(ATF) Chinese corporate bonds climbed for a second day led by Enterprise gauge-listed debt after data showed exports from Beijing rose in the first half, boosting trade-focused companies.

PetroChina bond prices climbed after it signed a multi-billion yuan pipeline deal and logistics giant China Merchants Group’s notes rose on bets it would benefit from increasing overseas trade.

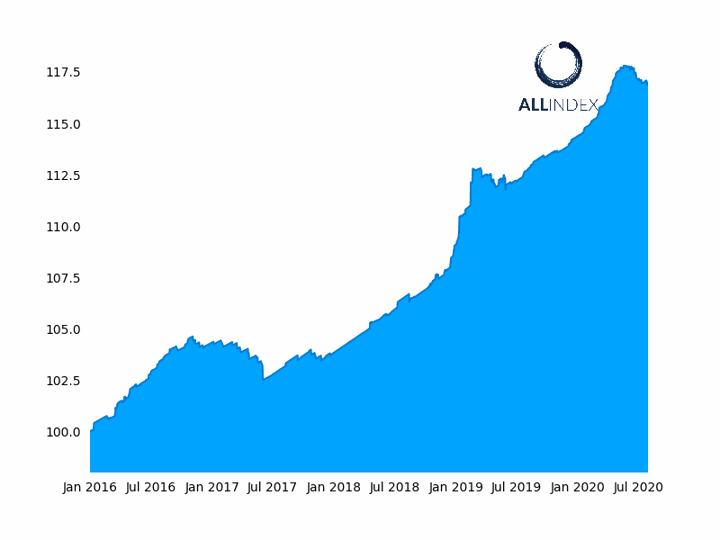

The benchmark ATF China Bond 50 Index climbed 0.04%; of the ALLINDEX sub-gauges, Enterprises jumped 0.05%, while Corporates, Financials and Local Governments all rose 0.01%

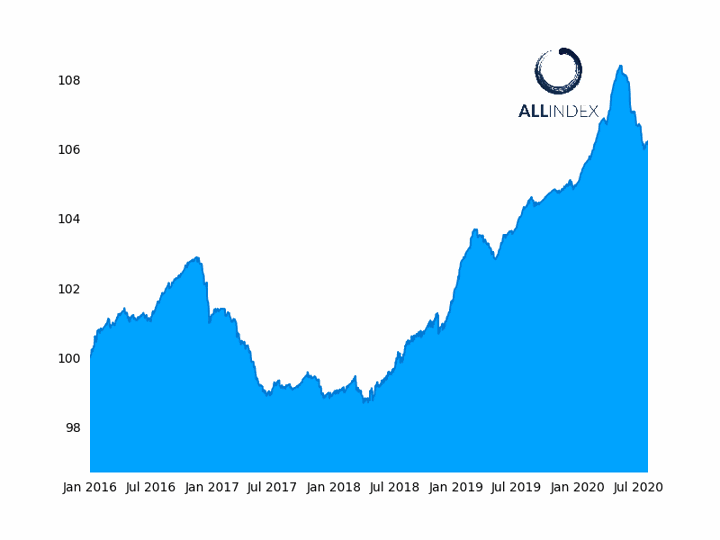

The ATF China Bond 50 Index rose 0.04%

Chinese corporate and local government debt is climbing in lockstep with equities as the economy stages a comeback from the coronavirus downturn. That’s reversing a selloff that was sparked in March when investors switched to special bonds targeted at specific coronavirus-mitigation projects. A slowdown in central bank stimulus, and Chinese sovereign bond yields languishing near record lows have prompted investors to seek riskier assets.

