(ATF) Chinese telecom giant Huawei Technologies reported 3.8% revenue growth for 2020, its slowest annual increase in the past decade, amid the global pandemic and intense pressure on its supply chain from US trade sanctions.

The Shenzhen-based company reported on Wednesday 891.4 billion yuan (US$136.7 billion) in group revenue. Net profit for 2020 came in at 64.6 billion yuan, up 3.2%, compared to growth of 5.6% a year earlier.

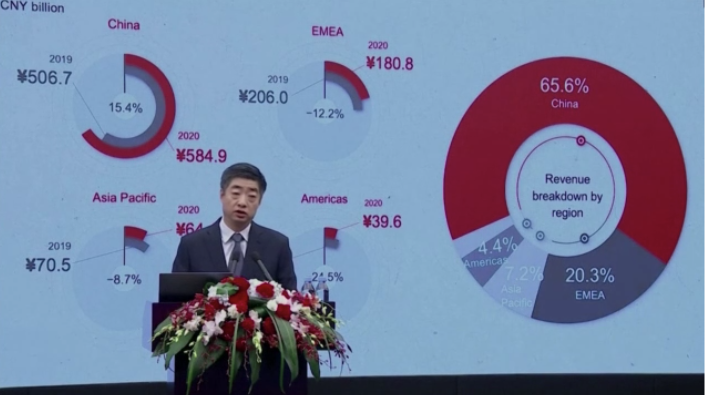

Huawei’s growth was driven by its home market, with revenue in China up by 15.4% to 584.9 billion yuan. The home market accounted for 65.6% of the company’s total sales in 2020.

Its business declined everywhere else, largely due to the pressure on its smartphone business posed by US sanctions. Sales were down 12.2% to 180.8 billion yuan in Europe, the Middle East and Africa, down 8.7% to 64.4 billion yuan in the rest of Asia, and down 24.5% to 39.6 billion yuan from the Americas.

US sanctions bite

The US has slapped Huawei with a number of sanctions over the last two years. Washington maintains that the Chinese telecommunications giant is a national security threat, a claim that Huawei has repeatedly denied.

Huawei was put on a so-called Entity List by former US president Donald Trump in 2019, which restricted the company’s access to key software and components such as Google’s Android operating system and services, and microchips from Intel and Qualcomm. The export restrictions also barred contract chipmakers that use American technology, including Taiwan Semiconductor Manufacturing Corp, the world’s largest, from selling advanced chips to Huawei.

The ban put Huawei’s handset business under immense pressure, with the company selling off its budget smartphone unit to a consortium of agents and dealers in November 2020 to keep it alive.

They also cost Huawei the No-1 spot in the global smartphone market. After the ban took full effect in September, Huawei fell out of the world’s top five smartphone vendors in the fourth quarter (Q4) and were ranked sixth, after being the market leader in the second quarter.

Huawei’s consumer business, which includes smartphones, brought in 482.9 billion yuan, up 3.3% year-on-year, and accounted for over half of the company’s revenue. That was slower than the 34% growth seen in 2019.

A 65% growth in other consumer devices such as smartwatches, laptops, and tablets was able to offset the blow to its smartphone business, rotating chairman Ken Hu said.

Facing huge blows from the US sanctions on its smartphone business, Huawei has adopted a “1+8+N” device portfolio strategy with “1” representing the smartphone, “8” referring to other Huawei devices such as smart TVs, laptops, watches, and head units, and “N” meaning third-party devices enabled by Huawei’s IoT solutions.

The company’s business installing mobile telecom infrastructure, and especially new 5G-capable systems, has also been severely damaged by the US campaign against it.

The company’s carrier business, which includes 5G network equipment, brought in over 302 billion yuan, an increase of just 0.2% a year earlier.

Revenue from the company’s enterprise segment soared 23% year on year to just over 100 billion yuan, although it still makes the smallest in revenue of the three business groups.

The Chinese tech giant had a glimmer of hope that sanctions enforced by Trump might be eased somewhat once his political rival Joe Biden took office in mid-January, indeed Huawei founder and CEO Ren Zhengfei told media at an event in February he would “welcome a phone call from Biden”.

Biden tightens restrictions

However, there has been no US backdown. Biden has not signaled that he would go more easy on China or the tech giant.

Earlier this month, the Biden administration amended licences for companies to sell to Huawei, but this was to further restrict companies from supplying items that can be used with 5G devices, Reuters reported. New conditions make older licences more consistent with tougher licensing policies implemented in the waning days of the Trump administration.

In addition, the US Federal Communications Commission (FCC) this month designated Huawei among five Chinese companies as threats to national security under a 2019 law aimed at protecting US communications networks.

Huawei’s chief financial officer and Ren’s daughter, Meng Wanzhou, is, meanwhile, in the final rounds of a court battle as she fights extradition to the US on fraud charges. Meng, who has said she is innocent, has been living under house arrest in Canada ever since she was detained at Vancouver International Airport in December 2018 on a warrant from the US.

Among other arguments, Meng’s lawyers said the US government’s pursuit of Meng is part of a strategy to thwart the rise of the Chinese technology company, and it remains political in Biden’s presidency.

Meng’s case is scheduled to wrap up in May, although the potential for appeals on either side mean it could continue for some years.