Chinese buyers have set up a secretive ship-to-ship crude oil transfer hub in the Atlantic Ocean to transport Russian crude oil, according to Lloyd’s list.

The dangerous manoeuvres have been taking place to disguise the origin of the Russian oil.

Lloyd’s List said an anonymous entity based in Dalian has bought several very large crude carriers (VLCC) to create the hub off the coast of Portugal.

Two of these VLCCs, the Catalina 7 and Natalina 7, were sold for $78 million in May to undisclosed buyers and immediately sailed for the mid-Atlantic, Lloyd’s List said.

The ships are now in the area off Portugal as they transfer cargoes from tankers that loaded at Russian ports in the Baltic and Black Sea, which are then being taken on to China.

Ship-to-ship transfers are legitimately used to avoid the need for vessels enter a port area and incur port fees or when vessels are too big to enter a terminal.

Transshipment ports such as Hong Kong and Singapore also transfer many cargoes in a process known as lightering.

No Sanctions Being Breached

But such ship-to-ship transfers are also used to disguise cargoes’ destinations, although no sanctions are apparently being breached in the case of the Russian oil, according to Lloyd’s List.

However, such transfers are now regularly used for Russia-origin crude due to what Lloyd’s List said were market participants “self-sanctioning”, which was recalibrating oil trades.

Analysts fear for the VLCC crews’ safety as there is little regulatory and technical oversight of the transfers. Similar ship-to-ship transfers have been used to disguise Venezuelan and Iranian oil to evade sanctions.

Ship-to-ship transfers in open ocean is “high-risk”, Alex Glykas of transfer adviser Dynamarine told Lloyd’s List, adding that such operations in the mid-Atlantic were unknown.

“Shipowners who want to take big risks, they make big money, and there are traders that support them,” he added.

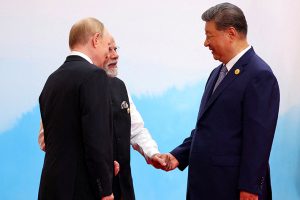

China has become a major importer of Russian oil since the West imposed sanctions in response to Moscow’s war on Ukraine.

Russia has replaced Saudi Arabia as China’s biggest oil trading partner, although its Urals blend of oil is trading at a steep discount to benchmark Brent crude.

- George Russell, with Reuters

READ MORE:

Shipping Group Maersk Cuts Growth Outlook on China Curbs

India Buyers Say Cheap, Discounted Russian Oil Out of Stock

China Oil Slowdown Drags Down Tanker Trade – Shipping News