India’s central bank made an inter-meeting cut in benchmark repo rates to a record low and unveiled steps to support small businesses, extend loan moratoriums and ease bond redemption pressures on state governments in a bid to contain the economic fallout of the world’s largest coronavirus lockdown.

Even before almost all activity shut down in late March, Asia’s third-largest economy was struggling to gain traction with sluggish growth, record unemployment and banks reluctant to lend.

The Reserve Bank of India (RBI) slashed the repo rate – the rate at which it lends to commercial banks – by 40 basis points to 4.0%, the second cut this year. The bank had cut the repo rate by 75 basis points in March as fears grew over the spread of the virus in the country of 1.3 billion people.

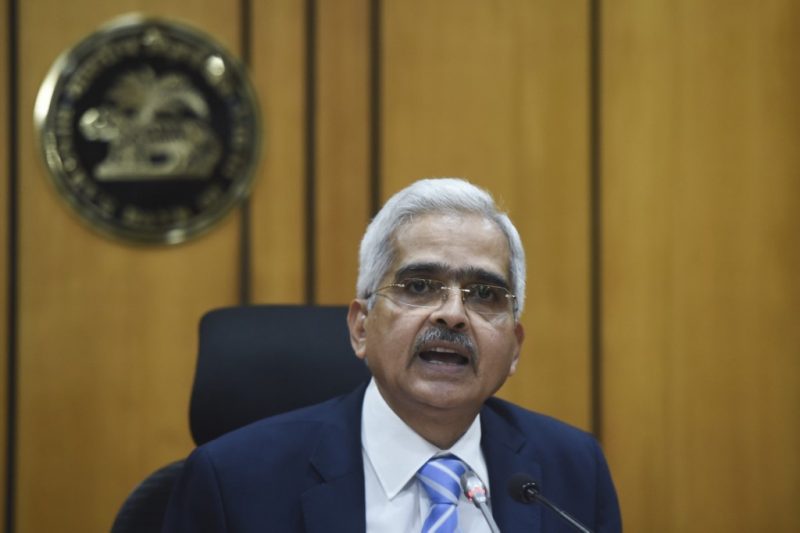

“The impact of coronavirus is turning out to be more than expected. GDP growth is estimated to remain in negative territory in 2021,” Reserve Bank governor Shaktikanta Das told an online news conference.

“RBI will continue to be vigilant and will take whatever measures are needed to be taken due to Covid pandemic,” Das added.

Virus infections in India surged past 110,000 this week, with Mumbai – the worst-hit city – accounting for more than a fifth of the cases.

Alarm bells

Recent data have also set alarm bells ringing. Last month the purchasing managers index (PMI) of activity in the services sector suffered its sharpest contraction since it began in 2005, while inflation soared to 8.6%.

India witnessed its steepest decline in trade in April, he added, with exports and imports both slumping around 60%.

Earlier this month Prime Minister Narendra Modi announced a 20-trillion-rupee ($266 billion) stimulus package – 10% of the country’s GDP – to boost the battered economy.

The RBI also lowered the reverse repo rate, the rate at which it borrows from commercial banks, by 40 basis points.

India’s central bank also extended existing liquidity support measures, including the extension of a three-month loan moratorium by another three months, an easing of pre- and post-shipment export credit rules with an increase in the credit period to 15 months from one year and 150 billion rupees credit line to EXIM Bank as well as higher lending for corporates.

The move shouldn’t be a complete surprise given the economy’s increasing struggle with Covid-19 – India has already displaced China as Asia’s epicentre of the pandemic, ING economist Prakash Sakpal said, adding that it was the RBI which was carrying the burden of supporting growth as the government’s stimulus package was more about long-term structural economic reforms than an immediate real boost to the economy.

“We believe more policy rate cuts remain on the cards given that there is no change to the central bank’s accommodative policy stance just yet. We don’t rule out another 25-50bp rate cut at the next scheduled meeting in early August, or even earlier if the situation continues to worsen in the months ahead,” Sakpal said.

The central bank was also likely to unleash other supportive measures.

Shilan Shah, Senior India Economist of Capital Economics, said that additionally, the cash reserve ratio could be slashed and the size of the TLTRO programme – which was left unchanged today – could be ramped up further.

Das said the global economy was headed towards a recession because of coronavirus-induced disruptions to supply chains.

The rate cuts did little to soothe investor fears, with shares in Mumbai falling almost 2% on Friday.

– with additional reporting by AFP