Economic events

Financial markets will begin trading this week on a jittery note after a turbulent January which saw wild swings on the back of US politics, the spread of the coronavirus and the progress of vaccination campaigns. Even as mutations dampen sentiment, vaccine rollout hurdles both in the form of logistics and political conflict is beginning to play out.

Vaccine nationalism is starting to raise questions about the distribution and prioritisation of these life-saving jabs. Still the growth in the number of effective vaccines is bound to provide a boost to the cyclical trade. Johnson & Johnson single-dose vaccine has shown to be 66% effective against Covid-19, while offering complete protection against hospitalisation and death in trials. This vaccine does not have to be stored at sub-zero temperatures and is therefore easier to distribute than those from Moderna and Pfizer.

“The general public and the financial markets have unrealistic hopes for what a Covid vaccine can achieve,” said Dhaval Joshi, BCA Research’s Investment Strategist.

“The Covid vaccine will not be like the ‘one and done’ measles vaccine, but more like the ‘frequent jab’ seasonal flu vaccine.”

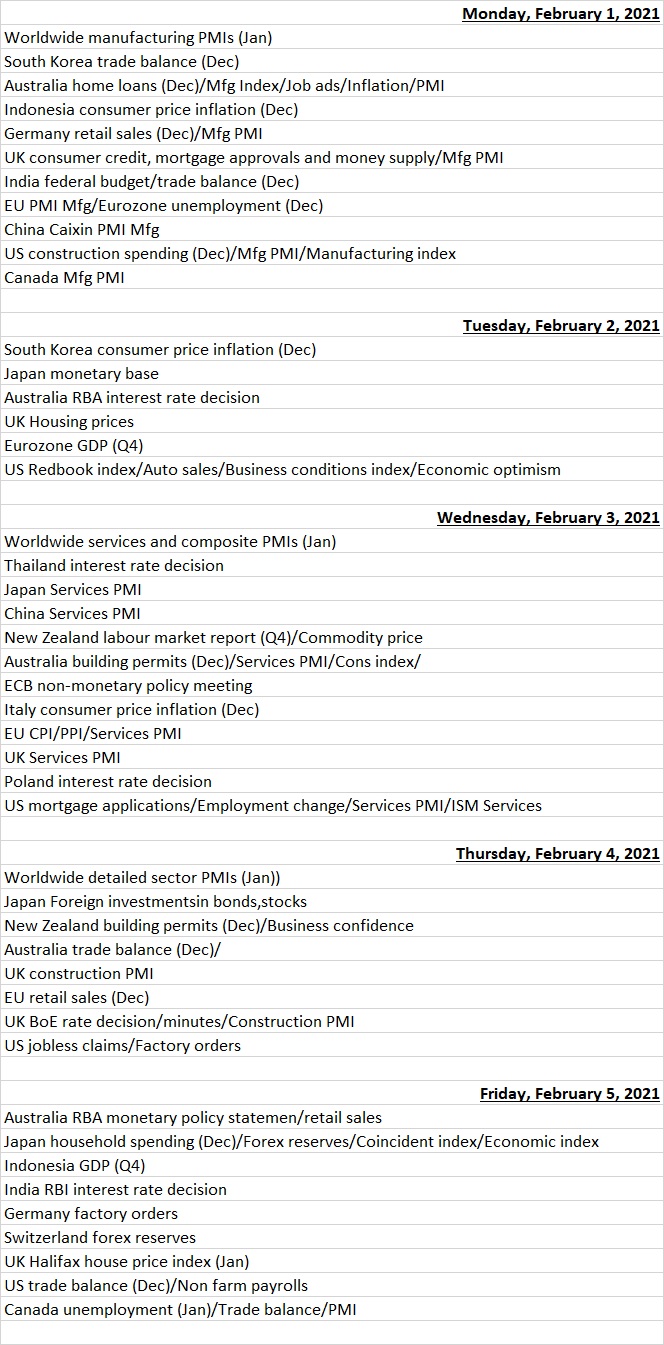

On the data front, focus will be on manufacturing surveys plus service sector updates for China, Japan, India and Australia, Korea trade, CPI reports in Korea, Taiwan, Indonesia, Philippines and Thailand, and Indonesia Q4 GDP. Central bank meetings in Australia, India and Thailand, and Union Budget in India will also be of interest.

