The Fumio Kishida government’s decision to support US export curbs on chipmaking tools – to limit China’s ability to produce advanced semiconductors – has not had total support in Japan.

Some Japanese officials fear the US move is combative and will further inflame ties with Beijing.

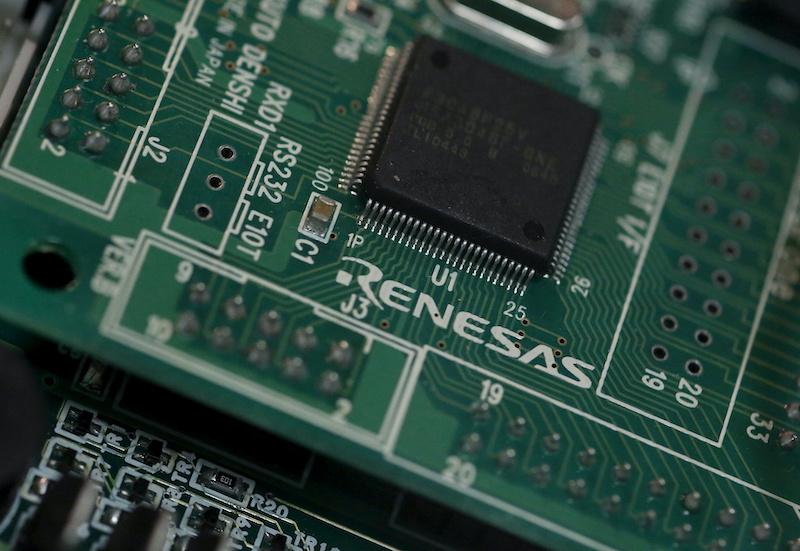

From this week, Japan is restricting 23 types of equipment, ranging from machines that deposit films on silicon wafers to devices that etch out the microscopic circuits of chips that could have military uses.

But, while the US referenced China 20 times in its announcement in October that targets Chinese companies, Japan has chosen broad equipment controls not specifically aimed at its bigger neighbour.

ALSO SEE: EU, US Sanctions Aim to Curb Funds for War in Myanmar

‘No need to identify the country targeted’

“We feel an odd discomfort with how the US is doing this. There’s no need to identify the country, all you need to do is control the item,” a Japanese industry ministry official said.

Japan can’t sanction countries unless they are involved in a conflict, the source explained.

Japan’s trade and industry minister told reporters when announcing Japan’s measure in March that China was only one of 160 countries and regions that would be subject to controls and that Japan’s rules were not meant to follow the US.

Even so, China has warned Japan to backdown.

Tokyo and Washington share concerns about China’s push for advanced technologies and in May agreed with other Group of Seven industrial democracies on “de-risking” from potential Chinese economic coercion.

However, differences in chip-making equipment controls could test that unity, should either gain a competitive advantage over the other by allowing exports the other blocked.

“Each country is responsible for its own licensing policies, and on top of that it’s up to each country to enforce the licensing decisions that it undertakes,” said Emily Benson, the director of the trade and technology project at the bipartisan nonprofit Center for Strategic and International Studies (CSIS) in Washington.

Exports ‘will be allowed when possible’

Japan is not applying a US standard of presumption of denial and will allow exports whenever possible, a second Japanese government official said. Japanese government sources asked to remain anonymous because of the sensitivity of the issue.

There may also be underlying tensions because unlike Japan and the Netherlands, which will implement controls starting September, the US is not limiting restrictions to specific tools.

“The US rules still restrict other items and services the others do not,” Washington trade lawyer Kevin Wolf said.

Reuters contacted six chip tool makers in Japan. Two of them, deposition machinery maker Kokusai Electric and Japan’s leading chip tool maker Tokyo Electron, said they expect Japan’s controls to have a limited business impact.

Chip tester company Advantest Corp said none of its products are affected.

Lithography machine makers Nikon Corp and Canon Inc, and wafer cleaner manufacturer Screen Holdings did not respond.

‘Chip tools should be in Wassenaar Arrangement’

Dovetailing Japan’s controls with those of the US and the Netherlands will require close coordination.

“The issue in all these things is, what is it you can let go safely and what do you need to block. Everyone draws the line a little bit differently,” former US State Department and Commerce Department official Jim Lewis said.

Lewis is a researcher at the CSIS). He has met with Japanese trade officials and believes Tokyo is committed to curbing certain exports.

Tokyo, Amsterdam and Washington have all indicated they would like chip tools added to a list of weapons, dual-use goods and technologies controlled by the 42 nations that are party to the Wassenaar Arrangement established after the Cold War.

They are unlikely, however, to win the unanimous backing they need from its members.

“The Wassenaar arrangement is next to hopeless because Russia’s a member,” Lewis said. “You’re never going to start by getting universal consensus. So, pick the guys who care and get them to work together.”

The alternative is to form a closer group with the US and the Netherlands to oversee chip manufacturing tools that could eventually include other countries, the first Japanese industry ministry official said.

The US Commerce Department and Dutch government declined to comment. The White House did not respond to a request for comment.

Japan still talking to US, fears retaliation

In the meantime, US President Joe Biden’s administration is expected to update its October rules, in part to align with the broader Japanese tool list.

It could also go further than the Netherlands in limiting what Dutch lithography manufacturer ASML can supply to certain Chinese plants.

The US can regulate ASML directly as its equipment includes US parts. At the time, sources expected the updates in July, but that now appears unlikely.

“Part of the reason it’s taking so long is that the US is still talking to Japan. They need to make sure that if they block anything, that they similarly block it in Japan,” a source familiar with the discussion said.

Tokyo remains worried that targeting China will provoke damaging retaliation, such as a ban on Japanese electric cars, a third Japanese industry official said.

“What advantage is there to making someone lose face, unless that is your objective.”

- Reuters with additional editing by Jim Pollard

ALSO SEE:

Dutch Restrict Chip Exports Amid US Push to Tighten China Curbs

Japan to Buy Chips Material Firm as Tokyo Ramps Up Tech Push

Japan and US Agree to Cooperate on Advanced Technology

China Warns Japan to Reverse its Ban on Chipmaking Gear

US Risks ‘Enormous Damage’ With China Chip War: Nvidia CEO

Access to China ‘Essential’ as it Develops Chips: ASML CEO

US, Japan Chips Alliance Aims to Thwart China Ambitions