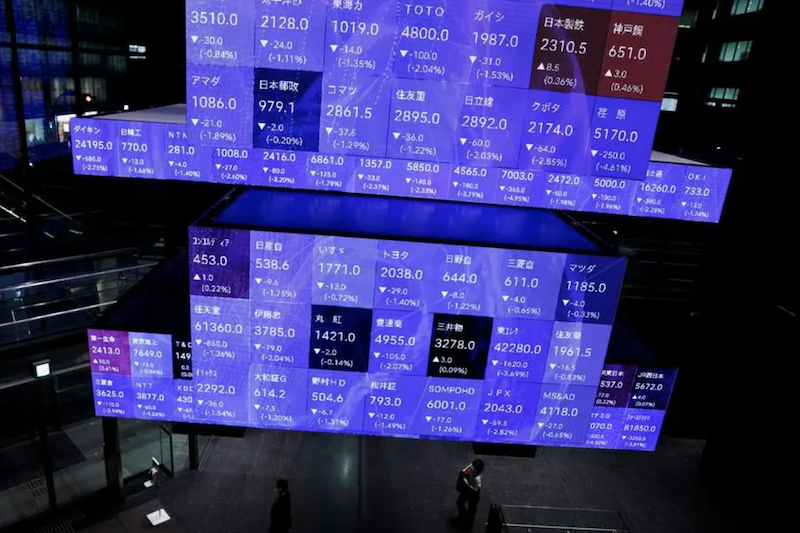

Asian stocks slipped on Wednesday as optimism at the start of the week that interest rate cuts were in the pipeline were dashed by signs of caution from US Fed officials.

Expectations had been building that US policy rates have peaked and cuts could begin as early as May, following a softening in key monthly jobs data at the end of last week and a tempering in the Fed’s hawkish stance.

However, investor mood flipped amid guarded remarks from central bank officials.

Also on AF: China ‘World’s Largest Official Debt Collector’: US Report

Japan’s Nikkei share average closed lower, giving up early gains as investors sold value stocks, although gains in growth stocks limited losses.

The Nikkei edged down 0.33%, or 105.34 points, to close at 32,166.48, while the broader Topix was behind 1.16%, or 26.96 points, at 2,305.95.

The sell-off came after the Nikkei rose more than 6% in a four-session streak that lasted till Monday. Oil refiners lost 6.11% to become the worst performer among the Tokyo Stock Exchange’s 33 industry sub-indexes. The banking index, another gauge for performance of value stocks, lost 4.75%.

China stocks were little changed, tracking mixed regional peers on concerns of global rates tightening, while Chinese authorities were bullish about the world’s second largest economy.

The blue-chip CSI 300 Index lost 0.24%, while the Shanghai Composite Index was 0.16% off, or 4.90 points, to 3,052.37. The Shenzhen Composite Index on China’s second exchange edged up 0.14%, or 2.63 points, to 1,920.84.

Shares in property developers gained 1.6%, while media firms jumped 3.7%, and computer stocks rose 1.8%.

Hong Kong’s Hang Seng Index dropped 0.58%, or 101.70 points, to close at 17,568.46, and the Hang Seng China Enterprises Index slipped 0.78%.

Elsewhere across the region, in earlier trade, Singapore, Seoul, Wellington and Jakarta all dropped, though Sydney, Taipei, Manila, Mumbai and Bangkok edged up. MSCI’s broadest index of Asia-Pacific shares sank 0.44%.

Crude Prices at Three-Month Low

Globally, Treasury yields and the dollar hovered above multi-week lows as markets grappled with the possibility of another US interest rate hike while waiting on comments from Federal Reserve Chair Jerome Powell later in the day.

Fed Governor Christopher Waller said on Tuesday that the economy bears watching after “blowout” third-quarter GDP figures, while fellow governor Michelle Bowman said she still expects higher rates will be needed.

Stocks were in the red, with declines in energy shares and financials eclipsing gains for tech stocks.

Crude oil sank to a three-month low after data showed a steep build in US stockpiles, while worries about the Chinese economy weighed on the outlook for demand.

Brent crude futures ticked up 4 cents to $81.65 a barrel, while US crude futures slipped 14 cents to $77.24. Both declined to the lowest since July 24 late on Tuesday.

US 10-year Treasury yields were little changed at around 4.58%, finding a floor after dipping as low as 4.484% on Friday for the first time since September 26. They reached a 16-year high of 5.021% last month.

The dollar index, which measures the currency against six major peers, ticked up to 105.605, pulling away from the more than six-week low of 104.84 reached on Monday, but well back from the high at the start of this month at 107.11.

Wall Street futures pointed slightly lower following gains across the big three indexes overnight, led by a 0.9% rally for the tech-heavy Nasdaq. Pan-European Stoxx 50 futures slipped 0.2%.

Key figures

Tokyo – Nikkei 225 < DOWN 0.33% at 32,166.48 (close)

Hong Kong – Hang Seng Index < DOWN 0.58% at 17,568.46 (close)

Shanghai – Composite < DOWN 0.16% at 3,052.37 (close)

London – FTSE 100 > UP 0.01% at 7,410.52 (0935 GMT)

New York – Dow > UP 0.17% at 34,152.60 (Tuesday close)

- Reuters with additional editing by Sean O’Meara

Read more:

China Officials Seen Asking Ping An to Take Over Country Garden

Multinationals Eye Production Shifts, China Blamed: ECB Survey

China’s Money Market Chaos Shows Tight Mix of Economic Goals

Nikkei, Hang Seng Slide on Fading Rate Hopes, China Data