Hong Kong’s flagship stock index, the Hang Seng this week announced plans of sweeping changes to the Special Administrative Region’s (SAR) stock benchmark that would dilute the influence of its largest companies and give more sway to fast-growing technology stocks.

The updates include maintaining 20 to 25 companies to be classified as “Hong Kong companies”; broadening the number of industry classifications from 4 to 7, adding Information Technology, Healthcare, and Consumer Discretionary & Staples; and reducing the time required after an IPO before a new stock can be included, from 2 years to 3 months.

The plans also include increasing the number of companies to between 65 and 80, as well as capping weightings at 8% from 10%.

The sweeping proposal comes amid significant changes within the city’s stock market, as a wave of Chinese megacaps choose the financial hub as a preferred venue to sell shares.

Hong Kong’s benchmark index is near its lowest level versus the MSCI World Index in 17 years, and the gauge’s abundance of old-economy financial stocks has made it look outdated in an age when China’s tech giants have increasing sway.

Financial news services around the world quote the Hang Seng Index (HSI) as the main indicator of Hong Kong listed stock performance, and locally, billions of dollars of retirement savings track its ups and downs.

Brief history

The HSI launched in November 1969 with 30 stocks, backdated to a base value of 100 from the end of July 1964. The original 30 included names like the iconic Star Ferry and Philippine beer brand San Miguel, both of which were dropped from the index in 1972 and Dairy Farm, dropped in 1973, added back in 1987, then dropped again in 1995.

Up until 2006, the HSI composition witnessed little expansion in its components with just 33 companies, the vast majority of which were still mostly known as Hong Kong companies, making most of their revenues and profits within the Hong Kong SAR.

Major changes, though, started thereafter when several more mainland-oriented “H-Share”, “Red Chip” and “P Chip” stocks were added without removing existing components.

These additions included CCB, Sinopec, and Bank of China in 2006, and ICBC, China Life, Ping An, Bank of Communications, PetroChina, China Overseas and China Shenhua in 2007, taking the total number of stocks to 43.

Soon, Chinese tech biggie, encent replaced PCCW in 2008, then a few more additions in the following years made the Hang Seng a 50-stock index for most of the period from 2012 through the end of 2020.

However, the steady rise of Mainland-based but Hong Kong-listed companies has raised some concern since then, as the index started mimicking the Mainland-focused benchmarks like the related Hang Seng China Enterprises.

This explains why the quota for the index to assure inclusion of 20-25 “Hong Kong companies” was highlighted.

Before and after

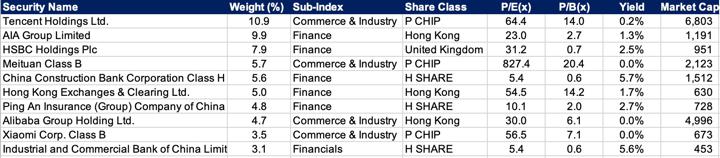

Today, the top-10 HSI components represent just two industries, Finance and Information Technology, and total just over 60% of the index:

Source: Tracker Fund Portfolio Holdings

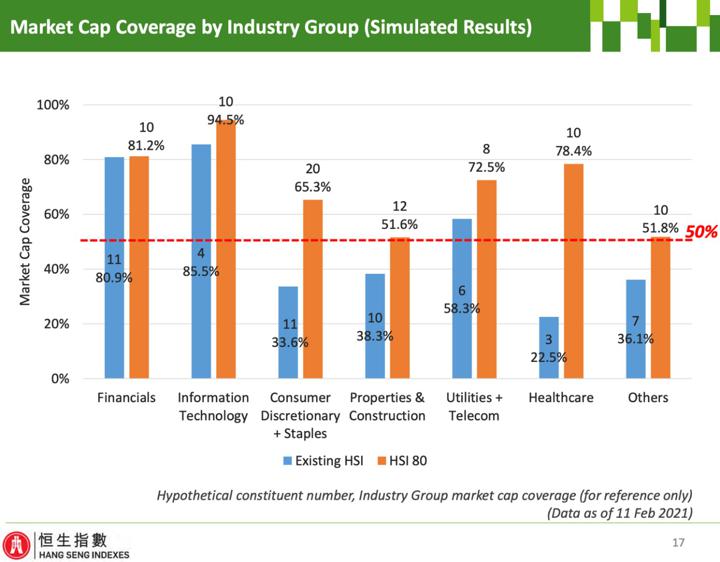

Another enhancement accompanying this sector update is an explicit target that the index should cover at least 50% of the market value of each of the seven industries listed on the Hong Kong Exchange.

This is expected to have the biggest impact on the Healthcare and Consumer sectors, though all this chart means is that the index will cover more of those two industries, not that those two industries will be a significantly larger share of the index.

Experts say, as listed companies across Greater China continue to increase their weightage on the stock exchange, the proposed changes would help the Hang Seng more comparable to the S&P 500 or STOXX 600 than to the more bank-heavy S&P/TSX 60.

Customers and competitors

Broadly, the Hang Seng fund benchmark customers are local and regional, while traders of Hang Seng futures and options are global ones.

The most “captive” customers of the HSI are employees working in Hong Kong who are required to contribute to local Mandatory Provident Fund (MPF) retirement savings schemes.

