Latest News: Bonds

"Achieving carbon neutrality requires 'carrots and sticks'," People's Bank of China Governor Yi Gang said

Japanese investors sold a net 2.15 trillion yen ($15.6 billion) in foreign equities in February, their largest monthly selloff since April 2021

Shares of Adani companies rose on Tuesday after sources said the group was looking to repay or prepay debt of up to $790 million in March.

China’s banks have been given till 2025 to rate their financial assets; listing bond investments, interbank lending and off-balance-sheet assets into five categories ranging from 'normal' to 'loss'.

Some analysts say equities will offer better profits as China recovers from its zero-Covid years, while other markets also offer strong returns

Shares of Adani Enterprises were down 11%, while stocks of five other group firms – Ambuja Cements, Adani Power, Adani Transmission, Adani Total Gas and Adani Green were down 5% to 9%

A corporate filing by Adani Green on Tuesday said the group was "evaluating an independent assessment" on transaction issues and legal compliance

Shares of the group's flagship rose after news Adani will repay some loans, while analysts suggest assets could be sold or spending plans deferred to bolster credibility

Hundreds of Congress party members gathered to protest across the country over government ties to Adani group; parliament suspended as companies' total market losses exceed $110 billion

Ruling party sources say the 'dovish' deputy governor Masayoshi Amamiya has been sounded out on taking over from Haruhiko Kuroda at the Bank of Japan

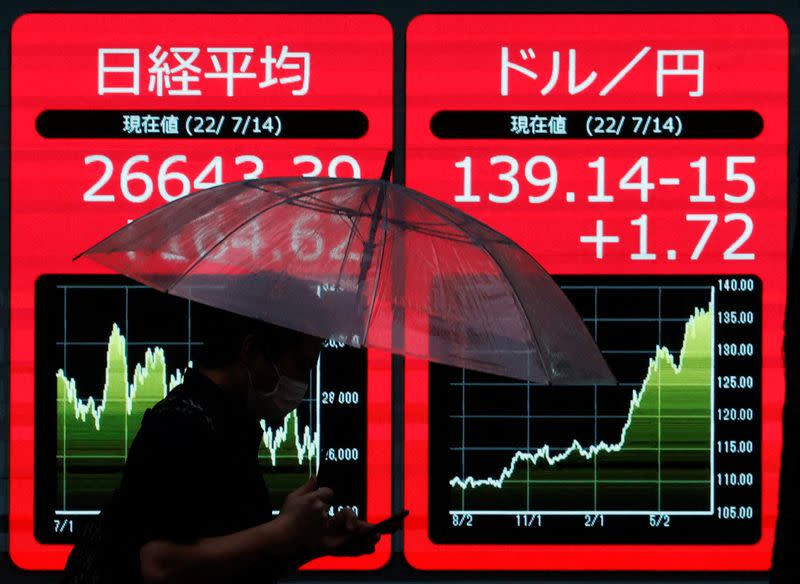

Hopes of a slowdown in central bank tightening were dashed by Friday’s upbeat US payroll numbers, weighing on Asian investor sentiment on Monday

Local government bodies accumulated an estimated $18 trillion of debt last year, according to CNN, which said the problem is so bad some cities have cut basic services and are at risk of default

AF China Bond

- Popular