(ATF) Economic events

As investors remain transfixed by the elections in the United States, markets will be on edge as the outcome will determine economic policies in the world’s biggest economy for the next four years. The technology sector is wary amid concern that Washington will tighten regulations regardless of who wins the election. Sectors other than technology will be keen to get past the election uncertainty as there are expectations of a major stimulus package bill being passed.

The VIX “fear gauge” is at the highest since June, amid coronavirus worries and concerns around US President Donald Trump’s claims that mail-in ballots will cause fraud. There are fears that Trump may not accept the results of the election in the event that he loses.

PMI data and rate decisions dominate the week ahead calendar with Friday’s non-farm payroll being the major highlight.

Monetary policy meetings are scheduled for central banks in the US, UK, Australia and Malaysia.

“None of these banks are expected to loosen their belts further at their respective meetings in the week ahead,” said Fawad Razaqzada, Market Analyst at TF Capital.

“However, judging by the very dovish assessment made by the European Central Bank in the past week, don’t be surprised if the BoE also provides such dovish forecasts for the UK economy and in doing so signal its intension to loosen monetary policy further to combat the economic impact of the second wave of coronavirus.”

Capital Economics said it expects US employment growth to have slowed further in October, with non-farm payrolls rising by 600,000 – albeit partly because of another drop-back in temporary employment as operations for the 2020 Census wound down. This follows a fall in initial jobless claims to 751k for week ended 17 October, the lowest since the week of 14 March.

In Asia, analysts will await PMI data surveys to assess the recovery momentum in mainland China.

“With flash PMI data indicating that the global economy is seeing a sluggish start to the fourth quarter amid a global resurgence of coronavirus infections, eyes will be on the October PMI updates for 14 markets across Asia Pacific to assess regional economic trends. Australia and Japan both saw subdued demand, according to flash data,” said Bernard Aw, Principal Economist, IHS Markit.

Fund flows

As US presidential elections approached and COVID-19 cases surged in the US and much of Europe, flows during the week ending Oct. 28 ranged from subdued to negative, according to funds data provider EPFR. But it said fund groups dedicated to Emerging and Developed Asian markets bucked the trend.

“The appetite for Asian exposure is rooted in the region’s generally effective response to the pandemic and the trajectory of its recovery anchored by China’s return to positive economic growth,” said Cameron Brandt, EPFR’s Director, Research.

China Equity Funds saw inflows for the eighth time in the past 11 weeks, flows to Japan Bond and Equity Funds hit 38 and 79-week highs and both Philippines and Malaysia Equity Funds recorded their biggest inflows year to date, according to EPFR data.

China Equity Funds saw sector rotation to consumer plays from financials. Allocations to consumption linked funds exceeded those to financials for the first time since EPFR started tracking this data in 2006.

China’s just concluded plenum said it will promote a “dual circulation” model, envisaging that its next phase of development will depend mainly an internal cycle of production, distribution and consumption, backed by domestic technological innovation.

Spain, France, UK and Italy Equity Funds all recorded outflows during the fourth week of October, with the latter posting their biggest outflow since the second week of May. This is unsurprising given that France, Italy and Spain reinstated many of the COVID-19 containment measures in that week.

Economic data calendar

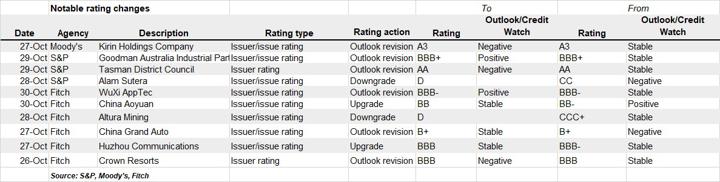

LAST WEEK’S RATING CHANGES