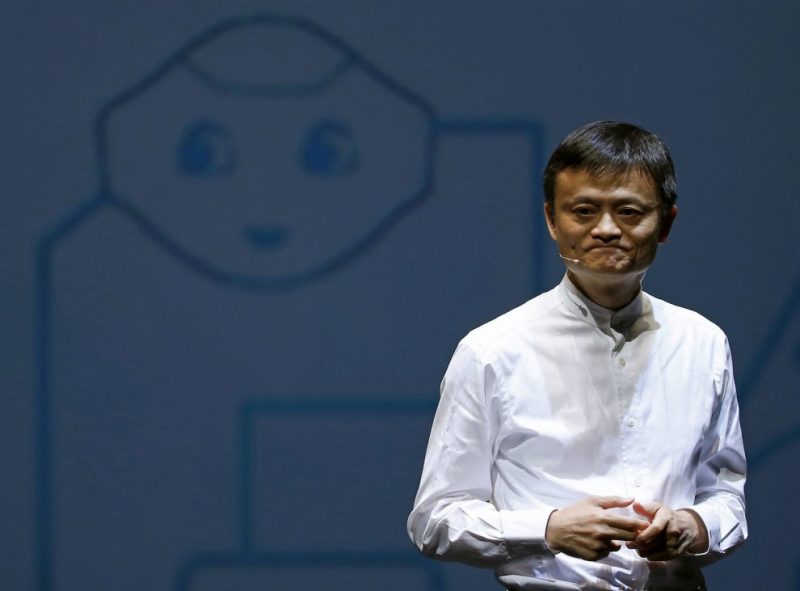

Chinese billionaire Jack Ma plans to give up control of Ant Group to help distance the company from its parent Alibaba after more than a year of regulatory pressure, the Wall Street Journal reported, citing people familiar with the matter.

Ant has told regulators that Ma plans to give up control as it changes into a financial holding company, perhaps by allocating a proportion of his voting rights to other Ant executives including CEO Eric Jing, the WSJ report reported, adding that he had contemplated the move for years.

With Ma giving up control, any potential revival of Ant’s IPO may be pushed back by a year or more, the story said. It added that securities regulations require a timeout for companies that have undergone a change in ownership. Ma currently holds 50.52% of Ant.

Regulators and central bank officials have for nearly two years said that they want to split Ant Group from Alibaba and restructure it as a financial holding company.

Unfair Advantage

China’s state-owned lenders had long complained that online competitors such as Ant had an unfair advantage by being subject to less stringent regulations.

Ant grew into a financial behemoth after it was split off by Alibaba in 2011, helped by affiliate Alipay’s almost 1 billion users.

Regulators asked Ant in late 2020 to consider folding most of its financial businesses – payments, lending, insurance and wealth management – into a holding company that would be subject to more stringent capital requirements. It was forced to rejig its lucrative micro-loan businesses and contribute over $625 million in registered capital.

In the 18 months since then, Ant has been transformed into a financial holding company, as demanded by the People’s Bank of China (PBOC), while seven senior Ant executives recently cut ties with Alibaba.

Ma, who is 57 and reportedly in semi-retirement, no longer has a formal position at Ant or a seat on the board.

- Jim Pollard

ALSO on AF:

Ant Executives Sever Ties With Alibaba After China Crackdown

China’s Alibaba Announces Dual Primary Listing in Hong Kong

China’s Alibaba Unwinds Corporate Links With Ant Group

Ant Group Said to Revive IPO in Latest Sign of Easing Tech Crackdown

Alibaba Earnings up on High Online Demand Amid Lockdowns