(ATF) At the current ‘Two sessions’ meeting in Beijing, China’s State Council submitted its work report. News on the work front was positive.

From the perspective of “major macroeconomic indicators”, officials said that 11.86 million new urban jobs were created in 2020. Urban surveys showed the unemployment rate averaged of 5.6%, while the urban registered unemployment rate at the end of the year was 3.6%.

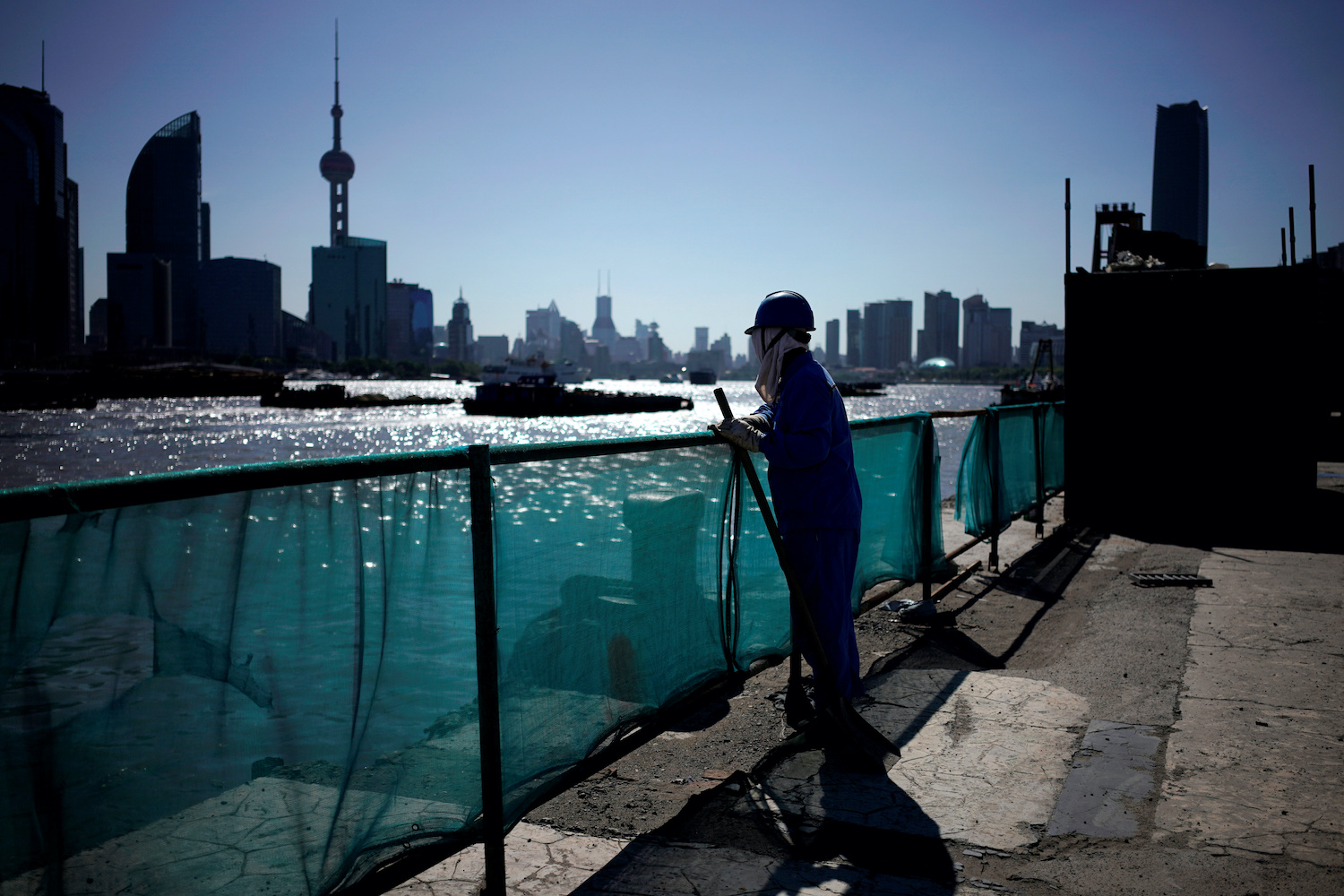

But the level of unemployed migrant workers is believed to be far higher and could number in the tens of millions, although Beijing is anxious to create more jobs for as many people as possible this year. And it also wants a greater proportion of people from rural areas to be registered as residents in cities and urban areas where they have found work and have homes.

In 2020, proactive fiscal policies were implemented in response to the impact of the Covid-19 pandemic, and these will continue.

According to the annual budget approved by the National People’s Congress, a fiscal deficit of 3.76 trillion yuan was allocated for 2020, an increase of 1 trillion yuan over the previous year.

At the same time, 1 trillion yuan of special treasury bonds to fund the response to the pandemic were issued, while some 2 trillion yuan of national funding was transferred to local governments. Meanwhile, the level of central government expenditure level fell by 0.1%, as non-urgent and non-rigid expenditure was reduced by more than 50%.

China will continue to implement its policy of lowering the value-added tax rate and social insurance rate declared in 2019, while the cumulative increase in tax and fee reduction will exceed 500 billion yuan.

In 2020, the cumulative burden of new enterprises was reduced by more than 2.5 trillion yuan. As of the end of December 2020, the balance of inclusive loans to small and micro enterprises from the five large commercial banks increased by 54.8% year-on-year.

But China’s regulators are telling banks to trim their loan books this year to guard against risks emerging from bubbles in domestic financial markets, sources have revealed this week.

The China Banking and Insurance Regulatory Commission (CBIRC) is also looking into the misuse of business loans to individual borrowers for personal investments, two of bankers said, according to Reuters.

“A large amount of money in the name of business loans had flown into the property and stock markets during the pandemic last year,” one of the bankers said. “Banks are scrambling to collect back loans issued last year and will not extend such loans.”

Meanwhile, the average tariff on enterprise broadband and dedicated lines dropped by 31.7% and 18.6% respectively, which was far higher than the set target of reducing prices by 15%.

The State Council said investment is the key to stable growth.

In 2020, 27 million people received subsidized vocational skills training nationwide; more than 22 million people were trained and vocational colleges nationwide increased enrolment.

In the field of social security, the per capita financial subsidy standard for residents’ medical insurance increased by 30 yuan. As of the end of December 2020, the per capita subsidy level in all regions reached or exceeded the national standard, and was not less than 550 yuan per capita in the year.