India’s federal budget will be a tough balancing act with the government trying to stabilize the public finances while avoiding economically and politically-damaging spending cut.

“The most likely outcome is that it will set ambitious revenue targets and quietly shift some spending off-balance sheet, allowing it to present a smaller headline deficit. This may keep the bond market on the side for the time being. But obfuscation of the true fiscal position risks undermining credibility over the long term,” said Shilan Shah, Senior India Economist at Capital Economics.

India may lean on its central bank to do most of the heavy lifting in providing support to the economy.

“The return of inflation to the RBI’s 2-6% policy target zone in December, after a year of remaining above-target, could tip the central bank to resume its easing cycle,” said Prakash Sakpal ING Bank’s Senior Economist, Asia.

The Reserve Bank of Australia is expected to hold interest rates at an all-time low of 0.1%, and the Bank of Thailand is seen keeping policy rates on hold at 0.50%.

The week signs off with the US non-farm payrolls data where IHS Markit economists expect a rise after the 140,000 fall in December, which was the first decline since April.

They say that consensus estimates are coming in slightly below 100,000, hinting at a still-weak labour market. Employee earnings growth is meanwhile expected to have weakened and the unemployment rate held at 6.7%.

Fund flow

In a week that saw retail investors take on the mighty institutions of global finance by utilising platforms like Reddit and Robinhood, it may be worth examining recent trends in retail flows. Retail investors have now committed fresh money to Equity Funds for 12 straight weeks, this trend which began in the second quarter of last year, has accelerated during the fourth quarter, according to EPFR data.

“These retail investors have, however, have been largely focused on building exposure to the global reflation story and China’s head start in the rebound stakes,” said Cameron Brandt, EPFR’s Director, Research

Global Equity Funds have recorded retail inflows 23 of the past 25 weeks while China Equity Funds’ retail inflow streak currently stands at 32 weeks and $10.5 billion.

Emerging Markets Equity Funds inflows have exceeded $16 billion in the year to date as investors continue to steer significant sums into Asia ex-Japan and the diversified Global Emerging Markets (GEM) Equity Funds.

“This puts them on course for their strongest start to a year since 2018 when a broad rotation from bonds to equity saw all Equity Funds post a new monthly record in January that held until December of last year,” said Brandt.

Overall, in the bond markets, Global Bond Funds posted their 10th inflow in the past 11 weeks and Emerging Markets Bond Funds their 17th in a row while Asia Pacific Funds snapped a three-week outflow streak after the US Federal Reserve stressed its commitment to keeping monetary policy extremely loose until there are meaningful gains in employment and sustained inflation at or above 2%.

But inflation continues to be a concern, reflected in Inflation Protected Bond Funds attracting another $1.4 billion and Bank Loan Funds, a group traditionally used to play rising interest rates, extended their longest run of inflows since 3Q18.

Economic data calendar

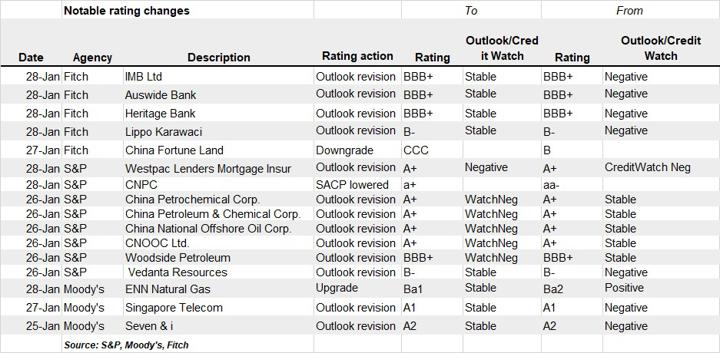

LAST WEEK’S RATING CHANGES

READ MORE:

Vaccine nationalism casts shadow over global recovery

Hong Kong’s recovery splutters as Covid’s return curbs spending