Another big international financial firm has shelved plans to operate in China because of the uncertain business environment, sources say.

Legal & General, the British insurance giant and asset manager, has put off its plan to seek obtain a business licence and halved its staff in China, the two sources with direct knowledge of the matter said.

Legal & General (L&G) had been planning to apply for a QDLP – Qualified Domestic Limited Partner – licence that allows foreign firms to sell offshore products to Chinese investors as part of its asset management business push, they said.

ALSO SEE: Hong Kong Security Law Has Global Firms Racing to Shield Secrets

The company, with has 1.2 trillion pounds ($1.53 trillion) worth of assets under management globally, has shelved that plan now. And, as a result, last month cut its local team size to two people from around 10, they added.

The remaining two employees will focus on the firm’s existing business of managing Chinese institutional investors’ offshore assets, said the sources, who declined to be named as they were not authorised to speak to the media.

L&G did not comment on the business licence shelving or the job cuts when Reuters sought a response but said that China remained “an important and large market opportunity for asset management over the long term”.

“This is why we are choosing to maintain a presence through our representative office and to retain a small team,” it said, adding the firm continued to actively seek ways to grow existing Chinese clients investing in international markets.

The move by L&G, one of UK’s largest insurers, adds to an expanding list of global financial firms reining in their China business ambitions amid market and economic uncertainties, and geopolitical tensions.

- Reuters with additional editing by Jim Pollard

ALSO SEE:

China’s Property Crisis Slows in 2024 But Downturn Yet to Ease

Large Korean Companies Getting Out of China – Business Korea

China Misses 2023 Emissions Targets, ‘Climate Credibility at Risk’

Fear of Tit-For-Tat Curbs ‘Hurting EU Businesses in China’

Mortgage Delinquencies in China Soared by 43% in 2023

China-Western Tensions Reshaping Global Business

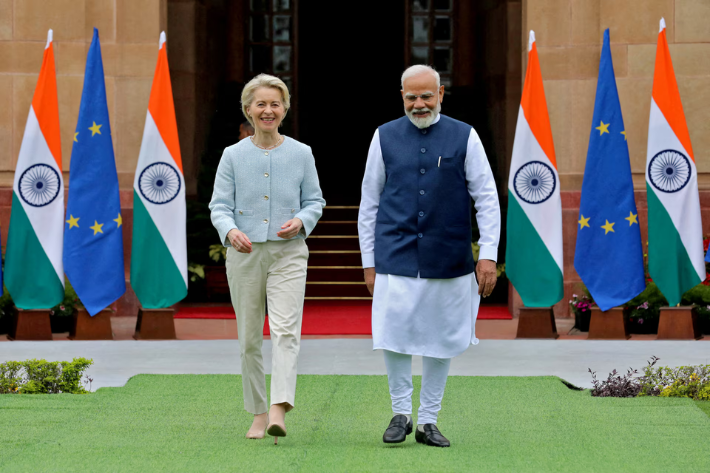

US, Euro Firms Switch Investment Focus From China to India

Foreign Investors Shunning China, Piling Pressure on Yuan

‘EU Must Prepare for China Decoupling if Taiwan Invaded’