(ATF) Regulatory challenges, the rise of bitcoin and accelerated digitalisation will mark the year ahead for fintech as legacy systems and manual processes will be under huge pressure to keep up and Covid-19 “fixes” and “workarounds” will be adapted as standard business processes.

Fintech – technology used to support or enable banking and financial services – had a massive role to play in 2020 with some businesses gaining from demands for remote and digital services even as others suffered from lockdowns and the economic slump, as the pandemic surged.

“Fintech will continue to thrive in 2021 as companies are forced to improve their digital offerings,” Edward Moya, Senior Market Analyst in New York for OANDA, said.

“The amount of dealmaking is not going to slow down and investors will want to be involved with financial technology. The payments world is changing and this is where investors see the money going.”

Christian Kronseder, CEO of ALLINDEX, said there was a steady change in investment habits of the new generation of consumers.

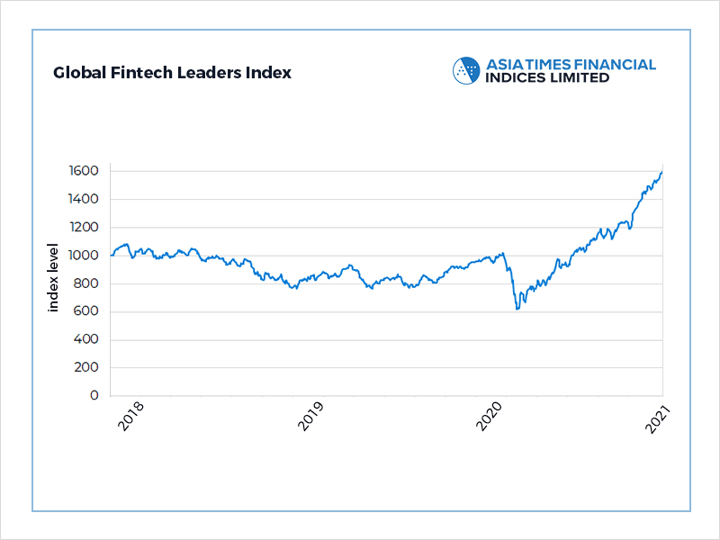

His company created the Global Fintech Leaders Index in collaboration with Asia Times Financial. The benchmark includes shares of digital asset exchanges, investment managers using robo advisories, social media companies and other fintech driven businesses.

“Innovative technology has fueled this change from impact investing to digital assets to hyper customized investment strategies. Again the pandemic has led to a surge in investing into financial assets almost on a casual basis,” he said.

The Global Fintech Leaders Index captures innovation in global fintech – the intersection of financial services and TMT.

Democratisation of technology has allowed disruption of traditional services by offering financial solutions which are more efficient and offer greater transparency. These solutions are supported by a range of technologies such as artificial intelligence, blockchain, machine learning and biometrics.

Big adoption rate in China, India

And nowhere is the impact greater than in China and India where the adoption rate is 87%, according to EY, as consumers lap up services offered by banks, insurers, stock brokers and other incumbent financial institutions.

A major role has been played by blockchain technology in the digital transformation of the financial services industry and one of the most prominent applications of blockchain technology is the cryptocurrency Bitcoin, started in early 2009.

The world’s biggest cryptocurrency has soared this year, as it is perceived as a hedge against inflation and an alternative to the depreciating dollar. Bitcoin extended its monster rally this week surging past $37,000 for the first time and touching a new-all time high of just above $40,000 on Wednesday.

This safe-haven appeal has prompted investment bank JPMorgan to set a target of $146,000 for the cryptocurrency.

Another growing application of blockchain is central bank digital currency (CBDC), which is legal tender created and backed by a central bank rather than a commercial bank or a Payment Service Provider (PSP).

Central bank digital currencies

CBDC solves for the inefficiencies and vulnerabilities in the current central banking infrastructure by simplifying the creation of a secure payments system that serves as a large-scale, decentralized clearing house and asset register.

Work on CBDCs accelerated in 2020, with mainland China’s central bank launching a pilot program and many others stepping up efforts to investigate design considerations and public appetite.

“Research and development work is likely to accelerate next year, though decisions as to issuance will likely take more time. Meanwhile, some jurisdictions are investigating options for interbank CBDCs, which could progress more quickly,” a note from Linklaters said.

The note added that the joint work of seven central banks and the BIS on CBDCs will continue, with exploration of open questions and further public outreach. Various international bodies will also be looking at how CBDCs may be used to enhance cross-border payments.

“Crypto and blockchain are the future and that is why relentless money will be thrown at them. The usage of blockchain is still in its infancy and will likely grow tremendously in 2021. Too much money is getting poured into the space and that will drive innovation. Blockchain will also be used for monitoring logistics and that is why many other sectors such as energy and healthcare will embrace it,” Oanda’s Moya said.

And as technology makes rapid progress, regulations now favour tech companies that mediate financial services rather than banks – particularly for data rules that enhance payments.

“Large technology companies are becoming a lending platform without complying with most banking regulations. Their role is growing, albeit relatively small overall. Pandemics only settle digital players,” said Ana Botín, chairman of Santander in a Financial Times article.

$795 billion worldwide

Last year, fintech and big tech credits reached $795 billion worldwide, according to the Bank for International Settlements.

“Instead of giving banks an advantage, they need to level the competition to remove the advantages that technology companies have had over the last decade. EU regulations require financial companies to allow technology companies access to customer-generated data if the customer agrees. This requirement should apply to data held by all sectors, including technology companies. The stadium should not be tilted for anyone,” said Botin.

And this lack of a level playing field has caused much resentment in Chinese banking circles where Jack Ma’s fintech empire Ant Group – set up in 2004 to process payments for the e-commerce monolith Alibaba – is now being broken up after a last minute halt to its IPO.

“Technological disruptions in finance are insufficiently captured by the existing regulatory framework,” said Fern Wang and Ryan Tsang, of S&P Global.

“We expect the Chinese government will further update its regulations and guidelines to manage the growth and risks brought by the fast evolving fintech industry. We also believe they will seek to reduce opportunities for regulatory arbitrage to level the playing field in terms of regulatory supervision for fintech players and traditional financial services providers.”