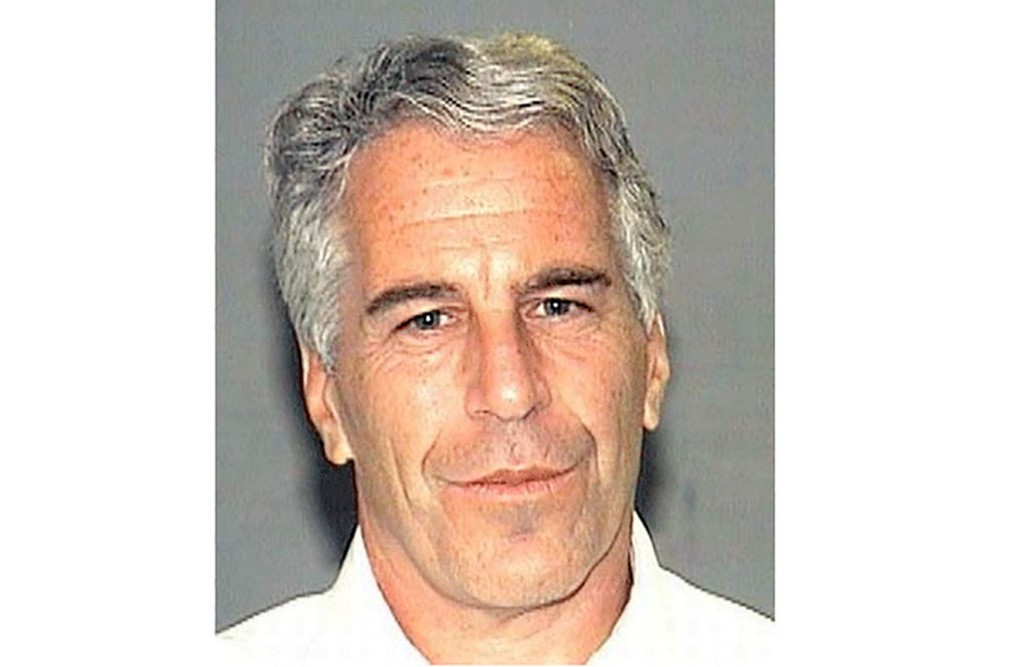

Financial regulators in New York said Tuesday they have fined Deutsche Bank $150 million for failing to raise red flags on accounts held by tycoon sex offender Jeffrey Epstein.

The fine marked the first time a financial institution has been penalised for its dealings with the late financier, said the New York Department of Financial Services (DFS), an agency of the state government.

It said in a statement Deutsche Bank had failed to monitor Epstein’s account sufficiently closely, “despite ample information that was publicly available concerning the circumstances surrounding Mr Epstein’s earlier criminal misconduct.”

Epstein, who was 66, hanged himself in Manhattan’s Metropolitan Correctional Center in August 2019 while awaiting trial on charges of trafficking minors for sex. He had pleaded not guilty.

“Banks are the first line of defence with respect to preventing the facilitation of crime through the financial system, and it is fundamental that banks tailor the monitoring of their customers’ activity based upon the types of risk that are posed by a particular customer,” DFS Superintendent Linda Lacewell said.

“Despite knowing Mr Epstein’s terrible criminal history, the Bank inexcusably failed to detect or prevent millions of dollars of suspicious transactions,” she added.

‘Bank should have acted’

The financial regulator said the bank should have raised red flags over transactions that included “settlement payments totalling over $7 million, as well as dozens of payments to law firms totalling over $6 million for what appear to have been the legal expenses of Mr Epstein and his co-conspirators.”

It also listed suspicious payments “to Russian models, payments for women’s school tuition, hotel and rent expenses, and… payments directly to numerous women with Eastern European surnames.”

The DFS added that the regulators also found “periodic suspicious cash withdrawals – in total, more than $800,000 over approximately four years.”

“Throughout the relationship, very few problematic transactions were ever questioned, and even when they were, they were usually cleared without satisfactory explanation,” it said.

The fine also covers Deutsche Bank’s relationship with Danske Bank Estonia, which is at the centre of a money-laundering scandal.

The regulator said Deutsche Bank had similarly failed to act on red flags in its relationship with FBME bank in Cyprus.

AFP