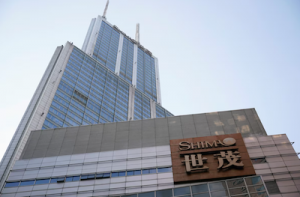

Shares of cash-strapped Shimao Group rose on Monday after the Chinese developer and its chairman sold a Shanghai hotel and a stake in a Hong Kong development, respectively, for a total of $836 million, in their latest efforts to raise funds.

The disposals come after Shimao put assets worth 77 billion yuan ($12.11 billion) up for sale to raise cash to repay its debts. It has offloaded two other assets over the past two weeks for 3 billion yuan.

The Shanghai-based developer said late on Friday it sold Hyatt on the Bund to state-owned Shanghai Land (Group) Co for 4.5 billion yuan.

Its chairman Hui Wing Mau also sold his 40% stake in a Hong Kong high-end residential development to Hong Kong investors CSI Properties and CC Land Holdings for HK$1.05 billion ($134.68 million), according to separate statements from the buyers late on Friday.

Chinese state-owned property firms are expected to acquire more assets from private developers facing tight liquidity, analysts said, as Beijing steps up efforts to stabilise and tighten control over a crisis-hit sector that accounts for a quarter of its economy.

Financial media outlet Cailianshe reported over the weekend that a state-owned healthcare real estate firm in the northeastern province of Shandong may become China Aoyuan Group’s controlling shareholder, and it has completed preliminary due diligence of the group.

Shares of Shimao gained 4.8%, while Aoyuan rose 6.8%. The Hang Seng Mainland Properties Index was up 2.2%.

- Reuters with additional editing by Sean OMeara

ALSO READ:

Shimao Group Sells Hyatt on the Bund as Asset Disposal Intensifies

Cash-Strapped Shimao Sells Joint Venture Stake to Raise Cash

China Resources, Other State Developers Secure Acquisition Funds

Shimao, Kaisa Among Firms Named as Overdue Payments Surge