The HSI is also currently tracked by at least 10 different ETFs (3 listed in Hong Kong, 2 in Shanghai, 1 in Shenzhen, 1 in India, and 3 in Europe and the Middle East) and 11 leveraged & inverse products (all in Hong Kong), as well as a few other funds).

The two largest Hang Seng ETFs (HKEX tickers 2800 and 2833) are also the two largest ETFs in Hong Kong with almost HK$150 billion (US$19.3 billion) in assets, and with a 0.1% expense ratio, are among the lowest cost funds in Asia.

Outside Hong Kong and Mainland China, the HSI is not as widely used as a fund benchmark, barring the two largest US-ETFs with significant allocations to Hong Kong listed stocks: the Vanguard FTSE Emerging Markets ETF.

Each of these ETFs currently have $108 billion and $78 billion in total assets under management, respectively, of which 20-30% are allocated to Hong Kong listed shares, both larger than Hong Kong’s largest tracker fund.

Going forward, futures and options traders in New York or London are more likely to use Hang Seng for their “go-to” China H-share indexes, expect experts.

That’s because Hong Kong lists futures and options on the related HSCEI, as well as “mini” futures contracts both the HSI and HSCEI, with the total volumes of these contracts making Hang Seng the clear leader in benchmarking derivatives on H-shares.

The next most traded China equity index futures contracts outside of Mainland China are the FTSE futures contracts listed in Singapore with roughly US$5-10 billion in daily volume tracking the very different “FTSE China A50” index of A-shares.

Singapore’s SGX recently launched a futures contract on the FTSE China H50 Index that more directly competes with Hang Seng, but the $40 million daily volume of these H50 contracts “have a long way to go before catching up.

The proposed changes then, could have an enormous impact on investment funds traded via options and futures.

Valuation and Expected Returns of Hang Seng Tracking Portfolios

For investors and retirement savers with funds benchmarked to the HSI, the key question is “what is my future expected rate of return on my funds”? Although future investment returns are impossible to predict, valuation is often a key input to future returns, as all else being equal, the more you pay for the same future profits, the lower your rate of yield and vice versa. At a time when many investors are concerned about stock markets being “high” or “expensive”, let’s take a quick look at how the HSI’s valuation multiples compare to history and how these recently announced updates may impact these multiples.

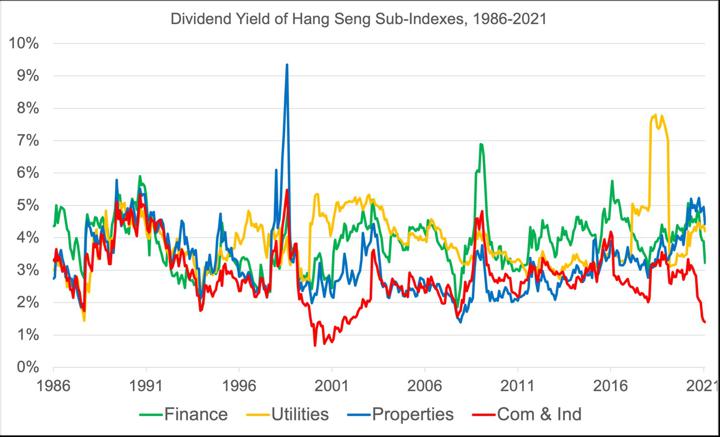

Since 1973, the dividend yield of the HSI has largely traded between 2% and 5%, with the two biggest spikes above 5% happening early, first at the end of the 1972-1974 bear market, and again in the early 1980s around the establishment of the Hong Kong dollar peg. The following chart plots the earnings yield (the inverse of the P/E ratio) above the dividend yield to show one important trend in Hong Kong dividends over the past 50 years: HSI components paid out almost all their earnings as dividends in the early 1970s, but over the past decade, payout ratios have fallen to less than half.

This next dividend yield chart shows dividend yields broken down by each of the four old industry classifications. What is notable is how the yield of the Commerce & Industry sector has diverged away from the other three sectors down to lows not seen since the 1999-2001 dot-com bubble. As seen in the table of top 10 components above, this seems to be due to the rising weight and valuation of Information Technology giants that pay little or no dividends. This means that from a yield and valuation perspective, it will be important to watch how much the upcoming rebalances of the HSI trim exposure to larger low-yield or no-yield names and re-allocate to higher yielding names. Seeing that the median dividend yield of the 52 largest HK-listed companies is currently 2.6%, versus 3.6% for the next 52 largest stocks (https://www.hkex.com.hk/Market-Data/Securities-Prices/Equities?sc_lang=en), it seems likely the rebalance may both raise as well as diversify the index’s dividend yield.

Conclusion

For most of my career so far, I had considered the Hang Seng to be an index widely used news sources and traders, but a lopsided and outdated measure for long-term Greater China investors seeking a benchmark. Of the modernizations described above, the lowering of the maximum stock weight to 8% and target that the index will cover at least 50% of the value of each of 7 industries listed in Hong Kong are the two I believe are most important to making the HSI more balanced and relevant to investors.

# Tariq Dennison is a wealth adviser at GFM Asset Management in Hong Kong, serving individuals, trusts, charities, and US 401k, IRA, and defined benefit pension plans. He is responsible officer of GFM Group Limited (a Hong Kong based Type 9 licensed asset management firm) and principal of GFM Asset Management LLC (a US SEC registered investment adviser).

READ MORE:

Yield spike sours risk appetite

China markets end with bang on strong PMI numbers