(ATF) All but one of the indexes were down on Monday, as investors worried about tight liquidity and unchanged interest rates which weighed on credit markets. Liquidity concerns hovered even as the PBOC continued to pump cash into the banking system via reverse repos. The central bank injected 120 billion yuan ($17 billion) on Monday, on the back of 150 billion on Friday. But it kept the interest rate unchanged at 2.2%. It had added 70 billion on Thursday.

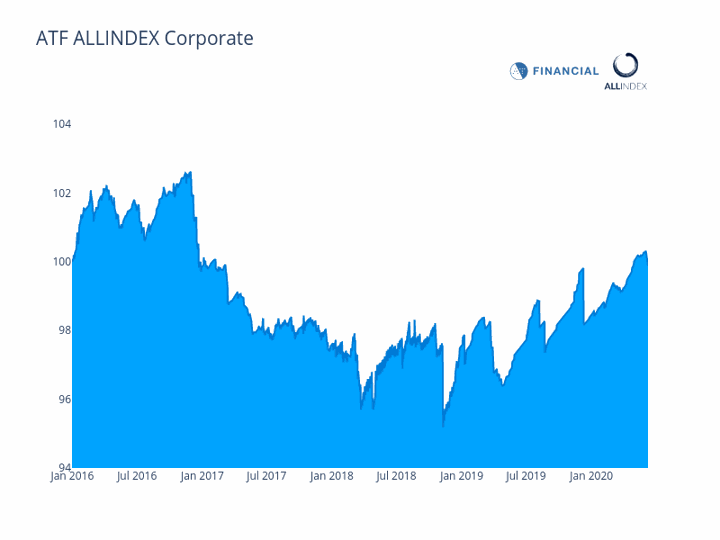

This time the ATF ALLINDEX Corporates led the fall, losing 0.27%, to close at 99.88. Changsha City North Investment bonds contributed to this move however, as they dropped 6.03% on the back of a coupon payment.