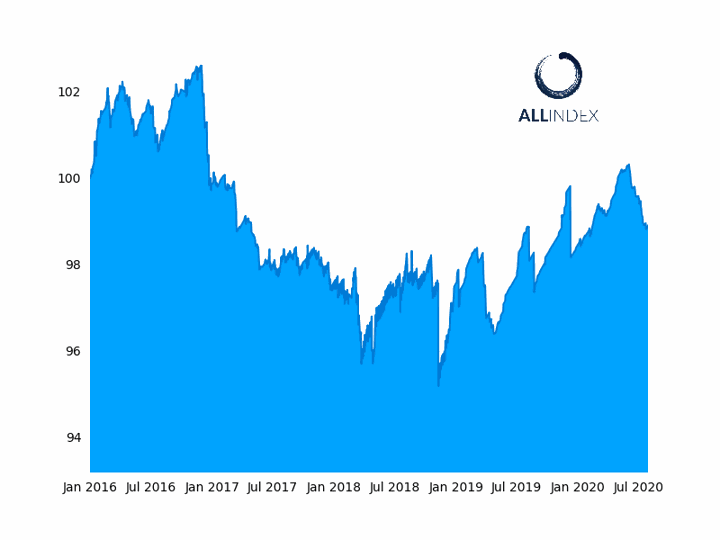

The ALLINDEX Corporates Index added 0.01%

The bonds of oil and gas exploration and services giant PetroChina climbed 0.69% after Kallanish Energy reported it had sold pipelines and storage facilities to pipeline operator PipeChina for 268.7 billion yuan ($38.3bn).

Logistics company China Merchants Group’s bonds posted a 0.77% gain following news that exports of goods from the nation’s capital climbed 2.9% in the first-half, signalling a recovery in overseas trade that had been decimated by the global pandemic.

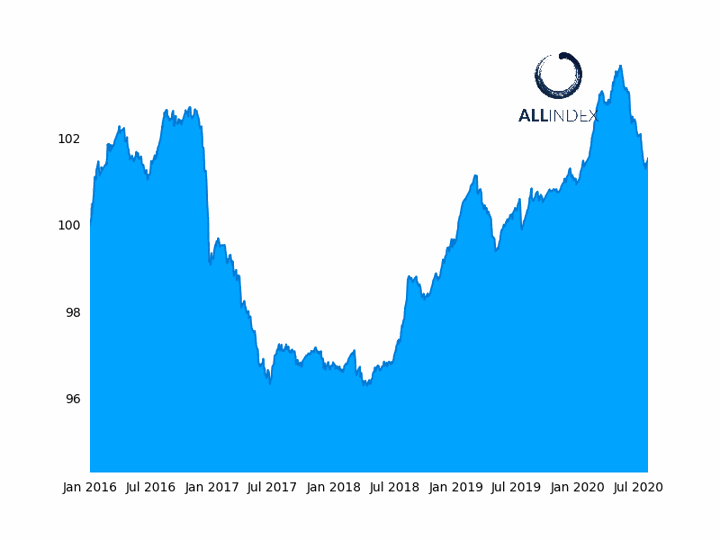

The ALLINDEX Enterprise Index surged 0.05%

China Zheshang bank’s bonds weighed on Financials; while its bonds fell 0.01, its yield climbed the most on the gauge. Caixin reported the bank and two other lenders were fined 100 million yuan each by the China Banking and Insurance Regulatory Commission for a “variety of misconduct related to their interbank businesses or corporate governance”.

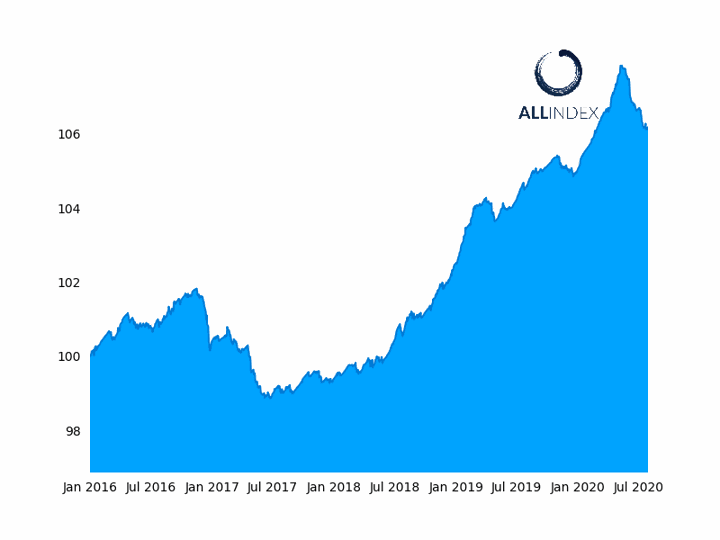

The ALLINDEX Financials Index advanced 0.01%

Securities of Wuxi Construction Development Investment climbed, with yields dropping 92bps. Private developers may benefit after Chinese President Xi Jinping said the government would push for more development in conjunction with other nations via the Asia Infrastructure Investment Bank. Xi’s comment followed reports that India, with whom China is in a diplomatic and trade standoff, may allow Chinese contractors to play a bigger role in the South Asian nation’s public infrastructure projects.

The ALLINDEX Local Governments Index added 0.01%