(ATF) Another month of coupon payments are expected to weigh down the ATF gauge of credit markets again in April, with more than 20 issuers due to meet obligations.

The benchmark ATF China Bond 50 Index fell for a fifth week in six after Citic Group and Bank of Jiangsu were among companies that made payments. Coupon obligations weigh on bond prices because they reduce the fixed pool of interest the securities pay out over their lifetime.

Investors will also be watching key inflation data for March, which are due on Friday.

Also on ATF

- Borrowing limits lifted in change to Asian financial safety net

- Navigating the new financial landscape

- China tightens the screw on H&M

The ATFCB50 climbed 0.02% to 106.63 on Friday, paring declines for the week to 0.02%. The measure dropped 0.32% in March, a month that was heavy on coupon payments but which was also subject to concern that inflation would rise after the global economy recovers from the pandemic downturn.

Coupon payments fall heavily in the first quarter, when borrowers tend to front-load their yearly debt sales early. They are usually concentrated in March and April, following the Lunar New Year celebration, which takes up much of February.

China Resources is due to make a payment next week.

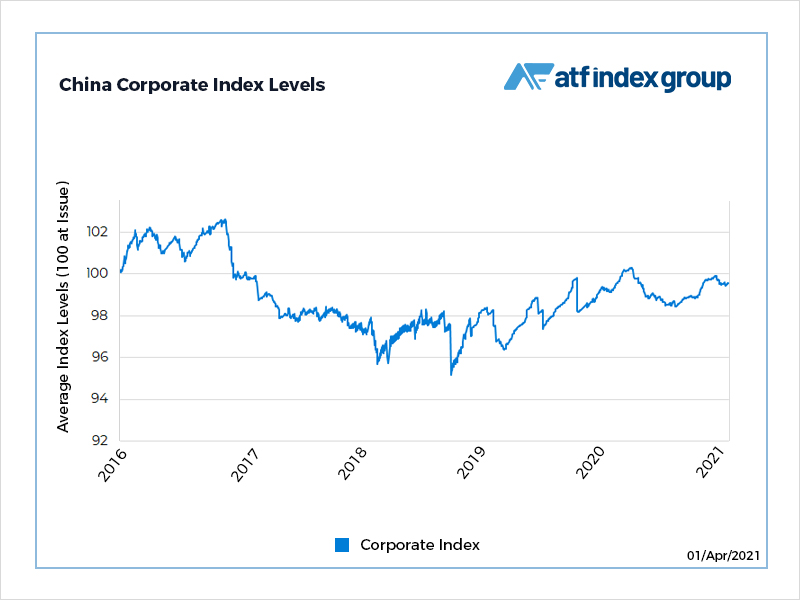

Corporate bonds climbed the most in more than a year during the week, adding 0.20% to an ATF sub-gauge after advancing 0.08% Friday. That surge followed reports that stock exchange officials planned to tighten rules on private-issue fixed income to reduce financial risks.

The prospects of a better-regulated trading environment helped attract more foreign investors into China’s $.5 trillion corporate debt market.

A report by S&P Global Ratings that banks may increase bond purchases to shore up their interest margins, also boosted corporates this week.

Chinese consumer and producer inflation figures are due Friday.