US President Donald Trump said in a post on social media on Wednesday that his administration will impose a 25% tariff on goods imported from India and an unspecified penalty on the country starting on August 1.

“While India is our friend, we have, over the years, done relatively little business with them because their Tariffs are far too high, among the highest in the World, and they have the most strenuous and obnoxious non-monetary Trade Barriers of any Country,” Trump wrote in a Truth Social post.

“They have always bought a vast majority of their military equipment from Russia, and are Russia’s largest buyer of ENERGY, along with China, at a time when everyone wants Russia to STOP THE KILLING IN UKRAINE — ALL THINGS NOT GOOD!”

Also on AF: India Now the Biggest Source of Smartphone Exports to the US

Trump’s post came after he made similar statements earlier this week indicating a higher tariff rate for India while a trade deal remains elusive.

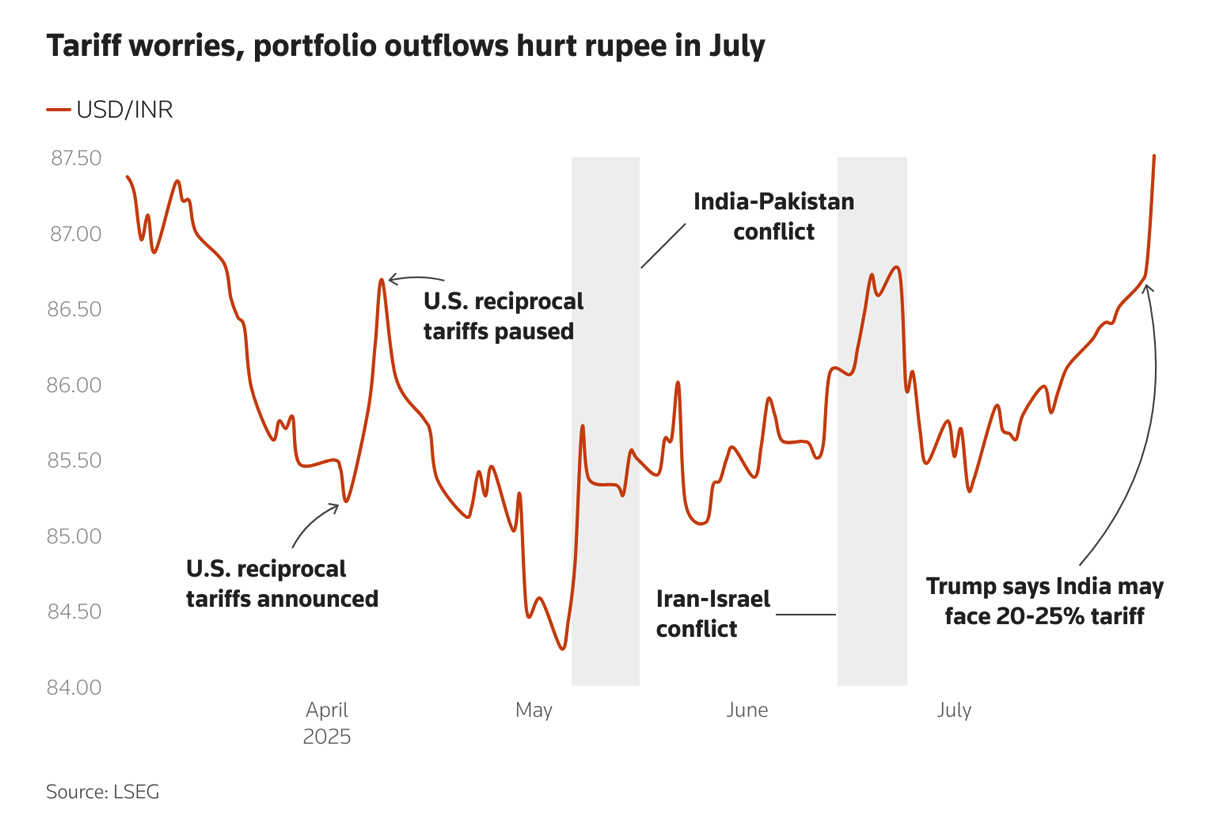

India’s rupee slumped to its lowest level in five months on Wednesday after Trump’s statements on Tuesday that a trade deal with India has yet to be finalised and that the country could face steeper tariffs.

“India has been a good friend, but India has charged basically more tariffs, almost more than any other country,” Trump told reporters aboard Air Force One, adding that would come to an end.

That resulted in the Indian currency posting its steepest one-day drop since May as it hit a low of 87.5125 against the US dollar before closing at 87.42. It was down 0.7% on the day.

