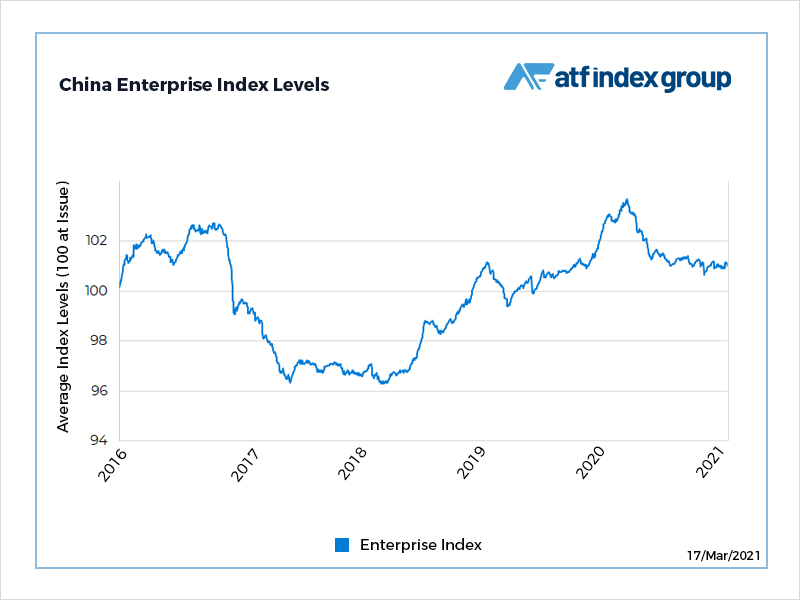

(ATF) A gauge of bonds issued by state-run Chinese firms fell the most in six weeks after one of its constituents made a coupon payment Wednesday.

The losses weighed on a broader index of corporate and local government debt.

The Enterprise sub-measure of the ATF China Bond 50 Index fell 0.11%, the most since early February, after Hubei United Development Investment Group made a coupon payment on its 4.27% security due in March 2027.

Also on ATF

- China cracks down on dodgy apps to protect citizens’ data

- WuXi Biologics to buy Pfizer drugmaking facilities in China

- Honda warns of production halts as Japan car exports slump

Bonds tend to decline after coupon obligations are met because that reduces the pool of interest the debt will pay out before maturity.

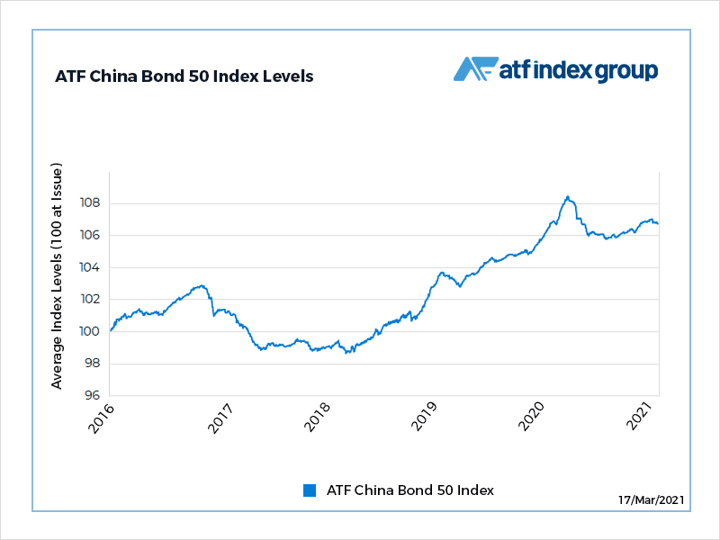

The broader ATF CB50 Index was unchanged at 106.733, in line with tepid trade on Asian stock markets as investors awaited cues from the conclusion of this week’s Fed meeting.

The index of AAA rated Chinese credits has declined 0.18% since the resumption of trade after the Lunar New Year break last month, fuelled by concern that pent-up demand will be unleashed after the pandemic and spur an inflationary spiral.