upward rising channel, a bullish technical pattern, if it stays above the $50,000 level.

Meanwhile, recent comments had dealt a setback to the rally.

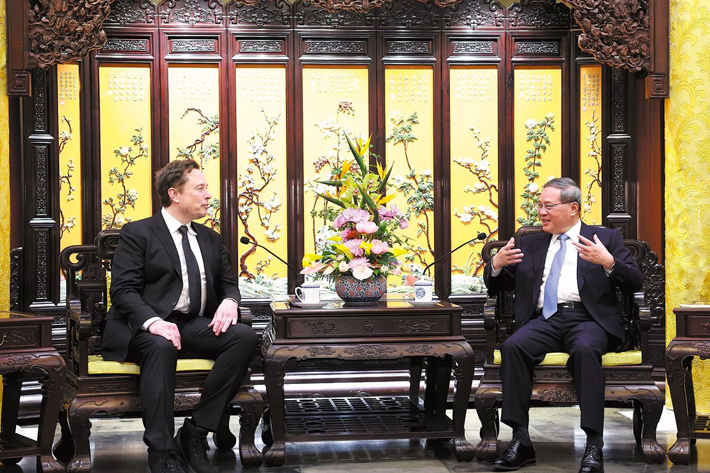

Tesla boss Elon Musk, whose tweets on bitcoin have added fuel to the cryptocurrency’s rally, said on Saturday the price of bitcoin and rival cryptocurrency ethereum seemed high.

US Treasury Secretary Janet Yellen also tamped down the flames on Monday, saying bitcoin is extremely inefficient at conducting transactions and is a highly speculative asset.

Selloff seen as ‘a much-needed unwinding’

“The selloff across the board this week is a result of some of last week’s exuberance easing, as well as a much-needed unwinding of over-leveraged long positions,” Ross Middleton, co-founder of cryptocurrency exchange DeversiFi, said.

Ethereum, which tends to move in tandem with bitcoin, also tumbled after hitting a record high on Saturday. It was last down about 12% at $1,642, hovering around a three-week low.

Trading platform IG said on Monday it had reached its limit for the amount of cryptocurrency it holds as a business and that it was no longer accepting new cryptocurrency buy orders from clients.

Bitcoin’s meteoric rise has been fuelled by signs that it is gaining acceptance among mainstream investors and companies, from Tesla and MasterCard to BNY Mellon.

“There are also worries about the value [and] the worth of the fiat currencies, with governments worldwide debasing their currencies, making them less worthy. This is another reason why people are kind of moving into digital currencies like bitcoin,” Fawad said, while adding that gold had lost some of its safe-haven appeal after major central banks and other institutions manipulated its price and kept it artificially low.

“Some investors clearly think that bitcoin and other bitcoins offering a much better store of value than gold.”

BNY Mellon is working with Fireblocks in conjunction with a new unit it announced earlier this month to help clients hold, transfer and issue digital assets, according to a report on Monday by CoinDesk.