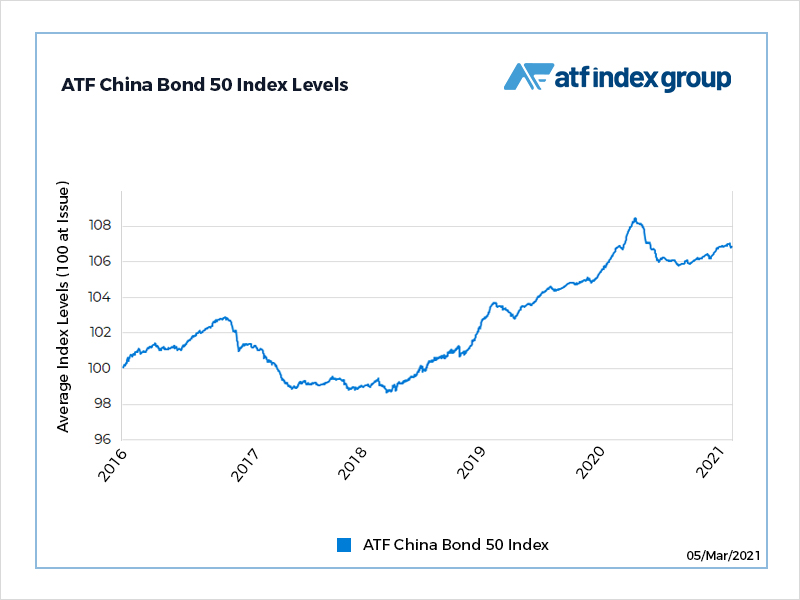

(ATF) Returns on a gauge of Chinese credits and local government bonds fell for a second week as the selloff in the broader global bond market kept investors away from even the best-performing securities on the world’s second-largest fixed-income market.

Concern remains that an unleashing of economic activity as vaccine rollouts tame the coronavirus pandemic will lead to a sudden surge in the cost of living. Bond investors are fearful of inflation because it erodes the value of the fixed-income payouts on them.

Uncertainty is likely to persist, however, in the coming week.

While all eyes will be on February’s inflation figures due from Beijing on Wednesday, the annual five-day confab of the Chinese leadership is also likely to feed into markets in the coming week.

The benchmark ATF China Bond 50 Index of the most liquid AAA rated credits fell 0.12% in the past week with the steepest decline seen on Monday after disappointing factory data combined with concern global concern.

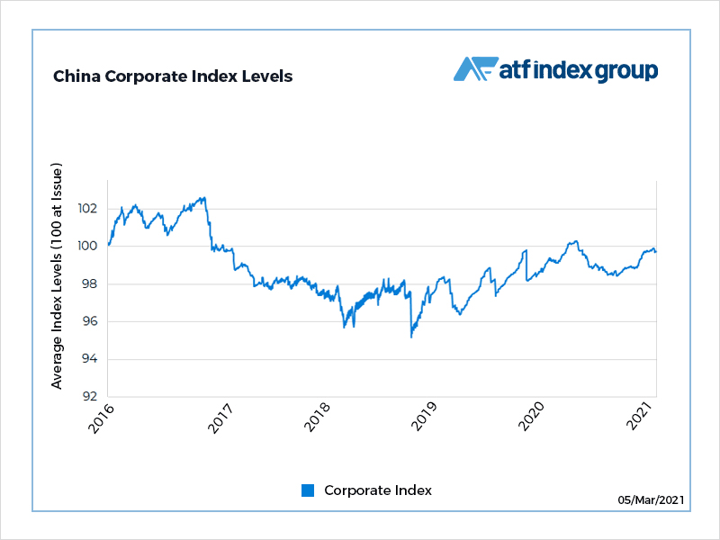

A sub-index of private bonds fell 0.09%, extending a 0.14% slide the previous week. Corporate bonds have been worst hit because the issuers are seen as less able to rely on the coffers of the state to bail them out in the event of a default.

Coupon payments by Beijing Capital Group and Chengdu Rail Transit Group are also likely to weigh on the indexes. Bond values tend to drop after coupon payments because they reduced the total pool of cash repayable on the debts.