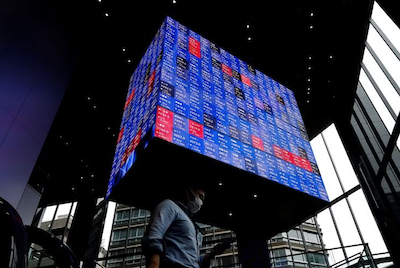

Asian stocks started the week on the front foot with investor mood upbeat on the back of promising China data and ahead of a host of central bank meetings over the next five days.

China’s factory output and retail sales beat expectations in the January-February period, surprising analysts, while this week could also could see the end of free money in Japan and a slower glide path for US rate cuts.

Tokyo stocks ended sharply higher, with the Nikkei surging over 2%, as exporters were boosted by the yen’s weakness against the US dollar, while sentiment was lifted on receding concerns regarding the Bank of Japan’s policy meeting results the next day.

Also on AF: Xpeng to Unveil Cheap EV Brands as China Price War Intensifies

Tuesday could see the end of an era as the Bank of Japan is widely tipped to end eight years of negative interest rates and cease or amend its yield curve control policy.

The Nikkei share average surged 2.67%, or 1,032.80 points, to close at 39,740.44, while the broader Topix was ahead 1.92%, or 51.19 points, to 2,721.99. Gainers were led by real estate, machinery and insurance issues.

Meanwhile, tech stocks were scooped up ahead of a speech by US chip giant Nvidia CEO Jensen Huang at its conference on artificial intelligence later in the day, with investors expecting his remarks will further fuel the AI equity craze.

China stocks rose after Beijing reported that industrial output climbed an annual 7% over January and February, while retail sales rose 5.5% on a year earlier.

The country’s securities regulator’s latest policy measures also helped but real estate remained a worry as property investment fell 9% on the year, underlining the case for further policy support.

The China Securities Regulatory Commission published a set of rules on Friday that would tighten scrutiny over stock listings, public companies and underwriters, as regulators ramp up efforts to revive investor confidence.

The blue-chip CSI300 Index gained 0.94% while the Shanghai Composite Index rose 0.99%, or 30.29 points, to 3,084.93. The Shenzhen Composite Index on China’s second exchange was up 1.62%, or 28.77 points, to 1,803.45.

China Property Slips

Tech giants listed in Hong Kong added 0.5%, with social media giant Tencent up 2% as the Hang Seng Index gained 0.10%, or 16.23 points, to 16,737.12. The Hang Seng China Enterprises Index climbed 0.48% but the Hang Seng Mainland Properties Index slumped 2.09%

Elsewhere across the region, in earlier trade, Taipei, Seoul and Manila rose while Bangkok, Mumbai and Sydney were also up. But Wellington and Singapore slipped.

MSCI’s broadest index of Asia-Pacific shares outside Japan gained 0.3%, after dipping 0.7% last week.

Central banks in the United States, Japan, UK, Switzerland, Norway, Australia, Indonesia, Taiwan, Turkey, Brazil and Mexico all meet this week and, while many are expected to hold steady, there is plenty of scope for surprises.

Eurostoxx 50 futures and FTSE futures both edged up 0.16% and 0.1%, respectively. S&P 500 futures added 0.3% and Nasdaq futures 0.54%, with tension building ahead of the Federal Reserve policy meeting in Tuesday and Wednesday.

The Fed is considered certain to keep rates at 5.25-5.5% but there is a possibility it might signal a higher for longer outlook on policy given the stickiness of inflation at both a consumer and producer level.

The Fed is also expected to begin formal discussion of slowing the pace of its bond sales this week, perhaps halving it to $30 billion a month.

Bank of England Meets

Bonds could do with the support given the damage done by a run of uncomfortably high inflation readings. Two-year Treasury yields are up at 4.72%, having climbed 24 basis points last week, while 10-year yields stood at 4.305%.

The probability of a rate cut as early as June has dropped to 56%, from 75% a week earlier, and the market has only 72 basis points of easing priced in for 2024 compared to more than 140 basis points a month ago.

The Bank of England meets on Thursday and is expected to keep rates at 5.25% as wage growth cools, while markets see some chance the Swiss National Bank might ease this week.

The ascent in the dollar and yields took some shine off gold, which eased to $2,146.70 an ounce, having fallen 1% last week and away from all-time highs.

Oil prices have had a better run after the International Energy Agency raised its view on 2024 oil demand, while the supply outlook was clouded by Ukrainian strikes on Russian oil refineries.

Brent added 35 cents to $85.69 a barrel, while US crude rose 36 cents to $81.40 per barrel.

Key figures

Tokyo – Nikkei 225 > UP 2.67% at 39,740.44 (close)

Hong Kong – Hang Seng Index > UP 0.10% at 16,737.12 (close)

Shanghai – Composite > UP 0.99% at 3,084.93 (close)

London – FTSE 100 > UP 0.13% at 7,737.20 (1002 GMT)

New York – Dow < DOWN 0.49% at 38,714.77 (Friday close)

- Reuters with additional editing by Sean O’Meara

Read more:

China’s Factory Output, Retail Sales Both Rise in First Two Months

China’s Property Crisis Slows in 2024 But Downturn Yet to Ease

Ex-Treasury Secretary Mnuchin Planning Group to Buy TikTok

Hang Seng, Nikkei Fall as US Inflation Data Curbs Rate Cut Hope