The Chinese economy has become more unbalanced, the International Monetary Fund said in an annual review on Friday, as it cut its forecast for the nation’s growth this year.

The fund attributed China’s slowdown to the “rapid withdrawal of policy support, the lagging recovery of consumption amid recurrent Covid-19 outbreaks … and slowing real estate investment”.

It now expects gross domestic product (GDP) to expand 4.8% in 2022, down from an earlier 5.6% projection, and 5.2% in 2023.

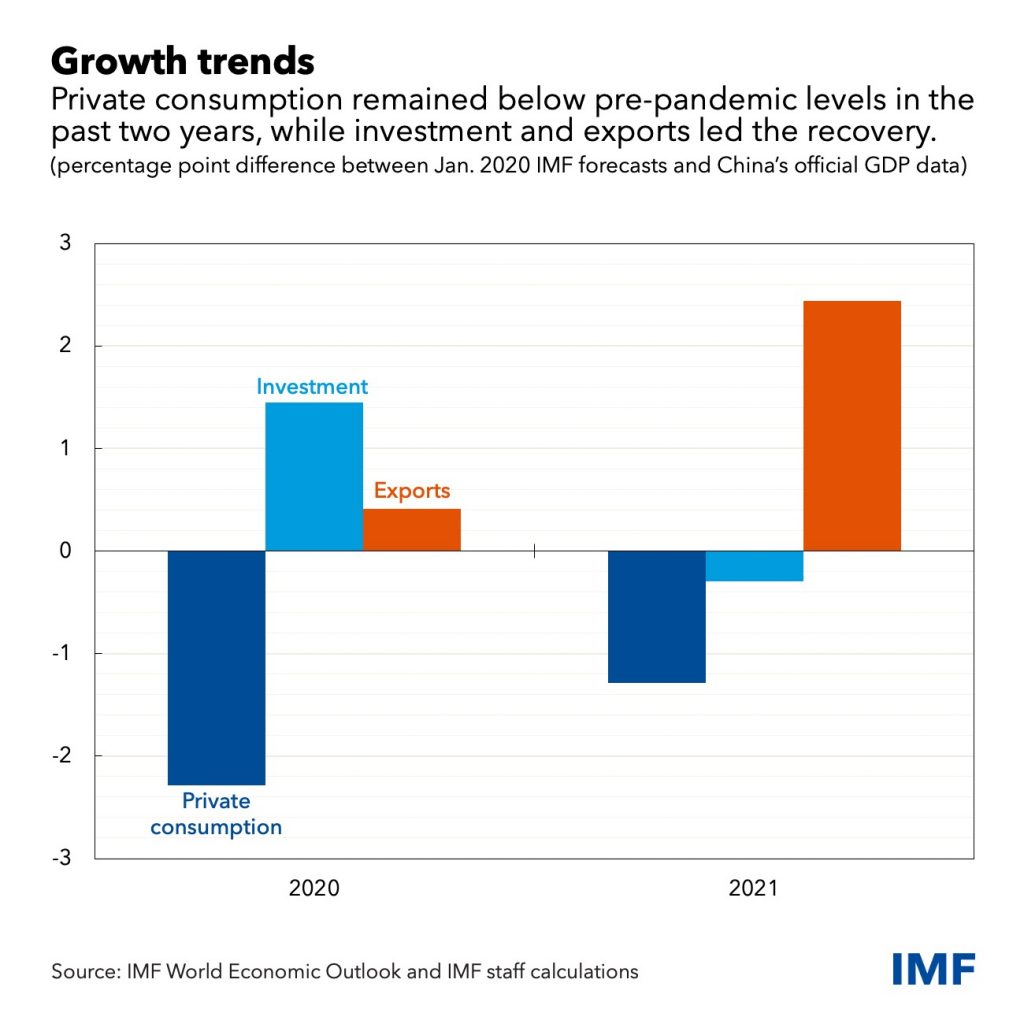

“China’s recovery is well advanced, but it lacks balance and momentum has slowed,” the IMF’s annual Article IV review stated.

Core inflation is projected to stay below Beijing’s 3% target, while the current account surplus is expected to narrow in 2022 to 1.5% of GDP from 1.8% in 2021 as demand for pandemic-related exports normalises.

During an Article IV consultation, an IMF team of economists visits a country to assess economic and financial developments and discuss the country’s economic and financial policies with government and central bank officials.

Significant Tightening

The significant tightening of macroeconomic policy support last year had slowed growth momentum, the IMF said. “Fiscal policy turned strongly contractionary at the beginning of 2021, reflecting policymakers’ shifting focus away from supporting the recovery to deleveraging,” the review stated.

“The withdrawal largely represented decreases in public investment, although some targeted fiscal support continued, including select tax and fee cuts for small firms.”

As a result, supportive measures from the People’s Bank of China are expected in the next few months to stabilise the faltering economy.

As a result, supportive measures from the People’s Bank of China are expected in the next few months to stabilise the faltering economy.

China saw a strong recovery from the pandemic-induced slump but growth slowed sharply in the second half of last year.

“Structural reforms — a requisite for China’s transition to high-quality growth, growth that is balanced, inclusive and green — have progressed unevenly across core areas, the IMF said.

While exports have boosted growth during the pandemic, the IMF warned that “global tailwinds are poised to unwind”, leaving the world’s second-largest economy to contend with serious challenges.

‘Policy Uncertainty’ Increases

The fund also appeared to criticise China’s crackdown on technology companies, private education providers and others, targeting unfair competition and data governance.

“A wave of regulatory policy measures targeting technology sectors, while intended to strengthen competition, consumer privacy, and data governance, has increased policy uncertainty,” the review said.

That uncertainty, it added, “has been further heightened by the financial stress faced by large property developers following policy efforts aimed at deleveraging”.

The review urged Beijing to guard against risks in the property sector by “strengthening monitoring, transparency on risk exposures, and policy coordination and communication”.

The IMF also called for measures to ensure fair competition between China’s private firms and its state-owned enterprises, warning that such reforms are needed to deal with slowing productivity growth.

The fund said the review’s key message was that rebalancing toward a more consumption-based model will boost growth prospects in the short term and deliver high-quality expansion in the long run.

“Importantly, it will also help bring the country closer to achieving its climate goal of carbon neutrality before 2060,” the fund added.

• George Russell

READ MORE:

IMF’s Gopinath Urges China to Ease Its Covid-19 Policy

China Pulled Plug on Economic Recovery Too Soon, Says IMF Chief

IMF Urges El Salvador to Dump Bitcoin as Legal Tender