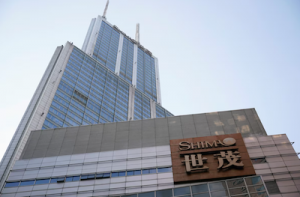

Shares of Chinese property developer Shimao Group Holdings fell 5% in early Asian trading on Tuesday after it denied a media report that it has entered into a preliminary agreement to sell a Shanghai plaza.

Shimao said in a filing, however, it is in talks with some potential buyers and may consider disposing of some properties to reduce debt.

The Shanghai-based developer said it defaulted on a trust loan last week after missing a 645 million yuan ($101.10 million) payment that it guaranteed.

Caixin reported over the weekend that Shimao had struck a preliminary deal with a state-owned company to sell its Shimao International Plaza Shanghai, for more than 10 billion yuan.

In Talks with Vanke

The report said the firm has put all of its real estate projects up for sale, including both residential and commercial properties, and it is also in talks with China Vanke to dispose of some assets.

In the filing, Shimao said it has no outstanding asset-backed securities (ABS) due and payable as of Tuesday.

Meanwhile, Shimao subsidiary Shanghai Shimao Construction has proposed extensions on maturities for two ABS due this month totaling 1.17 billion yuan.

As of 0156 GMT, shares of Shimao dropped 3.6%, after gaining 19% in the previous session.

Rating agencies S&P and Moody’s cut Shimao’s credit rating again on Monday after the firm unexpectedly defaulted on a trust loan last week.

- Reuters with additional editing by Kevin Hamlin

ALSO READ:

Shimao Puts All Projects On Sale as China Property Woes Deepen

Shimao Shares Fall as Exchange Suspends Developer’s Bonds

China Developer Shimao to Use Own Funds to Pay Onshore Bonds