The US Securities and Exchange Commission on Wednesday added dozens of Chinese companies – including new economy giants like JD.com, NetEase and Pinduoduo – to its list of shares that face expulsion from stock exchanges because of Beijing’s refusal to allow auditing access.

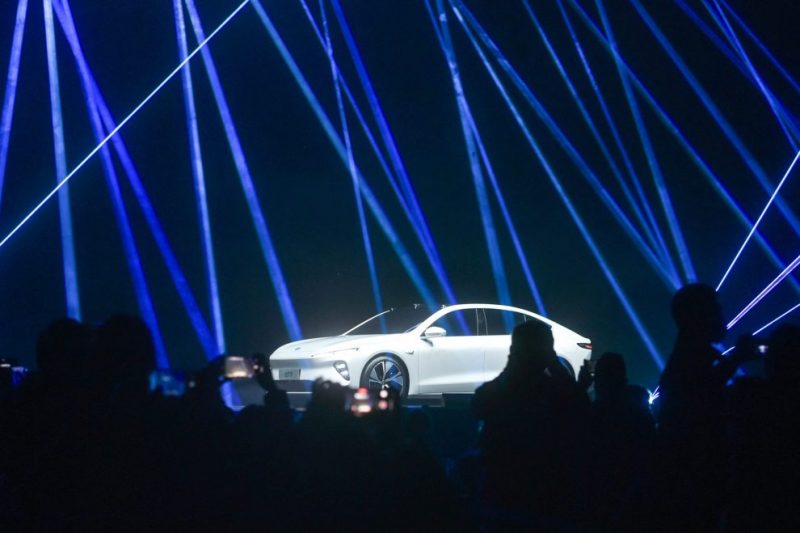

One of China’s largest companies, China Petroleum & Chemical Corporation, known as Sinopec, and electric vehicle maker Nio were also among the 80 new names added to the list.

The additions come after China’s securities watchdog said it has been in regular talks with US regulators over the audit stand-off and expects a deal soon.

Under the US Holding Foreign Companies Accountable Act (HFCAA), which became law in 2020, the SEC must identify public companies that have retained a registered public accounting firm to issue an audit report where the firm has a branch or office located outside the US, and the Public Company Accounting Oversight Board (PCAOB) “has determined that it is unable to inspect or investigate completely because of a position taken by an authority in the foreign jurisdiction”.

JD.com, one of China’s biggest internet companies, said it understood the SEC determination, and “has been actively exploring possible solutions”.

A statement said the company would “continue to comply with applicable laws and regulations in both China and the United States, and strive to maintain its listing status on both Nasdaq and the Hong Kong Stock Exchange”.

MARKET INSIGHTS: China Stocks Delisting From US: Everything You Need to Know

In accordance with the HFCAA, a company will be delisted from a US stock exchange only if the company has been identified by the SEC for three consecutive years due to PCAOB’s inability to inspect auditor’s working paper.

The HFCAA specifically requires the SEC to delist any company that does not cooperate with PCAOB audit inspection requests. Dozens of Chinese companies have been placed on the list, and face possible delisting.

Edison Lee, an analyst at Jefferies, said the likely eventual outcome was that no Chinese state-owned enterprises (SOEs), would be allowed to list in the US. “[China believes] that offering access to audit trails of SOEs would create a national security risk,” he said.

Tech companies that possess sensitive data would also be banned from US exchanges. “In fact the [China Securities Regulatory Commission] already introduced a rule that would monitor that,” Lee added.

He expected currently US-listed Chinese companies to be asked to split off businesses that may possess sensitive data from the listed vehicles, or else Chinese regulators would ask them to delist from the US.

- George Russell

READ MORE:

Chinese Firms Flock to Switzerland as US Delisting Risks Loom

SEC Delisting Warning Skewers Zhihu’s Hong Kong IPO

Didi Sets Shareholder Meeting on May 23 to Vote on US Delisting

China Stocks Delisting from US Pressures Index Providers