(ATF) Economic events

Financial markets are seen opening on a firm note after the Nasdaq and S&P 500 hit record highs on Friday following strong data and gold prices struggled to gain traction as investors loaded up on risk.

A lot of attention will be paid to the US Federal Reserve’s monetary policy framework review where Chairman Jerome Powell will unveil how it will tackle the coronavirus impact on the world’s largest economy. Financial markets expect to hear more about inflation targeting given the negative real yields struck a record low last week. If average inflation targeting is adopted by the central bank, the markets expect more aggressive policy responses ahead. Traditionally organised in Jackson Hole, this year’s meeting will be online.

On the political front the Republican National Convention will hold centre stage ahead of the November elections in the US.

Data releases

The economic front will see GDP data releases from developed economies which are expected to show major setbacks in the second quarter. In Asia, data releases on trade, industrial production and retail sales and sentiment surveys in South Korea, Japan and Indonesia will be of interest.

“Flash PMI data for Japan and Australia indicated weakness in economic activity midway through the third quarter. Industrial profits for July in China will also draw scrutiny for signs of improvement in the industrial sector,” said Bernard Aw, principal economist at IHS Markit.

Bank of Korea’s rate decision will be closely monitored after the country’s exports were hit by floods and consumption recovery was hurt by the second wave of coronavirus infections.

“A weakening economic outlook means that the Bank of Korea is likely to announce more unconventional policy measures to support growth at its meeting on Thursday,” said Capital Economics in a note.

Fund flows

In the week to August 19, emerging market bond funds extended their run of net inflows to seven weeks and EM equities saw a reversal with net inflows after five weeks of funds exiting that asset class.

BofA Securities analysts said EM debt funds continue to benefit from a weaker US dollar and that on the duration front, inflows were recorded across the curve for a fourth week in a row as yield-starved investors continue to flock into long-term funds.

“Attractive valuations relative to US stocks, a recovery in oil prices and solid gains for commodities viewed as inflationary hedges, hopes that Sino-US trade talks will ease tensions between the world’s superpowers and a broadly better outlook for growth” were the reasons behind funds flowing to EM, according to Cameron Brandt, director of research at funds data provider EPFR.

It said that in contrast to a strong first quarter where they had net inflows, EM bonds and equities funds have had a net outflow of $55 billion and $63 billion respectively in the five months to July.

“One of the reasons for the less gloomy EM growth outlook is the expectation that China, the world’s second largest economy, will post a positive GDP number in 2020,” Brandt said in a statement.

China Equity Funds recorded only their second inflow in the past 18 weeks, with sentiment helped by optimism that trade talks with the US will resume and that China’s regulators will not let a booming domestic stock market push into bubble territory.

Earlier this week, White House Chief of Staff Mark Meadows said the two sides remain in touch about implementing a phase-one deal and China’s ministry of commerce spokesman said both parties have agreed to hold a call in the near future.

Economic data calendar

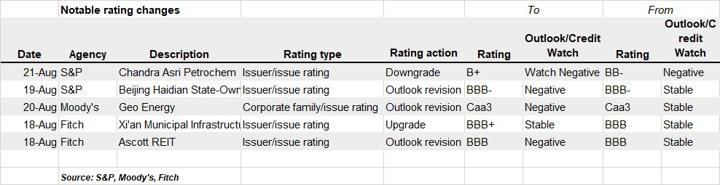

Last week’s rating changes