(ATF) The global shortage of semiconductors is hitting car production in China, where automotive executives say a recovery in the sector will begin.

Carmakers around the world have had to adjust assembly lines due to the shortages, caused by manufacturing delays that some semiconductor makers blame on a faster-than expected recovery from the coronavirus pandemic.

Volkswagen, China’s biggest foreign automaker, said the impact of the shortage remains unabated in the second quarter this year. “It’s really like fire-fighting … in some cases, we have switched to another chip so we changed suppliers,” Stephan Woellenstein, Volkswagen’s China chief, told reporters on Sunday.

Li Shaohua, a senior official at the China Association of Automobile Manufacturers, said chip supply shortage hit production by 5-8% in the first two months of this year but he expects the impact to ease from the third quarter of this year.

China, where over 25 million vehicles were sold last year, became a ray of hope for carmakers as the global auto industry was hit hard by the pandemic.

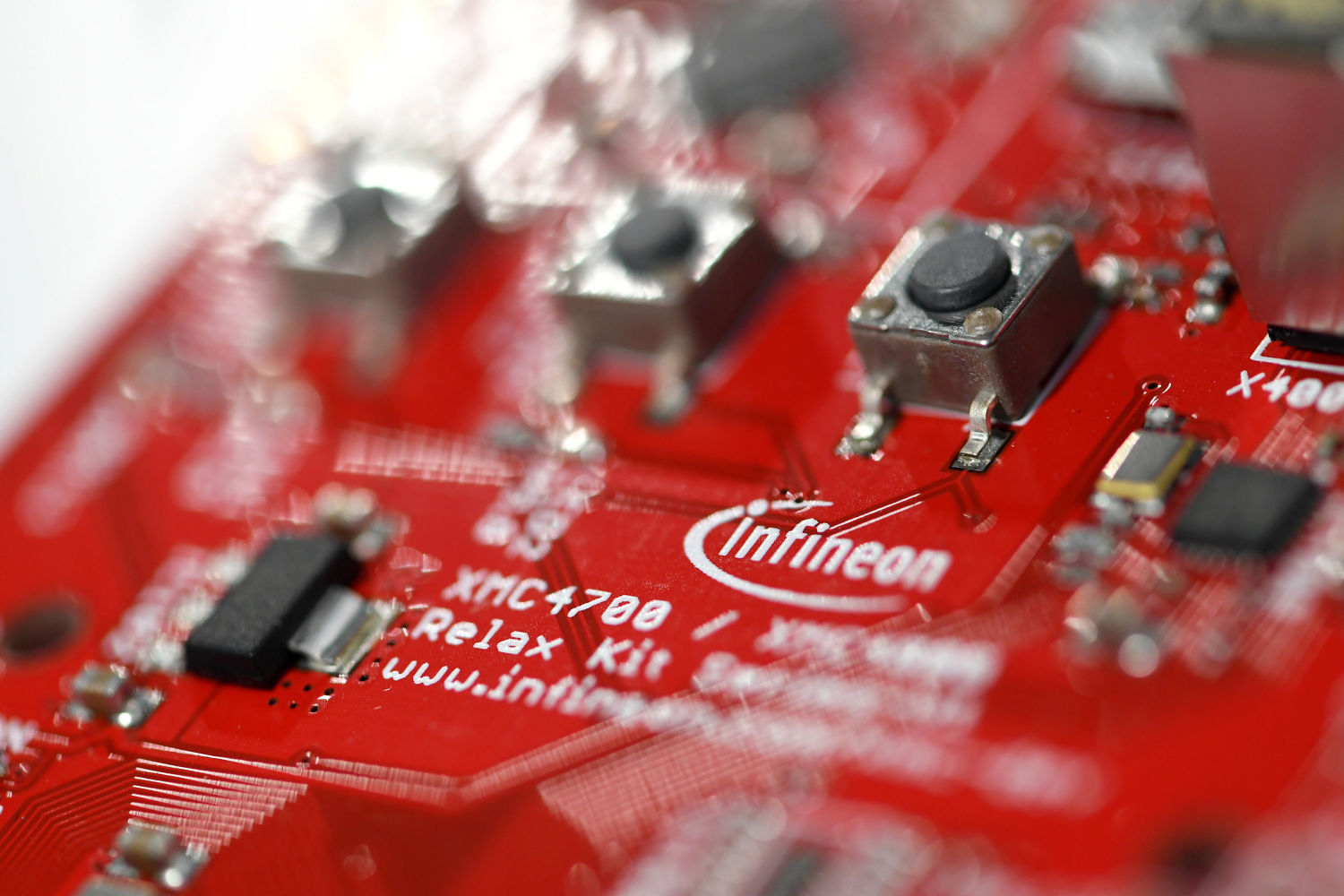

In 2019, automotive groups accounted for roughly a tenth of the $429 billion semiconductor market, according to McKinsey, with NXP Semiconductor, Germany’s Infineon and Japan’s Renesas among key suppliers to the sector.

The chip crisis is affecting companies throughout the automotive industry. Fuyao, a Chinese company that makes electronic sunroofs, said the shortage was “manageable” based on its order book for April to June. But continuing supply issues could pose problems, it added.

RENESAS RESTARTS

One glimmer of hope emerged over the weekend, as Renesas said it had restarted production about a month after a factory fire that threatened to worsen the global chip shortage.

In a separate development, Taiwan authorities said last week that its chip companies would obey US rules forbidding dealings with seven Chinese supercomputing entities.

Taiwan’s Alchip Technologies said it had already stopped selling chips to to Tianjin Phytium Information Technology, which is on the new list.

Taiwan’s technology firms are major suppliers of semiconductors globally, and Economy Minister Wang Mei-hua said they would follow Taiwanese and US rules.

Washington said the Chinese entities were “involved with building supercomputers used by China’s military actors, its destabilising military modernisation efforts, and/or weapons of mass destruction programmes”.

Companies or others listed are required to apply for licences that face tough scrutiny when they seek permission to receive items from US suppliers.

With reporting by Agence France-Presse and Reuters