(ATF) – Shanghai’s credit worthiness has been given a clean bill of health.

Mainland China’s most important financial hub has ample liquidity over the next year or two and low debt ratios, according to Pengyuan International, a Chinese credit rating agency.

“The Shanghai general government’s liquidity condition is certainly at higher end among its peers and is far above the local governments’ average in most of the liquidity indicators,” the agency wrote.

Pengyuan has assigned the Shanghai government a long-term foreign currency issuer credit rating of AA- and a long-term local currency issuer credit rating of AA, with a stable outlook.

Shanghai ranks far above the Chinese local governments’ average in various liquidity ratios, including the liquid assets coverage ratio and the usable liquid assets coverage ratio, according to Pengyuan.

In 2019, the city’s liquid assets coverage ratio was 3.6, well above the Chinese local governments’ average of roughly 1.6. Pengyuan estimates Shanghai’s liquid assets coverage ratio would remain at 3.6 in 2020.

-

![Local government chart]()

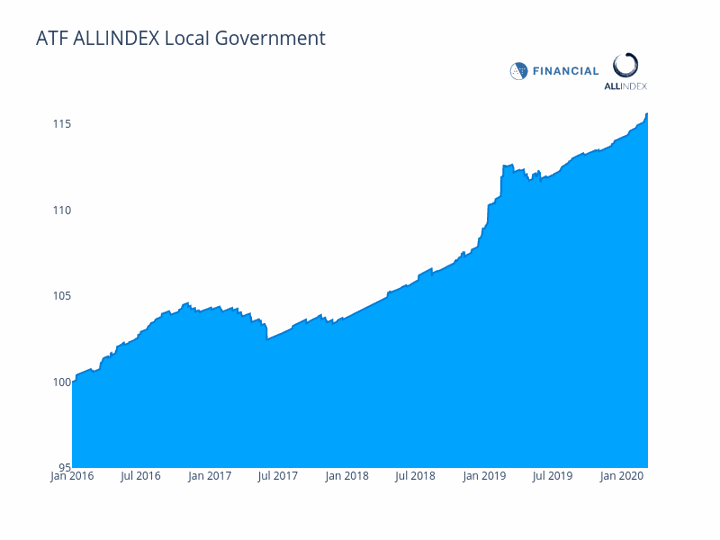

The ATF AllIndex Local Government gauge rose on Wednesday. Graphic: AllIndex

Last year, Shanghai’s usable liquid assets coverage ratio, including new debt issuance capacity and revolving debt, stood at 7.5 – three times higher than the local governments’ average of roughly 2.4. The rating company projects Shanghai’s usable liquid assets coverage ratio will decline to 6.9 this year, which is still high.

The city government has a new debt issuance capacity of 288 billion yuan ($41.4 billion) and debt revolving capacity of 53 billion yuan, which will substantially boost liquidity.

The government had a substantial fiscal deposit of 251 billion yuan at the beginning of last year, which was not only sufficient to cover its debt principal and interest payments, but also the city’s budget deficit funding requirements of 71 billion yuan.

Shanghai’s debt appears high, but its debt ratios are among the lowest in the nation. The municipal government’s broad debt stood at around 1 trillion yuan at the end of 2018, Pengyuan estimated. However, the broad debt to local GDP ratio of the Shanghai government was 31.8% in 2019, about half the local governments’ average of nearly 60 percent.

Shanghai, China’s most important financial centre apart from Hong Kong, boasts the highest GDP among the nation’s four municipalities, which also comprise Beijing, Chongqing and Tianjin, having grown 6% to 3.82 trillion yuan in 2019.

Under China’s administrative system, a municipality has the same rank as a province and is more important than a city. Shanghai’s per capital GDP exceeded $20,000 in 2019, comparable to the per capita GDP of Greece at $20,317, more than double the national average and among the highest in the country.

Diversified Economy

The risk of economic concentration in Shanghai is low, due to its fairly diversified economic structure. Industry and finance contributed the most to Shanghai’s economy, but only at 27.4% and 17.4% of the city’s GDP in 2017 respectively.

Moreover, the so-called Strategic Emerging Industries, representing industries with high technology content and good growth potential, have taken an increasingly important role in its economy.

However, Shanghai is not yet there as a full-fledged global financial powerhouse, according to a study released by the European Union Chamber of Commerce in China in December 2019.

Strict capital controls, lack of yuan convertibility and ongoing regulatory issues pose a serious threat to the Chinese government’s stated goal of turning Shanghai into a global financial centre by 2020, said the study. A survey in the study found that almost nine out of 10 members of the chamber felt Shanghai’s banking and finance market was too regulated compared to other international financial centres, which has hindered their growth in the mainland.

“Only removal of capital controls and renminbi convertibility can bestow the title of international financial centre upon Shanghai,” said Thilo L. Zimmermann, vice-chairman of the chamber’s banking and securities committee.

READ MORE: Ratings agencies must fight conflicts of interest

READ MORE: Gansu Highway ‘BBB’ Ratings Affirmed by S&P; Outlook Stable