(ATF) – Hordes of foreign investors are putting money into China and this time they are headed towards the bond markets, as global stock exchanges have been rocked by negative sentiment, while the Chinese central bank recently unleashed a wall of money to combat growth pressures.

China has been slowly opening its doors to foreigners and foreign ownership in bond markets has leapt over the past two years as different avenues of exposure have emerged – the Qualified Foreign Institutional Investor (QFII) and RMB QFII (RQFII) schemes, plus direct investment in China’s interbank bond market (CIBM Direct) and Bond Connect.

Last year, China’s onshore bond market overtook Japan to become the second-largest in the world in terms of bonds outstanding, behind the United States. Yet foreigners’ holdings are still tiny – less than 5% – when compared with developed markets such as Japan (12.1%) and the US (28%), as well as such emerging markets like Indonesia (39%) and Malaysia (24%).

That is starting to change.

Data from Bondconnect shows foreigners bought 75.5 billion yuan (US$10.81 billion) of government and quasi-government bonds in China in February using the various channels that have been made available. This is five times the amount they bought in the previous month.

-

![CBM50]()

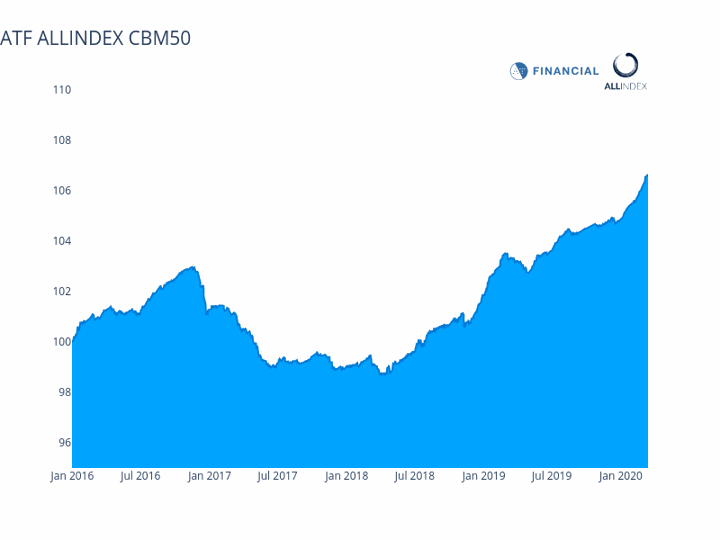

The ATF AllIndex CBM50 Index at the close on Friday

“China flow (of foreign money) is increasing, as it is in a stabilising stage of the Covid-19 recovery and that is allowing investors to buy the recovery, whereas the developed markets are still at an early stage,” said Paul Sandhu, head of Multi-Assets Quant Solutions & Client Advisory, APAC at BNP Paribas Asset Management.

“The high probability of policy activity in China fuelled by growth pressure resulting in lower interest rates could be a potential safe play in an otherwise turbulent global market,” he said.

Indeed those flows have piled pressure on government bond yields – the 10-year yield has tumbled by about 76 basis points since the start of the year to a low of 2.52% this month. They are currently yielding 2.72%, still a hefty 180 basis points above the US Treasuries.

‘Attractively priced’

“China government bonds remain very attractively priced relative to global developed market sovereign bond yields, while also providing investors with the downside protection during volatile time periods,” said Hayden Briscoe, Head of Fixed Income at APAC, UBS Asset Management. “We expect this favourable valuation and risk characteristics will continue to attract global investors to China fixed income. We expect both Chinese monetary and fiscal policies to remain loose in the coming months and Chinese treasury rates are likely biased to decline further.”

-

![Local gov]()

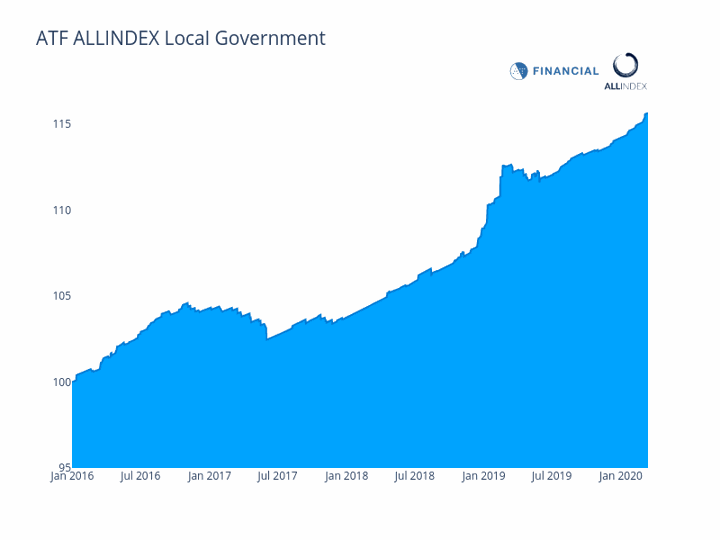

The ATF AllIndex Local Government Bonds Index at the close on Friday

Indeed, China’s central bank on Friday cut the reserve requirement ratio (RRR) by 50-100 basis points (bps), which will release 550 billion yuan into the banking system. This liquidity adds to the 800 billion and 900 billion pile that was released during the last two RRR cuts in January 2020 and September 2019.

“This additional liquidity should push down interbank rates. The 3M SHIBOR, one of the most widely-watched interbank benchmarks, has already dropped 90bps this year to its lowest level since the Global Financial Crisis but further falls are likely,” said Julian Evans-Pritchard, Senior China Economist at Capital Economics.

- READ MORE: West Air bonds go into ‘death spiral’

- READ MORE: China bids to make bond trading more user-friendly