Some 1.1 billion yuan ($174 million) of asset-back notes guaranteed by Shimao Group may not be redeemed on maturity next month, the trustee of the notes said in a filing, as the debt crisis for Chinese property developers rumbles on.

Yunnan International Trust Co said in a filing dated Tuesday that assets underpinning the notes had generated less income than expected.

The trust company said it would hold a meeting with investors on March 2 to vote on an unspecified agenda for the notes due on March 17. Shimao did not immediately respond to a request for comment.

Regulatory curbs on borrowing have driven China’s property sector into a liquidity crisis, with the struggles of Evergrande, the world’s most indebted property firm, to repay its borrowings mirrored at numerous smaller rivals.

Also on AF: China Evergrande Debt Crisis: Five Developers on the Brink

Shimao, which defaulted on a trust loan last month, has been scrambling to extend debt maturities including asset-backed securities and trust loans with creditors.

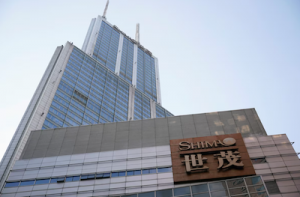

The Shanghai-based developer and its chairman have also been selling assets in China and overseas to raise funds.

Moody’s downgraded Shimao’s corporate family rating (CFR) again on Wednesday to Caa1 from B2, citing the firm’s heightened liquidity risks over the next six to 12 months given its slower-than-expected fundraising progress to address its large upcoming debt maturities.

Moody’s also changed Shimao’s outlook to negative from ratings under review.

Last week, Shimao sought to extend payments of a 6 billion yuan trust loan by two years, and some creditors said they were not happy with the proposal that did not offer any credit enhancement.

Shimao did not pay the 1.3 billion yuan in the trust loan that was due last Thursday, local media Cailianshe reported on Tuesday, and no agreement with creditors have been reached yet.

- Reuters with additional editing by Sean O’Meara