(ATF) The S&P 500 Index lost more than 8% at 2pm, dragged down by higher Treasury borrowing costs, as investors balked at a prospective flood of US government issuance. The total value of the US equity market as measured by the Wilshire 5000 index is down 33% since February 19.

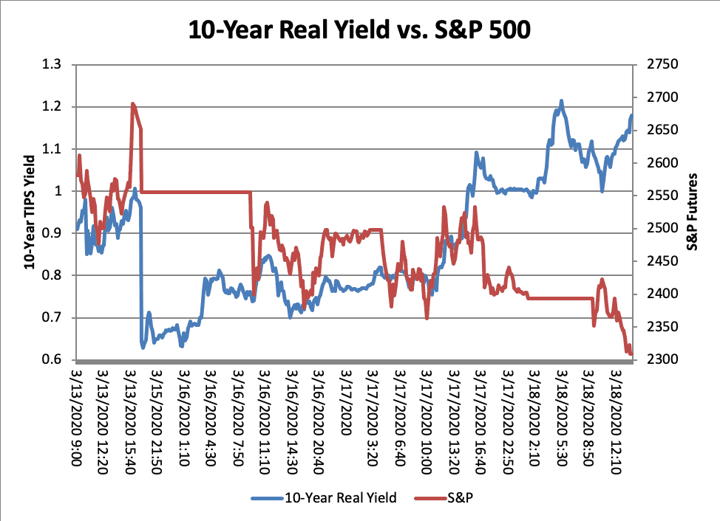

During the first phase of the crisis, bond yields fell as the S&P fell, but during the past week, there has been a near-perfect inverse correlation between the real cost of Treasury borrowing (the yield on Treasury Inflation-Protected Securities, or TIPS) and the broad stock market.

With the federal deficit already running above $1 trillion in the full-employment economy of January and February, the US Treasury is likely to issue more than $2.5 trillion in new debt during the next 12 months to cover the trillion-dollar stimulus proposed yesterday by the Trump Administration, and cover lost revenues due to slumping economic activity. Some forecasts project an 8% annual rate of decline of GDP for the second quarter.

The market is punishing weaker companies brutally. General Motors had lost 27% in today’s trading as of 2pm, followed by Boeing with a loss of 25%. Capital One Financial, a leading credit card issuer, was down 22% and American Express was down 21%. Real Estate Investment Trusts, a heavily levered sector, have lost 40% of their share price in both Europe and the US since late February.

Rising borrowing costs intersect with rising credit risk to force whole sectors of the economy out of the credit markets – requiring the federal government to step in, which in turn means issuing more Treasury debt. $2 trillion or more of new issuance is a gigantic pig to pass through the python of the fixed income markets.

US commercial banks as a group purchased a total of $180 billion in Treasuries during the past 12 months, but have been net sellers during the past two weeks, as their customers draw down revolving credit lines to stockpile cash in anticipation of a coming squeeze.

US households put some of their equity gains into Treasuries, but now they hold losses instead. Foreigners can’t buy US Treasuries because European and Japanese banks are short of dollars to hedge the foreign exchange risk. So real yields have to rise to attract more funds.

We have never been in this neck of the woods before, so we don’t have any way to estimate how far yields have to rise.