Asia’s major stock indexes were subdued on Monday with investors keeping their powder dry ahead of key US and Chinese inflation figures due out later this week.

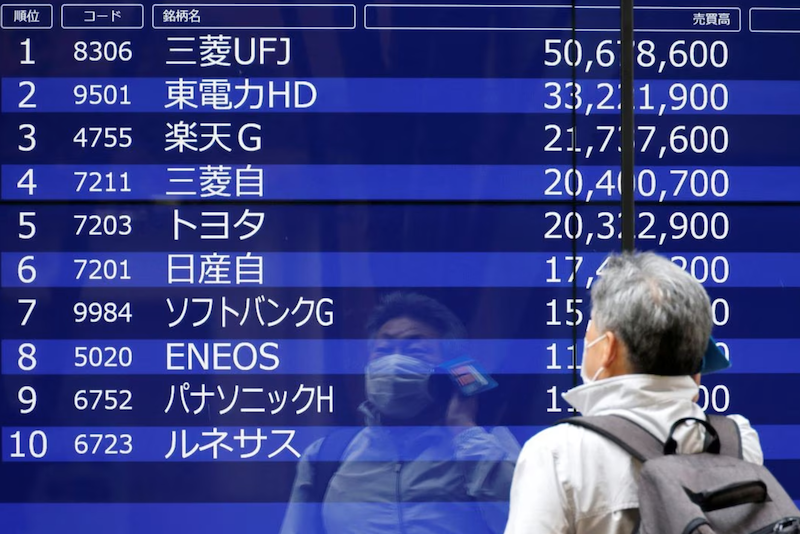

Japan’s Nikkei was an outlier, scraping together gains off the back of some strong domestic earnings while China’s flagging recovery dragged on mainland and Hong Kong stocks.

Tokyo’s Nikkei share average recouped most of its early losses to edge ahead, with companies like drugmaker Astellas leading the way after US approval of vision drug Izervay.

Also on AF: Typhoons, Floods, Heatwaves Cost China Economy $5.7bn in July

The Nikkei share average edged up 0.19%, or 61.81 points, to close at 32,254.56, after the index fell 0.9% to hit its lowest since July 12 earlier in the session. The broader Topix was ahead 0.41%, or 9.30 points, to 2,283.93.

Across the sea in China, mainland and Hong Kong stocks started the week on a weak footing, as the absence of forceful stimulus measures from Beijing sparked concerns that deflationary pressures will continue to sap the vigour from its struggling economy.

China has announced a series of incremental measures in recent weeks to support consumption, aid private firms, and bolster market confidence, but there has been a lack of detail and moves so far have fallen short of investor expectations.

Underscoring the challenges China’s economy faces, the latest official data showed that foreign direct investment (FDI) plunged in the second quarter, while outbound tourism spending fell.

Most sectors fell on the mainland, with real estate shares leading the decline. The Shanghai Composite Index dropped 0.59%, or 19.25 points, to 3,268.83, while the Shenzhen Composite Index on China’s second exchange retreated 0.66%, or 13.77 points, to 2,057.82.

In Hong Kong, the tech index fell 0.3%, while an index tracking Chinese developers fell 2.4%. The Hang Seng Index fell just 0.01%, or 1.54 points, to 19,537.92.

Core US Inflation Seen Slowing

Elsewhere across the region, Mumbai, Singapore, Taipei, Manila, Bangkok and Jakarta all rose while Sydney, Seoul and Wellington fell.

MSCI’s broadest index of Asia-Pacific shares outside Japan was a fraction lower in thin trade, after losing 2.3% last week.

Eurostoxx 50 futures dipped 0.3% and FTSE futures 0.5%. Going the other way, S&P 500 futures added 0.3% and Nasdaq futures 0.5%.

Data on US consumer prices are forecast to show headline inflation picking up slightly to an annual 3.3%, but the more important core rate is seen slowing to 4.7%.

Futures imply only a 12% chance of a Federal Reserve rate hike in September, and 24% for a rise by year-end.

Oil Prices Continue Rally

Michael Gapen, an economist at BofA, cautioned the market was still expecting too much policy easing next year given the recent run of resilient economic data.

“We now expect a soft landing for the US economy, not the mild recession we had previously forecasted,” wrote Gapen.

On Monday, two-year yields were ticking higher again to 4.82%, with the 10-year up at 4.06%.

The pullback in yields took some steam out of the US dollar, which was a shade firmer at 142.12 yen but short of last week’s top of 143.89.

The dip in the dollar helped gold hold at $1,940 an ounce, after Friday’s rally from $1,928.90.

Oil prices paused having rallied for six straight weeks amid tightening supplies. The 17% climb in Brent combined with upward pressure on food prices from the war in Ukraine and global warming, is a threat to hopes for continued disinflation across the developed world.

Brent was off 8 cents at $86.16 a barrel, while US crude also fell 8 cents to $82.74.

Key figures

Tokyo – Nikkei 225 > UP 0.19% at 32,254.56 (close)

Hong Kong – Hang Seng Index < DOWN 0.01% at 19,537.92 (close)

Shanghai – Composite < DOWN 0.59% at 3,268.83 (close)

London – FTSE 100 < DOWN 0.44% at 7,531.08 (0934 GMT)

New York – Dow < DOWN 0.43% at 35,065.62 (Friday close)

- Reuters with additional editing by Sean O’Meara

Read more:

Multiple Moves Needed to Defuse China’s Local Debt Crises

India Import Curbs on Tech Aimed at China, Officials Admit

Hang Seng, Nikkei Back in Positive Territory, Sensex Climbs