Traders said that while the Reserve Bank of India likely stepped in to support the local currency, the intervention was not very aggressive.

Trump’s decision dashes hopes of a limited trade agreement between the two countries, which had been under negotiation for several months.

US and Indian trade negotiators had held multiple rounds of discussions to resolve contentious issues, particularly over market access for American agricultural and dairy products.

India open to higher tariffs

Despite progress in some areas, Indian officials resisted opening the domestic market to imports of wheat, corn, rice and genetically modified soybeans, citing risks to the livelihood of millions of Indian farmers.

Indian officials said New Delhi had offered tariff cuts on a wide range of goods and was working to ease non-tariff barriers.

However, agriculture and dairy remain “no-go” areas, with India unwilling to allow US imports of genetically modified soybean or corn, or to open its dairy sector.

On Wednesday, Reuters reported India is preparing to accept higher tariffs of 20%-25% on its exports to the US in the absence of a trade deal. Indian officials are holding off on offering fresh concessions ahead of Friday’s deadline.

Analysts say Trump’s remarks on the India-Pakistan conflict have cast a shadow on trade negotiations.

On Tuesday, Trump reiterated his claim that he helped broker a ceasefire to a conflict between India and Pakistan earlier this year, saying both sides accepted his request.

“That was great,” he said describing his friendship with Prime Minister Narendra Modi. India disputes Trump’s claims that he brokered the ceasefire.

India’s commerce ministry, which is leading the trade negotiations with the United States, did not immediately respond to a request for comment on Trump’s latest social media post.

More tariffs coming

India now joins a growing list of countries facing higher tariffs under Trump’s “Liberation Day” trade policy, aimed at reshaping US trade relations by demanding greater reciprocity.

On Monday Trump said most partners that do not negotiate separate trade deals would soon face tariffs of 15% to 20% on their exports to the United States, well above the broad 10% tariff he imposed in April.

His administration will notify some 200 countries soon of their new “world tariff” rate. The Trump Administration has set an August 1 deadline to seal trade deals to prevent higher tariffs.

The White House had previously warned India about its high average applied tariffs — nearly 39% on agricultural products, with rates climbing to 45% on vegetable oils and around 50% on apples and corn.

The setback comes despite earlier commitments by Prime Minister Narendra Modi and Trump to conclude the first phase of a trade deal by autumn 2025 and expand bilateral trade to $500 billion by 2030, up from $191 billion in 2024.

US manufacturing exports to India, valued at around $42 billion in 2024, as well as energy exports such as liquefied natural gas, crude oil, and coal, could also face retaliatory action if India chooses to respond in kind.

Indian officials have previously indicated that they view the US as a key strategic partner, particularly in counter-balancing China.

The new tariffs are expected to impact India’s goods exports to the US, estimated at around $87 billion in 2024, including labour-intensive products such as garments, pharmaceuticals, gems and jewellery, and petrochemicals.

The United States currently has a $45.7 billion trade deficit with India.

Other pressures on the rupee

The Indian currency has been suffering since Trump’s tariff frenzy began and has remained under pressure as a trade deal between India and the US remains elusive.

Trump’s tariff threats, the psychological impact of the rupee breaching the 87 mark, plus urgency among importers to hedge before the August 1 deadline, has weighed on the rupee, said Dilip Parmar, a foreign exchange analyst at HDFC Securities.

If conditions remain the same, the rupee could fall below 88 in the coming weeks, Parmar said. The local unit had hit an all-time low of 87.95 in February.

In addition to trade uncertainty, persistent foreign portfolio outflows have also been a pain point for the rupee. Overseas investors have net sold over $1.5 billion of local stocks in July.

Caution among importers and the absence of inflows have kept the currency under pressure and that may persist in the near-term, a trader at a foreign bank said.

Meanwhile, Asian currencies were trading mixed and the dollar index was little changed at 98.8 as investors await the Federal Reserve’s policy decision later in the day.

The Fed is widely expected to keep rates unchanged, with the focus on commentary from Chair Jerome Powell and whether the decision is unanimous.

- Reuters, with additional editing by Vishakha Saxena

Also read:

India’s Modi Shows His Preference: a Free-Trade Pact With Britain

Survey Shows Business is Booming in India, Record Export Orders

India Agrees to Restart Issuing Tourist Visas to Chinese Citizens

WTO Complaint Shows India Wants a Better Tariff Deal With US

Trump’s Dealings With Pakistan Has India Slowing Tariff Talks

India And China Agree to Resume Direct Flights After Five Years

Trump Says He’ll Go To China — But ‘Only If Xi Invites Him’