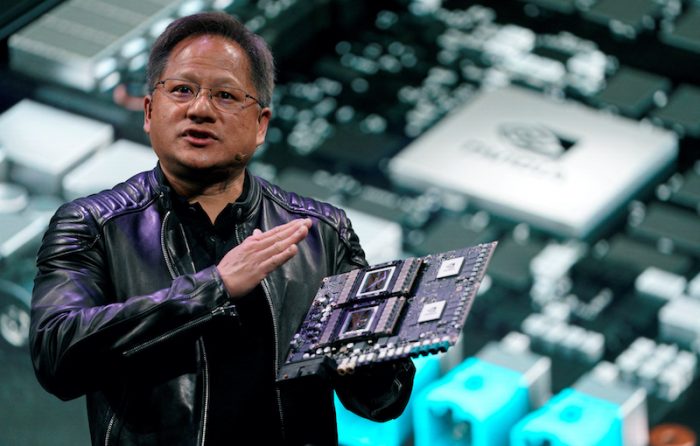

Nvidia chief executive Jensen Huang has given clues on how the world’s leading artificial intelligence chip designer plans to maintain its dominance.

Huang, who spent days at the Computex trade fair in Taipei, revelling in a sort of hero status known as ‘Jensanity’, flew out on Friday after indicating that there are ways his company – the world’s most valuable chip firm –can make significant earnings despite a drop in spending on AI infrastructure, and losses caused by intense US-China trade rivalry.

US restrictions on high-tech exports have seen Nvidia lose market share in China as it withdraws chips and designs inferior alternatives compliant with evolving US policy.

ALSO SEE: China’s Top Regulator Says it Will Help Tech Firms List Overseas

Now, cloud computing giants such as Microsoft and Alphabet’s Google have signalled cuts to AI spending. And while the 62-year old CEO has in the past month announced deals worth hundreds of billions of dollars in regions such as the Gulf, analysts said such deals are likely to become scarce.

“Is every country going to announce a $10 billion or $50 billion data centre like the Saudis? Of course not,” Seaport Research analyst Jay Goldberg said. “They’re sort of running out of obvious deals.”

When asked by Reuters how Nvidia planned to deal with AI spending slowdown, Huang said: “AI infrastructure is being built out (everywhere) – that’s one of the reasons I’m travelling around the world… AI infrastructure is going to be a part of society.”

New tech expands Nvidia’s grip on AI market

At Computex, Huang revealed a means of growth that does not rely on mega sovereign infrastructure arrangements: new technology that expands Nvidia’s grip on the AI market.

The tech’s centrepiece is called NVLink Fusion. It allows companies to plug custom chips into Nvidia’s AI infrastructure, thereby becoming a platform upon which others can build.

“Instead of having to build the entire rack of equipment themselves, (companies) could innovate or differentiate on the custom (chip) itself,” Nick Kucharewski, vice president at Marvell Technology, said.

The bet is that drawing companies to build hardware that utilises Nvidia’s Fusion platform will drive demand for the underlying AI network and data centre parts that Nvidia sells.

Nvidia has also begun to reach into the enterprise market. This week, it launched a line of servers that Huang described as an “enterprise AI supercomputer”.

Huang’s pitch was that the servers open up a multi-billion-dollar market because customers can use them for “everything”, such as graphics, virtual machines and AI applications.

The enterprise market is large but difficult to break into, Seaport Research’s Goldberg said. Deals tend to be small – compared with a sovereign data centre – and more expensive and time-consuming to win.

“My sense is we’re sort of bumping up against the limits of expanding the customer base,” Goldberg said.

Taiwan ecosystem

Nvidia works with some of Taiwan’s biggest names in tech, such as Taiwan Semiconductor Manufacturing Co, which makes many of its chips. However, the underlying infrastructure for AI would not be possible without the hundreds of Taiwanese companies big and small supplying components and manufacturing know-how needed to construct Nvidia’s complex AI systems.

