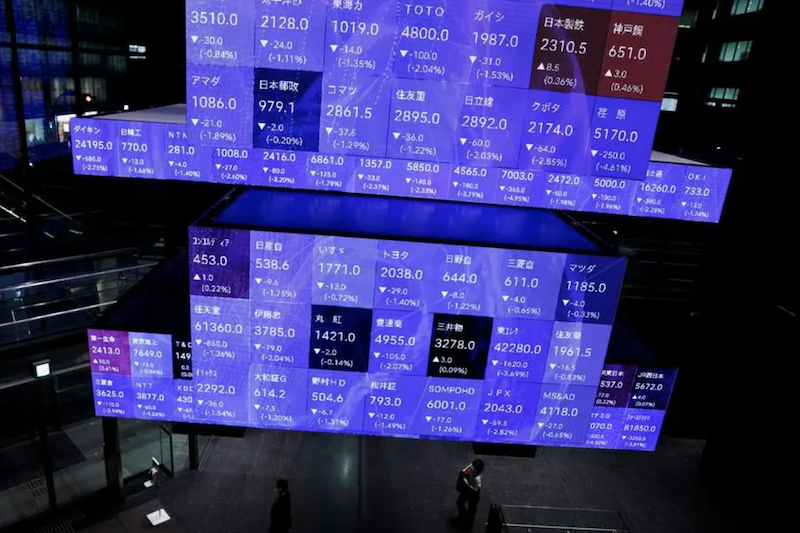

Asia’s major stock indexes retreated on Monday as the bargain-buyers moved in with many investors keeping their powder dry waiting for signs on which way central banks in the US and China will jump next.

Shares across the region fell, with traders consolidating gains after their best weekly run in five months, while also looking ahead to China’s next rate decision and US Federal Reserve Chair Jerome Powell’s testimonies for clues on the path ahead.

Japan’s benchmark index ended down as investors sold chip-related stocks, while foreign investors stayed on the sidelines with US markets being closed for the Juneteenth holiday.

Also on AF: Taiwan Asks EU to Deepen Ties if it Wants TSMC Chip Investments

The Nikkei share average fell 1.00%, or 335.66 points, to close at 33,370.42. Last week, the benchmark hit a 33-year high and posted its 10th consecutive weekly gain. The broader Topix was down 0.43%, or 9.86 points, to 2,290.50.

Chip-related stocks fell, with Advantest and Tokyo Electron slipping 2.45% and 3.32%, respectively. Screen Holdings lost 3.34%.

Meanwhile, the yen touched a near seven-month low against the dollar after the Bank of Japan maintained its ultra-low interest rate policy.

In China, hopes for more forceful stimulus were growing but the lack of concrete details from a cabinet meeting on Friday disappointed investors.

Goldman Sachs on Sunday cut its forecast for China’s GDP growth this year to 5.4% from 6.0%, joining other major banks to slash growth expectations for the world’s second largest economy.

But the People’s Bank of China is widely expected to cut its benchmark loan prime interest rates on Tuesday, following a similar reduction in medium-term policy loans last week.

Also, US Secretary of State Antony Blinken met with China’s top diplomat Wang Yi on Monday. As he wraps up his rare visit to Beijing, all eyes will be on whether Blinken will also meet with Chinese President Xi Jinping later in the day.

The Shanghai Composite Index retreated 0.54%, or 17.53 points, to 3,255.81, while the Shenzhen Composite Index on China’s second exchange edged back 0.09%, or 1.86 points, to 2,081.49.

The Hang Seng Index dropped 0.64%, or 127.48 points, to 19,912.89.

Elsewhere across the region, in earlier trade, Singapore, Taipei, Manila, Jakarta and Wellington were all down.

MSCI’s broadest index of Asia-Pacific shares outside Japan slumped 0.8%, after hitting a four-month high the previous session and finishing up 3% for the week, the best since January.

Yen Weakened by Dovish BoJ

Europe is set to extend the decline when markets there open, with pan-regional Euro Stoxx 50 futures down 0.7%. US markets are closed for the Juneteenth holiday, with Wall Street futures mostly flat in Asia.

After a week in which the stock market cheered the Fed’s decision to skip a rate hike in June, investors will now look to a number of Fed speakers this week, with Powell set to deliver congressional testimonies on Wednesday and Thursday.

Some officials have already sounded hawkish, and with the dot plot indicating two more hikes, markets are pricing in a 70% probability of the Fed hiking rates by a quarter point in July before holding steady for the remainder of the year.

The Bank of England also meets on Thursday when it is set to raise interest rates by a quarter point to a 15-year high of 4.75%. Markets are betting on the British central bank’s rates rising to nearly 6% this year.

In the currency markets, the dollar index was little changed against major peers at 102.33, after falling 1.2% the previous week, the most in five months.

The yen was undermined by a dovish BOJ, touching a seven-month low of 141.97 per dollar, while the hawkish European Central Bank, which hiked rates by a quarter point last week, helped the euro hold near a five-week top at $1.093.

Oil prices tumbled more than 1% on Monday. US crude futures fell 1.5% to 70.74 per barrel, and Brent crude was down 1.4% at $75.52 per barrel.

Key figures

Tokyo – Nikkei 225 < DOWN 1.00% at 33,370.42 (close)

Hong Kong – Hang Seng Index < DOWN 0.64% at 19,912.89 (close)

Shanghai – Composite < DOWN 0.54% at 3,255.81 (close)

London – FTSE 100 < DOWN 0.44% at 7,608.83 (0934 GMT)

New York – Dow < DOWN 0.32% at 34,299.12 (Friday close)

- Reuters with additional editing by Sean O’Meara

Read more:

China to Price Hong Kong-Listed Alibaba, Tencent Stocks in Yuan

Major Banks Cut China 2023 GDP Forecasts as Recovery Slows

Blinken Meets Qin Gang in China to ‘Steer’ Spiralling Ties