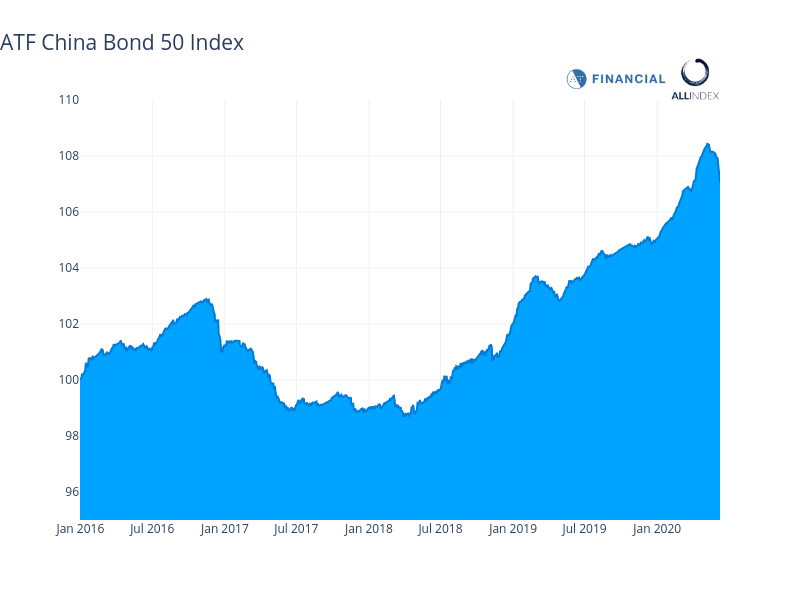

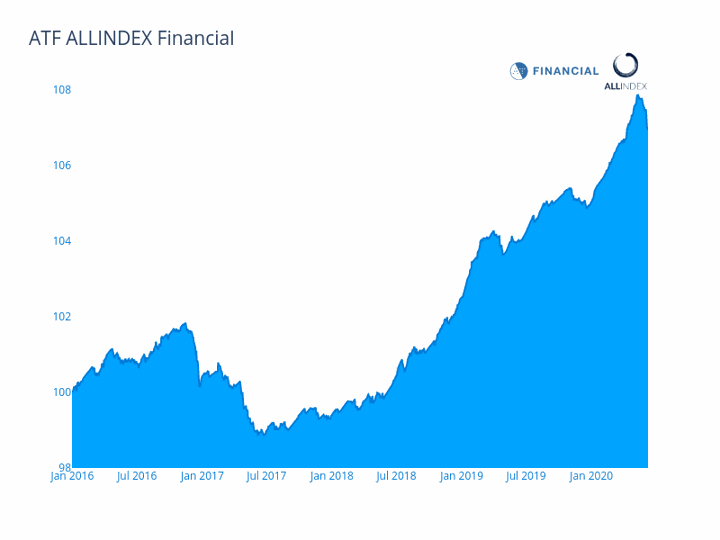

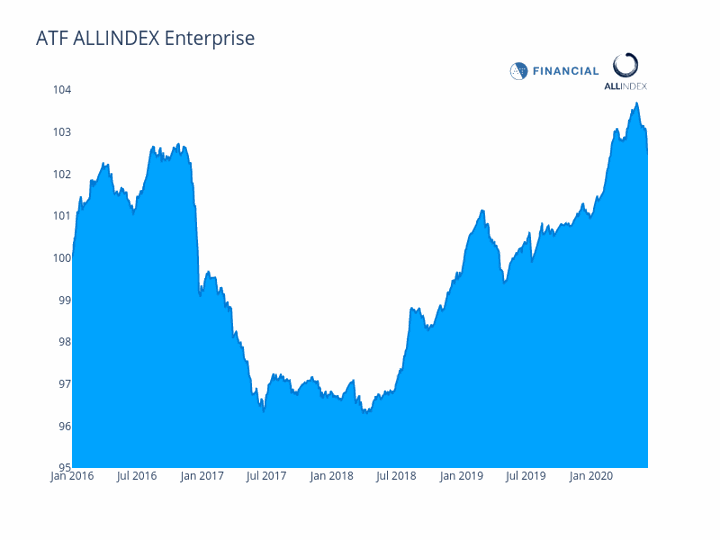

Meanwhile, the ATF China Bond 50 Index, the flagship index, retreated 0.23%, followed by the ATF ALLINDEX Enterprise (-0.16%), and the ATF ALLINDEX Financials (-0.08%).

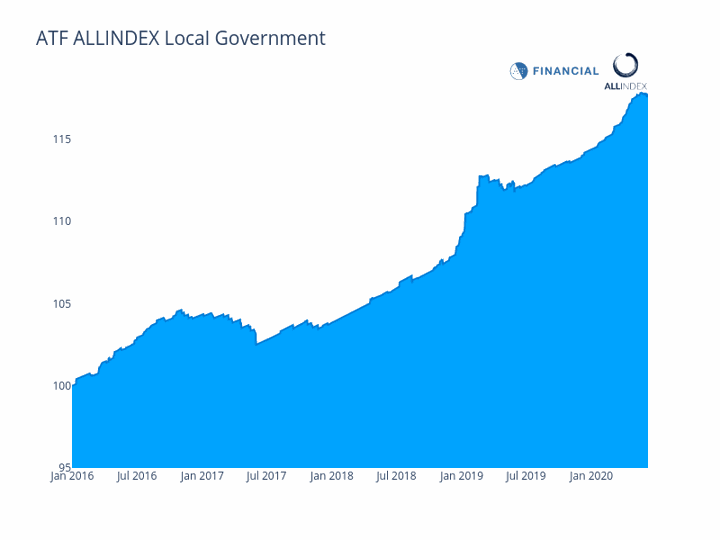

Only the ATF ALLINDEX Local Governments gauge rose, gaining 0.17%. However, this was a result of an increase in the price of the bonds of the People’s Government of Jilin of 2.6%. This moved the entire index.

Within the ATF China Bond 50 index, the financial sector was once again the big drag as banks are expected to support Beijing’s economic and policy goals unveiled at the National People’s Congress. The bonds of Bank of Beijing retreated 2.43%, followed by Central Huijin Investment (-1.18%), Industrial Bank (-0.65%), Agricultural Development Bank (-0.65%), Xiamen International Bank (-0.37%), the Export-Import Bank of China (-0.20%), and China Zheshang Bank (-0.10%).

Aviation Industry Corporation of China was down again from Friday, losing 0.67%, along with PetroChina which dropped 0.15%. The bonds closed at 103.85 and 103.11 respectively.

Click here to know more about ATF China Bond 50 Index