“The purpose of Computex was to bring together the ecosystem and the supply chain,” Ian Cutress, chief analyst at consultancy More Than Moore, said.

Such a network is necessary to support the deals announced in the Gulf and that are likely coming elsewhere in the world in the coming months, Cutress said.

Taiwanese industry has embraced Huang, who is perceived as a local-born hero hailing from Taiwan’s historic capital of Tainan before migrating to the US when he was nine years old.

By the time he flew out on Friday, Huang had appeared on stage or at banquets with nearly every prominent Taiwanese tech executive, including chairman Young Liu of AI server builder Foxconn, who called him the “leader of Team Taiwan”.

MediaTek CEO Rick Tsai gave Huang chunks of guava in a plastic bag from the Nvidia leader’s favoured fruit stall in Taipei during one of the chip designer’s events.

Solomon Technology, a provider of industrial automation and AI-based inspection solutions which uses Nvidia’s software tools, said working with Nvidia is a win-win situation.

Shares of Solomon have surged 241% since Huang mentioned the firm at Nvidia’s GPU Technology Conference in March last year.

“The collaboration with Nvidia has given us greater visibility. We weren’t very well-known before, but with Nvidia’s support, many more people know us now,” Solomon chairman Johnny Chen said.

Nvidia-Foxconn tie-up ‘will be watched’

But Reuters commentator Robyn Mak has suggested that Nvidia’s ‘bromance’ with Foxconn could be a focus of scrutiny, as the companies’ “burgeoning alliance” may attract unwanted attention from officials in Beijing and Washington.

Foxconn – formally known as Hon Hai Precision – is a major supplier for Nvidia’s flagship GB200 and GB300 AI servers used in data centres worldwide. And the $70-billion contract manufacturer led by Young Liu “has bet heavily on cloud computing and networking products as a way to lessen its reliance on top customer Apple,” Mak said, noting that earlier this year Liu said that revenue from servers would surpass that of iPhones “within two years”.

Their ties are set to increase, because on Monday the two companies said they will jointly build an AI supercomputer in Taiwan with the government and chipmaker TSMC.

“Moreover, Liu took the stage to spotlight Nvidia’s nascent software, Omniverse, which allows manufacturers to create 3D digital replicas of factories. This, according to Liu, gives Foxconn the wherewithal to plan, stress-test and simulate production lines using AI before deploying them in the real world,” Mak said.

“Another promising feature is that companies can train robots using these simulations. For Huang, having the world’s largest electronics manufacturer as an early adopter is a powerful proof of concept for Nvidia’s ambitions in this sector; he estimates there are currently $5 trillion worth of factories globally under construction.

But Mak said geopolitics could “cast a shadow” because Foxconn has a huge manufacturing presence in mainland China, which is prioritising self-sufficiency in areas including AI, chips and robotics – fields the US deems a potential security threat.

With President Trump voicing concern on Apple’s partnership with e-commerce group Alibaba, due to fears the deal may help a Chinese company improve its AI capabilities, Foxconn could be squeezed, and “US officials may want more clarity on what kind of software and hardware Nvidia is offering.”

- Reuters with additional editing by Jim Pollard

ALSO SEE:

Nvidia CEO Says US Export Curbs on AI Chips is ‘Flawed’ Policy

China Threatens Legal Action Against Anyone Who Shuns Its Chips

Beijing Says Latest US Chip Warning Puts Trade Truce at Risk

Nvidia to Build AI Supercomputer And New Office in Taiwan

Trump Unveils Huge Chip Deals in Gulf After Rejig of Export Rules

Trump Tells Apple CEO ‘I Don’t Want You Building in India’

Rogue Communication Devices Found in Chinese Solar Inverters

China’s CATL Looking to Raise $4 Billion In Hong Kong Listing

Satellite Images Show Huawei’s Expanding Chip Facilities – FT

US Lawmakers Push Location-Tracking For High Powered AI Chips

Nvidia and China Tech Giants Hit by Latest US Chip Clampdown

Server Fraud Case in Singapore May be Linked to AI Chips, China