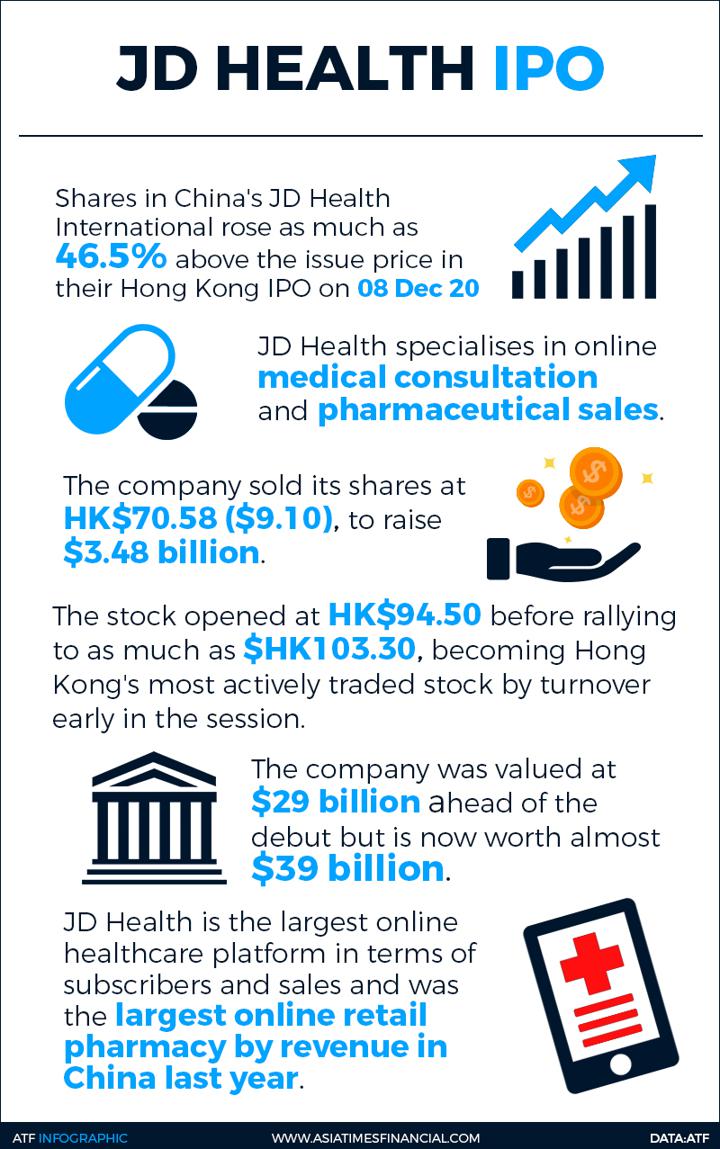

(ATF) Shares in China’s JD Health International rose as much as 46.5% above the issue price in their Hong Kong trading debut on Tuesday, signalling that healthcare technology (healthtech) companies could become China’s technology unicorns of the near future.

JD Health, a subsidiary of ecommerce giant JD.com that became Hong Kong’s largest initial public offering (IPO) of 2020, specialises in online medical consultation and pharmaceutical sales.

The company sold its shares at HK$70.58 ($9.10), to raise $3.48 billion. The stock opened at HK$94.50 before rallying to as high as $HK103.30, becoming Hong Kong’s most actively traded stock by turnover early in the session.

The company was valued at $29 billion ahead of the debut but is now worth nearly $39 billion. The stock bucked a downward trend in the broader local market as the benchmark Hang Seng Index fell 0.4%.

JD Health is the largest online healthcare platform in terms of subscribers and sales and was the largest online retail pharmacy by revenue in China in 2019.

Healthcare rivals

The JD Health IPO comes at a time when China’s medical technology companies are ramping up digital and contactless services in the middle of a global public health pandemic. “The Covid-19 pandemic has accelerated consumers’ adoption of online healthcare services,” said Shan He, senior research analyst at Bernstein.

Companies such as AliHealth, a division of Alibaba, China’s e-commerce champion, and Ping An Healthcare and Technology, also known as Ping An Good Doctor, a subsidiary of the Ping An insurance giant, have favoured status in high government circles.

In March, as the first wave of coronavirus ripped through Europe, Beijing hailed its digital healthcare providers, such as AliHealth, Baidu’s Ask Doctor and Tencent’s WeDoctor Global Consultation and Prevention Center, as “global aid platforms” fighting the pandemic.

“We hope these platforms can not only help our Chinese nationals, but all people suffering from #COVID19,” foreign ministry spokeswoman Hua Chunying wrote on Twitter.

Surging revenues

Both Ping An Good Doctor and AliHealth have reported surging revenues this year, partly due to patient fears over visiting hospitals during the Covid-19 outbreak.

Ping An Healthcare & Technology said its revenue surged 21% to $420 million in the January to June period, compared with the same period of 2019. However it posted a net loss of $30.8 million for the half year, compared with a $41 million loss in the same period last year.

Meanwhile, AliHealth posted $1.1 billion in revenue in the six months to September 30, 74% up year-on-year, and booked its first profit of $42 million after a $1.15 million loss in the same period in 2019.

For its part, JD Health reported revenues of $1.3 billion in the six months ended June 30, booking losses of $820 million.

Both JD Health and AliHealth blamed losses on high marketing costs. “We … expect JD Health to ‘invest’ in user acquisition and retention, raising operating expense,” said Michael Parker, an analyst at Bernstein. “Sales and marketing will naturally be elevated in healthtech’s early days.”

Wide open field

Analysts say the major Chinese digital healthcare companies occupy different niches, and there’s room for more competition. “With favourable policy tailwinds, the growing healthtech market is nurturing more players and business models, and attracting increasing amounts of capital and talent,” Leon Qi, executive director and regional head of Asian financials at Daiwa Capital Markets, said in a recent analysis.

He said Good Doctor is better positioned in the “upstream area of the value chain”, offering online medical consultations. “This is the starting point for every online medical service, a high frequency of customer contacts can serve as a traffic gateway to attract customers to downstream services,” said Qi.

In the first half of 2020, Good Doctor had secured a market share of 46% in online consultation cases, followed by JD Health with 5% and AliHealth 2%, according to Daiwa data. Qi noted that AliHealth and JD Health started in the e-commerce business and are now tapping into online consultations in order to meet increasing user demand.

We Doctor has a competitive edge in “appointment bookings, a wide hospital customer base, and close interactions with insurance companies”, according to Qi. For online healthcare shopping, such a direct sales of pharmaceutical and products, JD Health has a 9% market share and AliHealth 8%. Good Doctor has just 2%.

All about timing

There is no doubt that healthtech’s rise has coincided with the Covid-19 pandemic. Ping An Good Doctor was accessed over 1.11 billion times in the nine months to September 30. But part of that was good planning.

“Ping An chairman Peter Ma had the foresight to invest in technology early,” said Howard Yu, Lego Professor of Management and Innovation at the International Institute of Management Development in Switzerland. “He saw, before the rest of the traditional financial services industry, that the internet economy was affecting every aspect of people’s lives.”

Yet healthtech penetration remains low, analysts note. “The structural complexity of healthcare explains the low online penetration we see today,” said He at Bernstein, who added that the industry needs to tackle three major hurdles: interconnection, regulation and reimbursement.

She said China’s policy framework has become clearer about online consultation and prescriptions. However, China’s basic medical insurance (BMI) does not account for reimbursement of online healthcare by local health authorities. “Healthtech companies will need a very long time to crack BMI city by city,” said He.