Trade of the Day: Stocks broadly higher on further easing hopes; Wall Street gets Biden boost; US Treasuries rally with 10-year yields at record low.

Quote of the Day: “It seems that either the Fed knows something that no one else knows, or it is panicking. Business surveys do point to slower activity. However, there has not been a collapse in US activity. Meanwhile, the number of cases remains low. Certainly, things can get worse and we expect activity to be flat in the first quarter, but we had expected greater confirmation of this before the Fed acted,” said Keith Wade, Schroders’ chief economist.

Stock of the day: CanSino Biologics rose as much as 15.2% after the company said it is in the process of developing of a vaccine against Covid-19. It said it had secured the support of the Tianjin Science and Technology Bureau and the vaccine candidate was in the pre-clinical stage.

Number of the Day: 3 – The number of rate cuts UBS US economist Seth Carpenter expects will be made by the US Federal Reserve in 2020. “It will have difficulty in untangling slowing caused by coronavirus from slowing caused by other factors. Right now, our forecast for a total of three cuts this year is still a good outlook. If the economy deteriorates more than the Fed and we anticipate, then we should put increasing probability on cutting to the zero lower bound.”

Tip of the Day: “We are of the view that the RMB will outperform the basket this year. Our forecast for USD-RMB is 6.95 by year-end, with room for downside in 1H,” said HSBC fx strategists in a report issued on Wednesday.

Financial markets grappled with the grim message conveyed by central bank actions and comments even as the economic damage from the fast-spreading coronavirus continued to unfold. After the Federal Reserve made a surprise 50-basis point cut in its benchmark interest rate, Bank of Japan governor Kuroda said the institution was ready to take “appropriate action” while warning that the impact from the virus could be big.

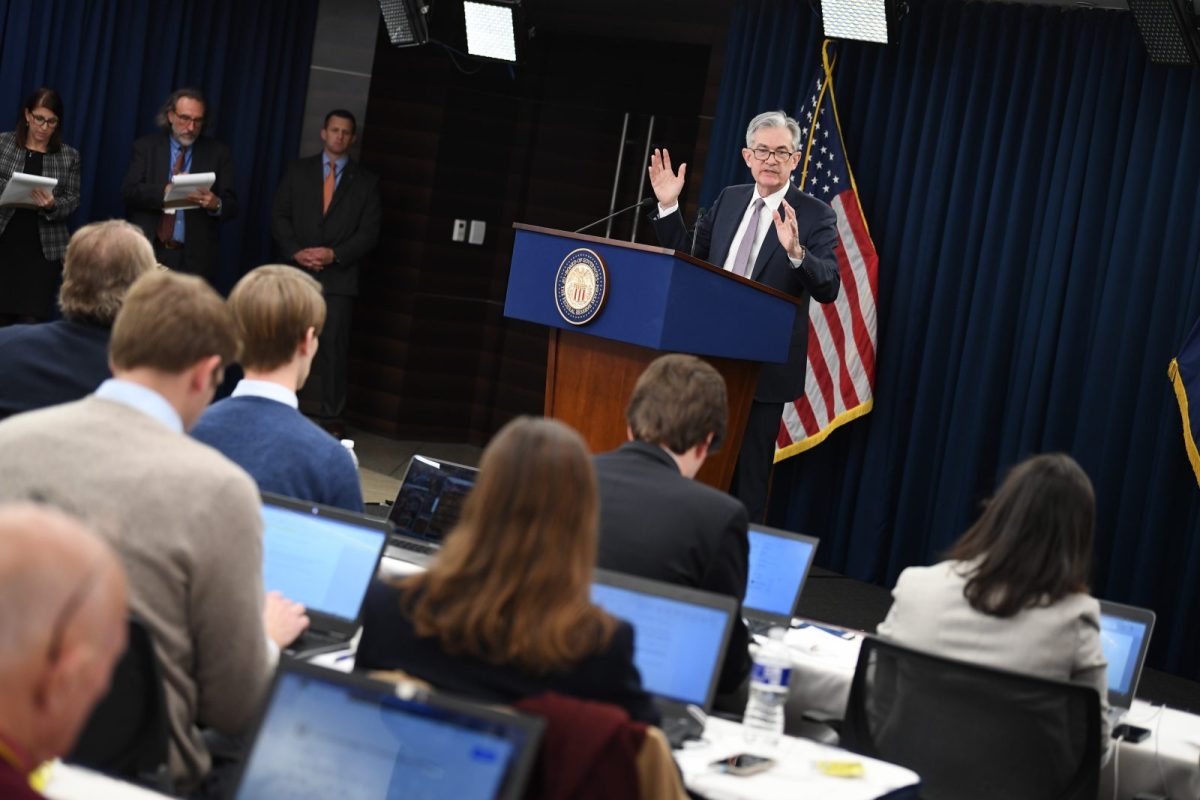

Overnight, US Federal Reserve Chairman Jerome Powell said the economy was strong, clearly something that the market disagreed with and coming on the back of growth warnings from investment banks and global financial institutions. At the weekend, Goldman Sachs warned of a “larger coronavirus drag on growth” and S&P Global cut its US growth forecast following the Fed’s emergency cut.

S&P Global economists now estimate 1% average sequential (seasonally adjusted annualized) GDP growth in the first two quarters of 2020 versus 2% pre-virus.

“Rate cuts – or even hints that they are coming – can help calm markets and keep credit flowing,” they said in a note while adding lower short-term rates would provide some cushion to cash flow pressure from supply and sales disruptions, thereby lessening the need to displace workers in an effort to conserve cash flow. “Cutting now will help speed up recovery in the second half of the year. If it seems that the coronavirus is going to have longer-lasting effects on consumer and business spending, lower borrowing costs can offer some reprieve by stoking demand.”

Financial markets are expecting more reductions, with the US 10-year Treasuries below 1% and gold prices still hovering around seven-year peaks.

Drawing parallels with the last emergency rate cuts, analysts said the economic conditions were different and therefore one cannot expect the same outcome.

“Current risks to supply-chain disruption and consumer confidence, especially when interest rates are already near all-time lows, may potentially be harder to address directly,” said Morgan Stanley analysts in a report saying it was the first 50bp (or higher) rate cut since December 16, 2008, and the first inter-meeting cut since October 8, 2008.

After analyzing the last six inter-meeting rate cuts of 50bp+ by the Federal Reserve, Morgan Stanley said the median global equities and credit market performance was weak. “The reason? These emergency cuts mostly happened at times of rising economic risk.”

Australia’s S&P ASX 200 fell 1.71%, and Japanese shares ended flat with the Nikkei 225 index edging up 0.08%. The MSCI Asia Pacific ex-Japan index rose 0.87% with the gains mainly driven by mainland China and South Korea. The CSI 300 index rose 0.58% and the Kospi surged 2.24%.

European and US markets are pointing to positive sentiment continuing. The Stoxx Europe 600 index soared 1.8% and the S&P Futures are up 2.4%.