(ATF) The bonds of state-owned-enterprises (SOEs) resumed a selloff Thursday after it emerged that further regulatory action would be taken to clamp down on credit risks following a rash of defaults.

Financial bonds also slid for the eighth day in 11 on news that the troubled Baoshang Bank would be the first Chinese commercial lender to be declared bankrupt.

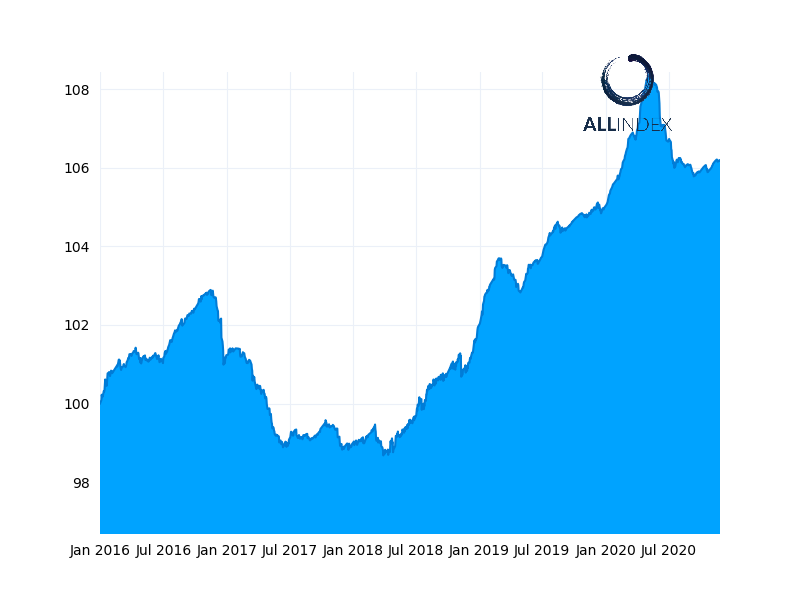

The benchmark ATF China Bond 50 Index was unchanged. Trade was thin as US investors took a day’s holiday to mark the Thanksgiving public holiday.

The SOE-based Enterprise sub-index fell 0.01% on news that Financial Stability and Development Committee (FSDC) chairman, Vice Premier Liu He, said China will show “zero tolerance” for corporate misconduct.

Read Related News on ATF

- China bond defaults signal a coming of age as state safety net shrinks

- China to crack down on misconduct after bond defaults

- Baoshang, China’s first commercial bank to go bankrupt

- New rules bring China’s internet giants to heel

Fraudulent issuance, disclosure of false information, malicious transfer of assets and misappropriation of issuance funds will be strictly investigated, and various “debt evasion” behaviour will be severely punished, the FSDC said in a statement on the central government’s website.

The declaration was in response to a wave of more than 120 defaults among SOEs that had breached financial rules, among them by trying to hide debt onto their balance books. The defaults have roiled China’s credit markets in the past week.

The Financials sub-index also declined 0.02%, led by an 8.25 percentage-point rise in the yield of China Bohai Bank’s 3.55% security. Lenders’ bonds were hit after the China Banking and Insurance Regulatory Commission agreed that Baoshang Bank should start bankruptcy proceedings and asked it to report to the CBIRC if any “major situations” arise.

The Corporates sub-index declined 0.02% led by the 4.1% bond of Zhuhai Da Heng Qing Investment, whose yield climbed 0.24% as it approached a coupon payment Friday. Bond prices fall when a coupon payment is made because they reduce the fixed-payment a bond will pay out over its its lifetime.

The Local Governments sub-index rose 0.01%.