(AF) Markets have been roiled and concern for the fate of China’s economy has grown as the financial woes of property giant China Evergrande have deepened.

With about $305 billion of debt on Evergrande’s books, the crisis reached a pivotal moment this week when an $83.5 million interest payment on one of the privately-owned company’s bonds came due. More obligations are due next week.

Some economists fear that Evergrande’s default would ripple through China’s financial system and property market, causing substantial damage to domestic economic growth and potentially to global financial markets. Others say Beijing has the tools to limit any contagion.

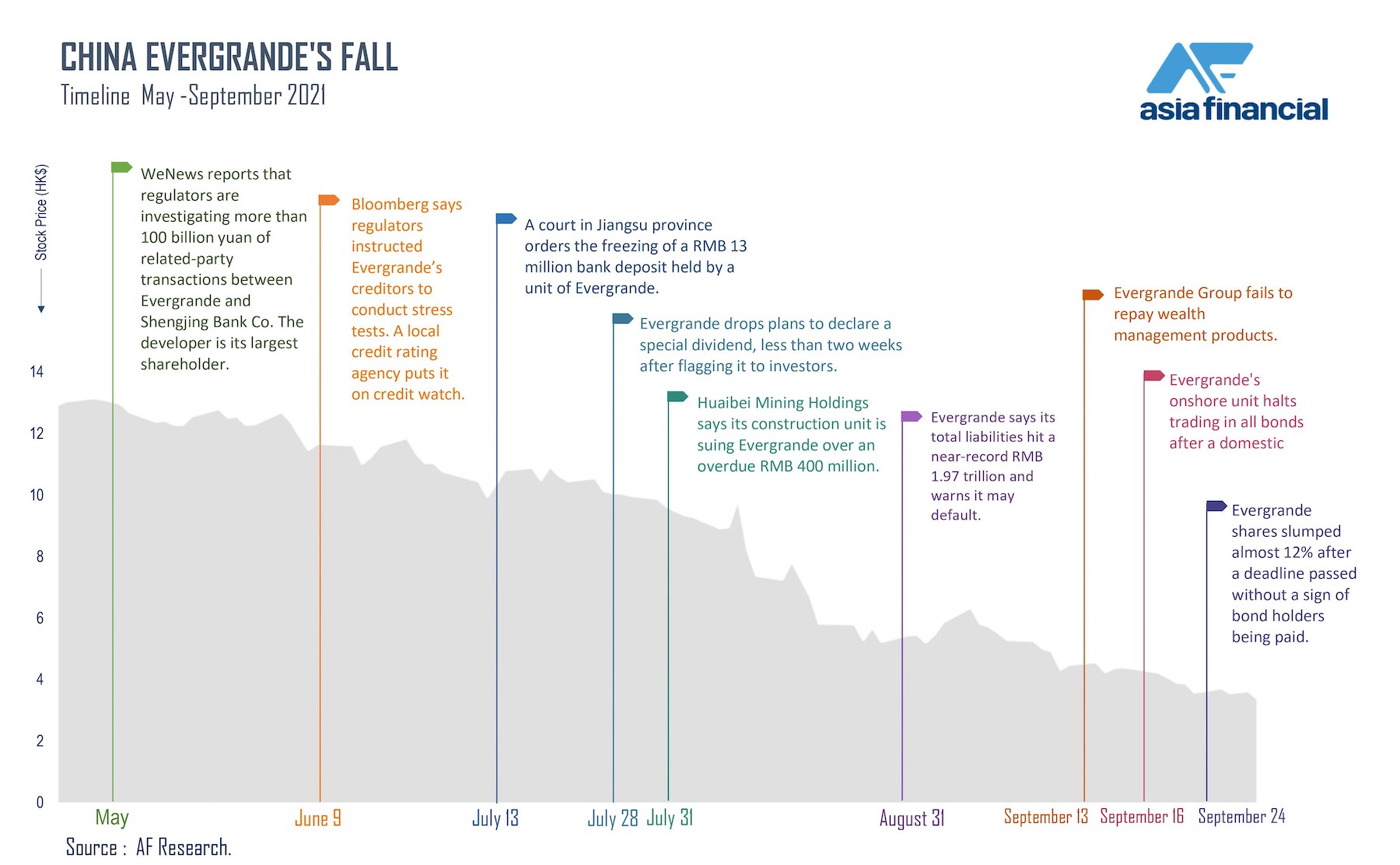

A deadline for a coupon payment due September 23 has already passed and, so far, there has been no sign that it has been paid.