(ATF) Hong Kong: Asian markets roared back on more positive news on the vaccine front while the improving chances of a further US stimulus package also lifted sentiment.

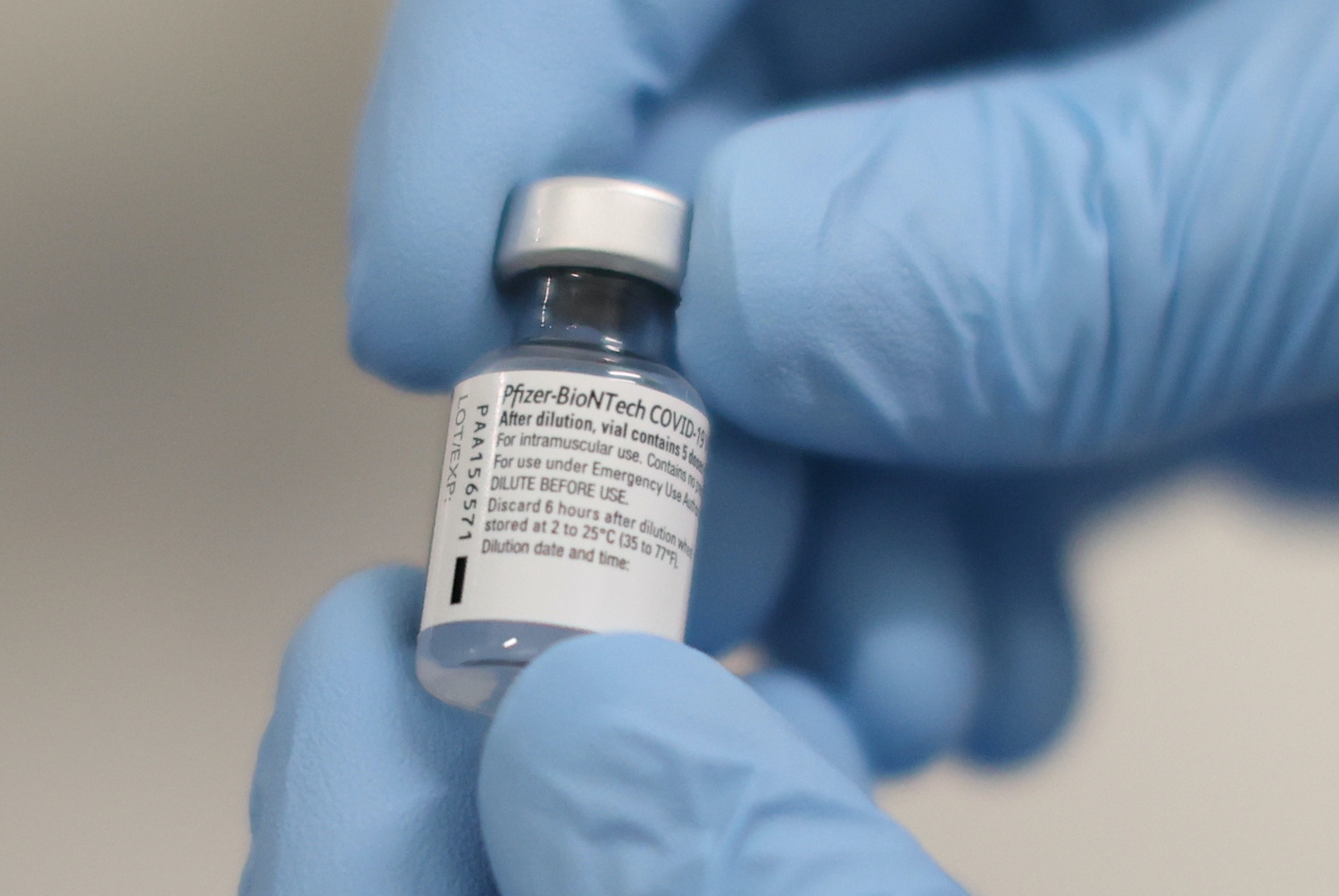

A report by the US Food and Drug Administration said the coronavirus vaccine made by Pfizer and its German partner BioNTech SE is highly effective and there were no safety concerns.

“Vaccine efficacy for the primary endpoint against confirmed Covid-19 occurring at least seven days after the second dose was 95.0% with 8 Covid-19 cases in the vaccine group compared to 162 Covid-19 cases in the placebo group,” the report said.

US Treasury Secretary Steve Mnuchin posted a statement on Twitter about his $916- billion stimulus proposal – slightly larger than the earlier bipartisan proposal.

Japan’s Nikkei 225 index surged 1.33%, Australia’s S&P ASX 200 jumped 0.61% and Hong Kong’s Hang Seng index advanced 0.75%, but China’s CSI300 slumped 1.34% as tensions with the United States continued to simmer. Regionally, the MSCI Asia Pacific index jumped 1.13%.

The US dollar continued to fall, declining 0.1% against a basket of currencies and US Treasuries sold off with the 10-year yield rising 2 basis points to 0.94%. Gold remained under pressure in the risk-on environment falling 0.7% to $1,856 per ounce.

The British pound rallied ahead of Prime Minister Boris Johnson’s dinner meeting with European Commission President Ursula von der Leyen but analysts were quick to snub the optimism around its 0.7% rise to $1.35.

“There is no certainty that the three-course meal will resolve the three contentious issues – fisheries, the level playing field and governance – needed to break the impasse for a trade deal,” DBS Bank strategists said in a note.

“The EU will also need to accept the UK’s offer to drop most of the controversial international law-breaking parts of the Internal Market Bill only after an ‘agreement in principle’ is reached on Brexit. This will not be easy after UK MPs voted on Monday to reinsert these clauses taken out by the House of Lords. Any deal agreed will face the hurdle of ratification by the UK House of Commons and the European Parliament.”

Also on Asia Times Financial:

China Evergrande asset disposals lift bonds but shareholders wince

Tech experts help companies assess and manage climate risks

Goldman Sachs seeks 100% ownership of China JV

Tata plans to build on Apple business

Japan’s machinery orders soar in latest sign of economic comeback

Chinese consumer prices fall for first time since 2009

An economic rebound is coming: What to look for in 2021

Asia Stocks

· Japan’s Nikkei 225 index surged 1.33%

· Australia’s S&P ASX 200 jumped 0.61%

· Hong Kong’s Hang Seng index advanced 0.75%

· China’s CSI300 slumped 1.34%

· The MSCI Asia Pacific index jumped 1.13%.

Stock of the day

Tianqi Lithium shares soared 6% and its bonds rallied after the company sold 49% of Australian unit to IGO in $1.4 billion deal. Its 3.75% bonds due 2022 rallied 26% to 72 cents on the dollar.